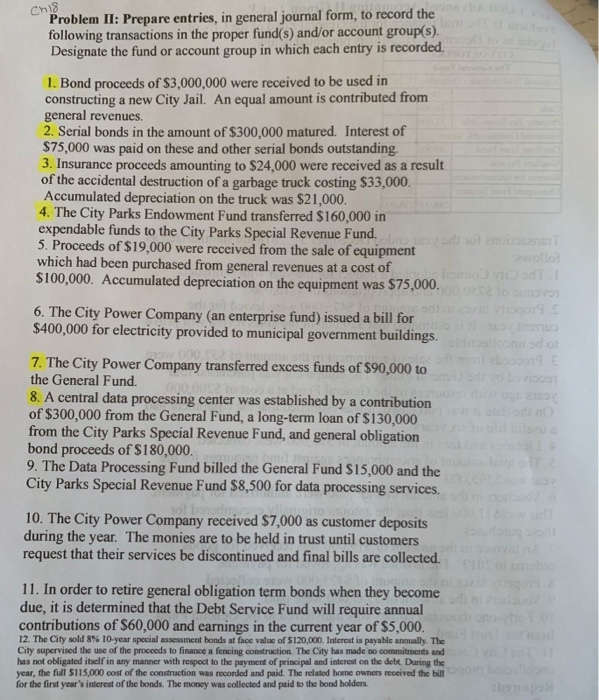

Chis Problem II: Prepare entries, in general journal form, to record the following transactions in the proper fund(s) and/or account group(s). Designate the fund or account group in which each entry is recorded. 1. Bond proceeds of $3,000,000 were received to be used in constructing a new City Jail. An equal amount is contributed from general revenues. 2. Serial bonds in the amount of $300,000 matured. Interest of $75,000 was paid on these and other serial bonds outstanding. 3. Insurance proceeds amounting to $24,000 were received as a result of the accidental destruction of a garbage truck costing $33,000. Accumulated depreciation on the truck was $21,000. 4. The City Parks Endowment Fund transferred $160,000 in expendable funds to the City Parks Special Revenue Fund. di tangan 5. Proceeds of $19,000 were received from the sale of equipment which had been purchased from general revenues at a cost of mond $100,000. Accumulated depreciation on the equipment was $75,000. 00 6. The City Power Company (an enterprise fund) issued a bill for $400,000 for electricity provided to municipal government buildings. TID 29 7. The City Power Company transferred excess funds of $90,000 to the General Fund. 8. A central data processing center was established by a contribution of $300,000 from the General Fund, a long-term loan of $130,000 from the City Parks Special Revenue Fund, and general obligation bond proceeds of $180,000. 9. The Data Processing Fund billed the General Fund $15,000 and the City Parks Special Revenue Fund $8,500 for data processing services. ata Process Services. 10. The City Power Company received $7,000 as customer deposits during the year. The monies are to be held in trust until customers request that their services be discontinued and final bills are collected. llected. 11. In order to retire general obligation term bonds when they become due, it is determined that the Debt Service Fund will require annual contributions of $60,000 and earnings in the current year of $5,000. 12. The City sold 8% 10-year special sessment bonds at face value of $120,000. Interest is payable annually. The City supervised the use of the proceeds to finance a fencing construction. The City has made no commitments and has not obligated itself in any manner with respect to the payment of principal and interest on the debt. During the year, the full ST15,000 cost of the construction was recorded and paid. The related home owners received the bill for the first year's interest of the bonds. The money was collected and paid to the bond holders