Question

Chloe Company has performed $600 of Cleaning services for a client but has not billed the client as of December 31, 2018. What adjusting entry

Chloe Company has performed $600 of Cleaning services for a client but has not billed the client as of December 31, 2018. What adjusting entry must the company prepare? *

a-Debit Cash and credit Unearned Revenue $600

b-Debit Accounts Receivable and credit Service Revenue $600

c-Debit Unearned Revenue and credit Service Revenue $60

d-None of the above

Chloe Company signed a four-month note payable in the amount of $8,000 on September 30, 2018. The note requires interest at an annual rate of 9%. The amount of interest to be accrued on December 31, 2018 is: *

a-$240

b-$540

c-$720

d-$180

On December 31, 2018, wages accrued were $3,700, the adjusted balance for salaries & wages expense on December 31, 2018 would be: *

a-$3700

b-$21,033

c-$17,333

d-$0

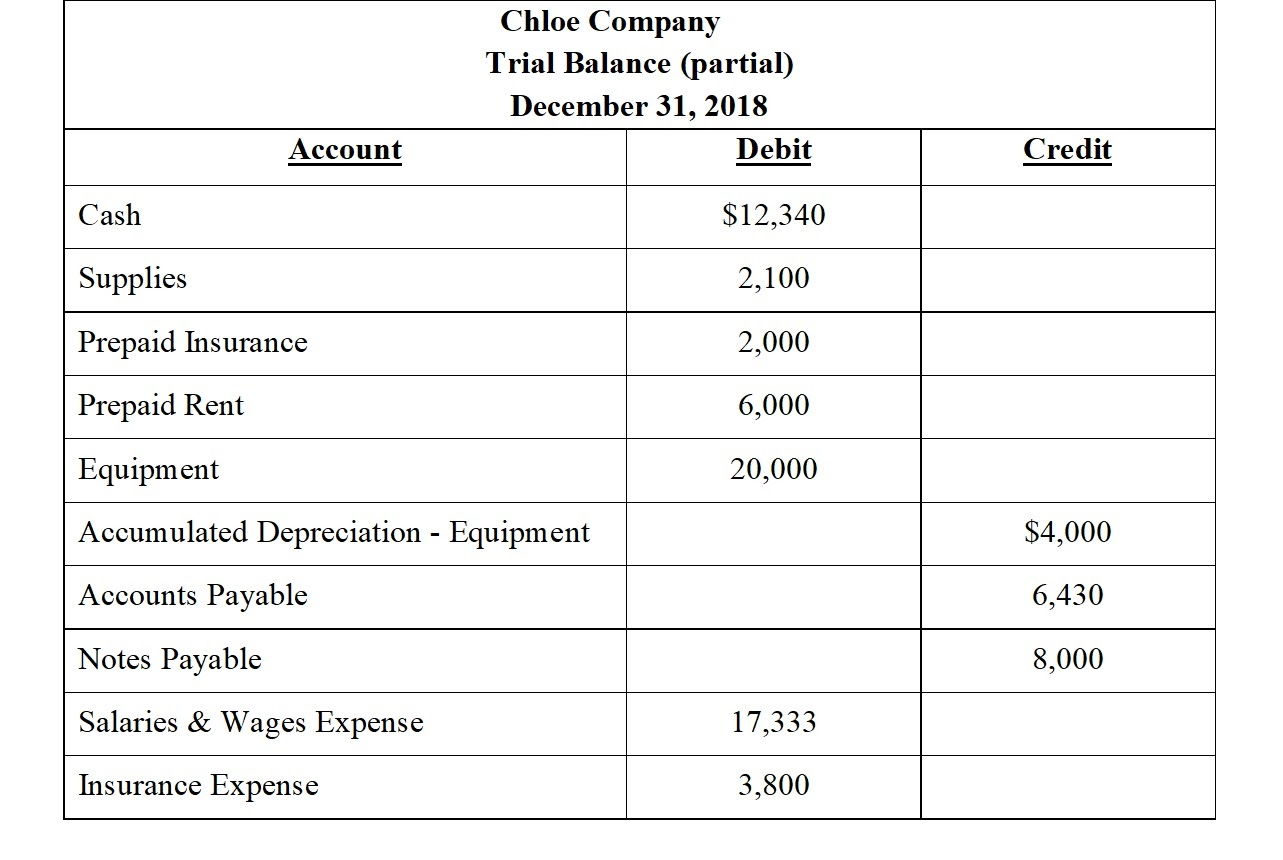

Chloe Company Trial Balance (partial) December 31, 2018 Debit Account Credit Cash $12,340 Supplies 2,100 Prepaid Insurance 2,000 Prepaid Rent 6,000 20,000 Equipment Accumulated Depreciation - Equipment $4,000 Accounts Payable 6,430 Notes Payable 8,000 Salaries & Wages Expense 17,333 Insurance Expense 3,800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started