Answered step by step

Verified Expert Solution

Question

1 Approved Answer

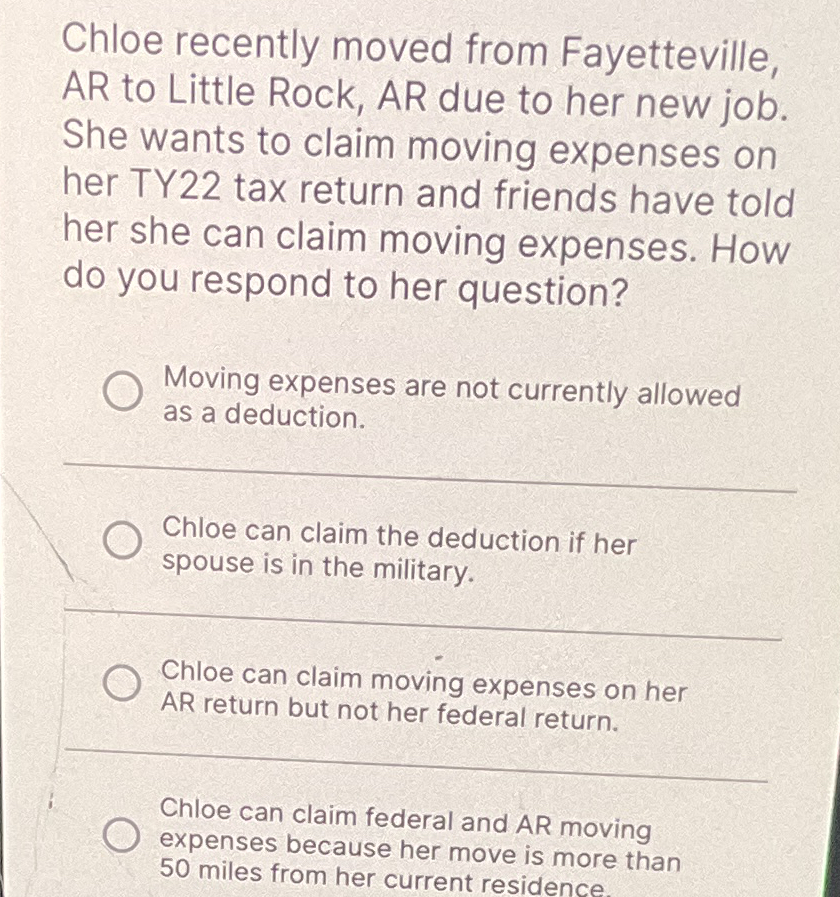

Chloe recently moved from Fayetteville, AR to Little Rock, AR due to her new job. She wants to claim moving expenses on her TY 2

Chloe recently moved from Fayetteville,

AR to Little Rock, AR due to her new job.

She wants to claim moving expenses on

her TY tax return and friends have told

her she can claim moving expenses. How

do you respond to her question?

Moving expenses are not currently allowed

as a deduction.

Chloe can claim the deduction if her

spouse is in the military.

Chloe can claim moving expenses on her

AR return but not her federal return.

Chloe can claim federal and AR moving

miles because her move is more than

miles from her current residence.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started