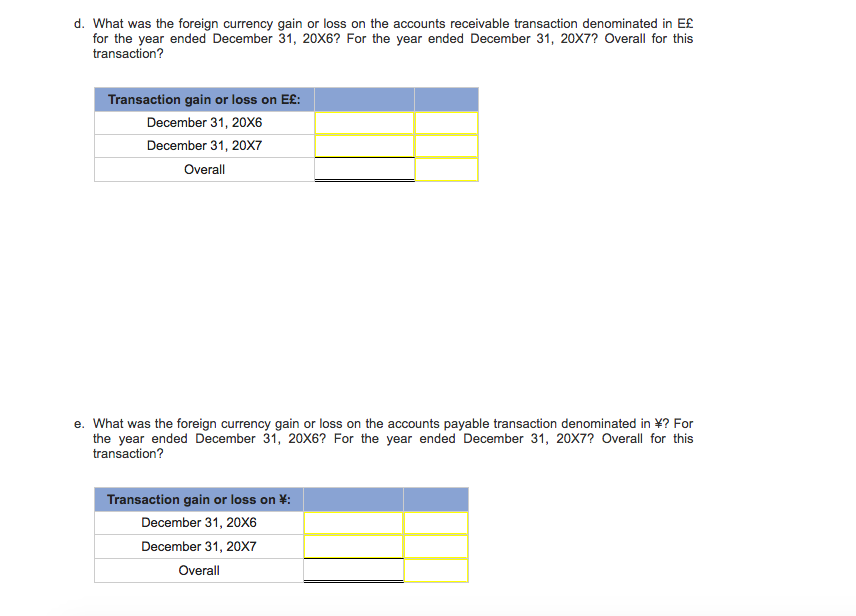

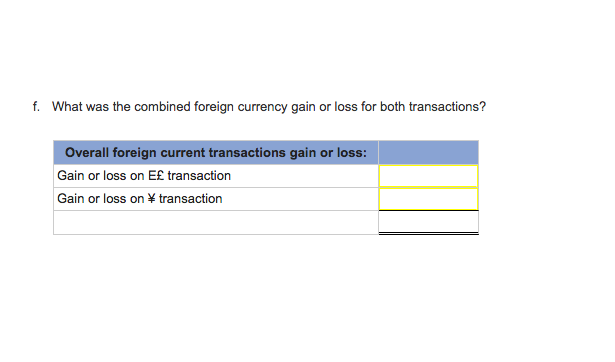

Question

Chocolate De-lites imports and exports chocolate delicacies. Some transactions are denominated in U.S. dollars and others in foreign currencies. A summary of accounts receivable and

| Chocolate De-lites imports and exports chocolate delicacies. Some transactions are denominated in U.S. dollars and others in foreign currencies. A summary of accounts receivable and accounts payable on December 31, 20X6, before adjustments for the effects of changes in exchange rates during 20X6, follows: |

| Accounts receivable: | ||||

| In U.S. dollars | $ | 164,000 | ||

| In 475,000 Egyptian pounds (E) | $ | 73,600 | ||

| Accounts payable: | ||||

| In U.S. dollars | $ | 86,000 | ||

| In 21,000,000 yen () | $ | 175,300 | ||

| The spot rates on December 31, 20X6, were | |||||||

| E1 = $0.176 | |||||||

| 1 = $0.0081 | |||||||

| The average exchange rates during the collection and payment period in 20X7 are | |||||||

| E1 = $0.18 | |||||||

| 1 = $0.0078

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started