Question

Chocolate, Inc. began 2018 with cash of $60,000. During the year, Chocolate earned revenue of $594,000 and collected $616,000 from customers. Expenses for the year

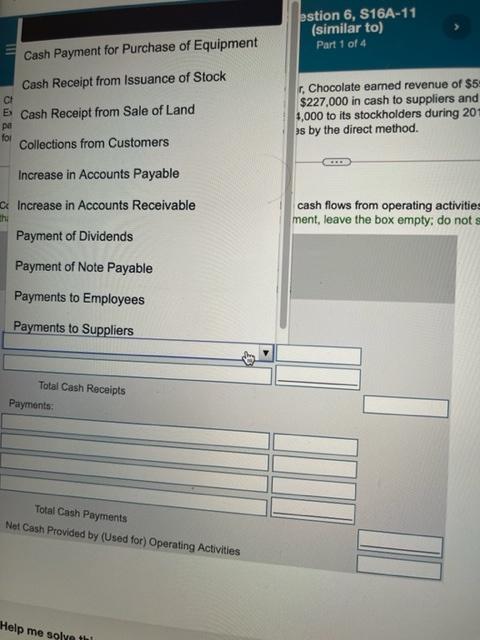

Chocolate, Inc. began 2018 with cash of $60,000. During the year, Chocolate earned revenue of $594,000 and collected $616,000 from customers. Expenses for the year totaled $444,000, of which Chocolate paid $227,000 in cash to suppliers and $207,000 in cash to employees. Chocolate also paid $145,000 to purchase equipment and a cash dividend of $54,000 to its stockholders during 2018. Prepare the company's statement of cash flows for the year ended December 31, 2018. Format operating activities by the direct method. Question content area bottom Part 1 Complete the statement one section at a time, beginning with the cash flows from operating activities

Use a minus sign or parentheses for amounts that result in a decrease in cash.) If a box is not used in the statement, leave the box empty; do not select a label or enter a zero.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started