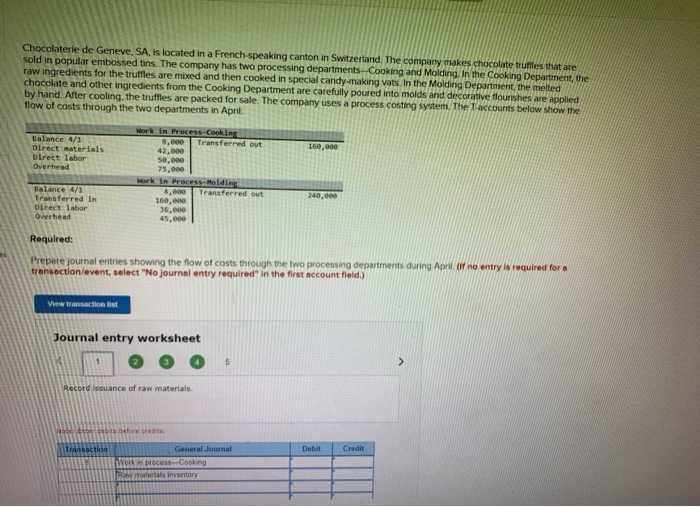

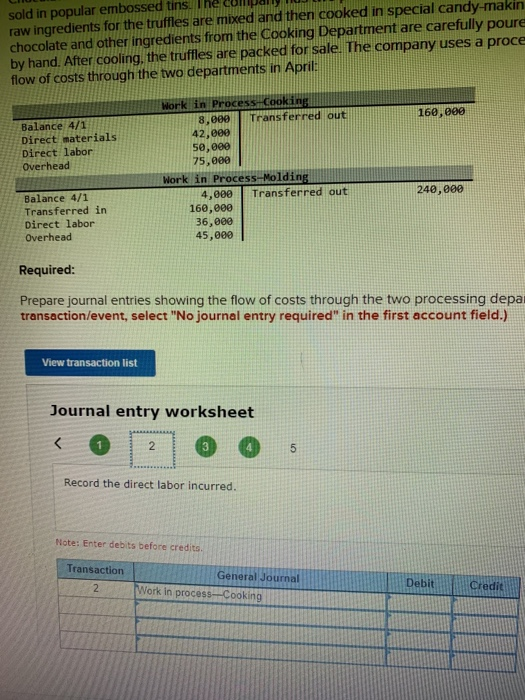

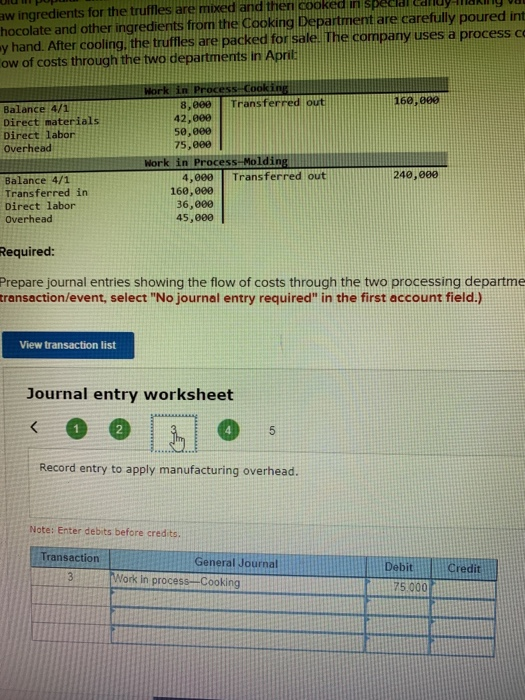

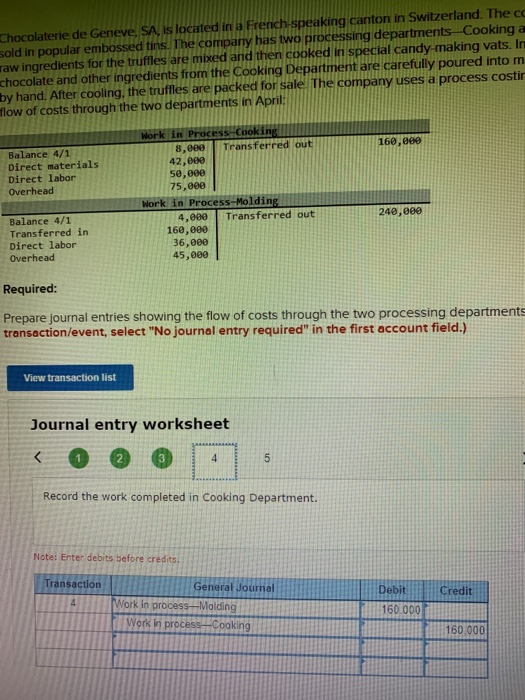

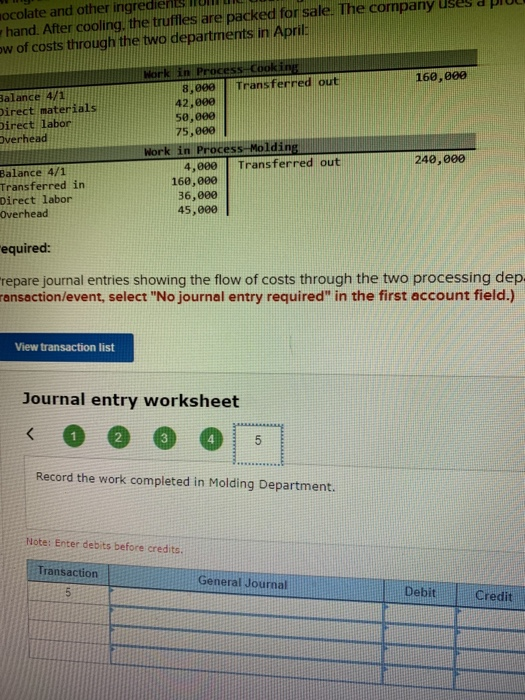

Chocolaterie de Geneve, SA is located in a French-speaking canton in Switzerland. The company makes chocolate truffles that are sold in popular embossed tins. The company has two processing departments --Cooking and Molding. In the Cooking Department, the raw ingredients for the truffles are mixed and then cooked in special candy-making vats. In the Molding Department, the melted chocolate and other ingredients from the Cooking Department are carefully poured into molds and decorative flourishes are applied by hand. After cooling, the truffles are packed for sale. The company uses a process costing system. The T-accounts below show the flow of costs through the two departments in April: Work in Process Cooking Balance 4/1 8.000 Transferred out 160,000 Direct materials 42.000 Direct labor 50,000 Overhead 75,000 Work in Process-Moldin Balance 4/1 Transferred out 240,000 Transferred in 160,000 Direct labor Overhead 45,000 36,000 Required: Prepare journal entries showing the flow of costs through the two processing departments during April Of no entry is required for transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet > Record issuance of raw materials. Bereits before credits Transaction Debit Credit General Journal Work in process Cooking Raw materials inventory sold in popular embossed tins raw ingredients for the truffles are mixed and then cooked in special candy-makin chocolate and other ingredients from the Cooking Department are carefully poure by hand. After cooling, the truffles are packed for sale. The company uses a proce flow of costs through the two departments in April: 160,000 Balance 4/1 Direct materials Direct labor Overhead Work in Process Cooking 8,000 Transferred out 42,000 50,000 75,000 Work in Process Molding 4,000 Transferred out 160,000 36,000 45,000 240,000 Balance 4/1 Transferred in Direct labor Overhead Required: Prepare journal entries showing the flow of costs through the two processing depa transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 5 Record the direct labor incurred. Note: Enter debits before credits Transaction 2 General Journal Work in process-Cooking Debit Credit aw ingredients for the truffles are mixed and then cooked in spec hocolate and other ingredients from the Cooking Department are carefully poured int y hand. After cooling, the truffles are packed for sale. The company uses a process ce low of costs through the two departments in April 160,000 Balance 4/1 Direct materials Direct labor Overhead Work in Process Cooking 8, eee Transferred out 42,000 50,000 75,000 Work in Process-Molding 4,000 Transferred out 160,000 36,000 45,000 240,000 Balance 4/1 Transferred in Direct labor Overhead Required: Prepare journal entries showing the flow of costs through the two processing departme transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet