Question

CHOICES: Larrys current investment in the company is A.) $50,400, B.) $84,000, C.) $92,400, D.) $33,600 If the company issues new shares and Larry makes

CHOICES:

CHOICES:

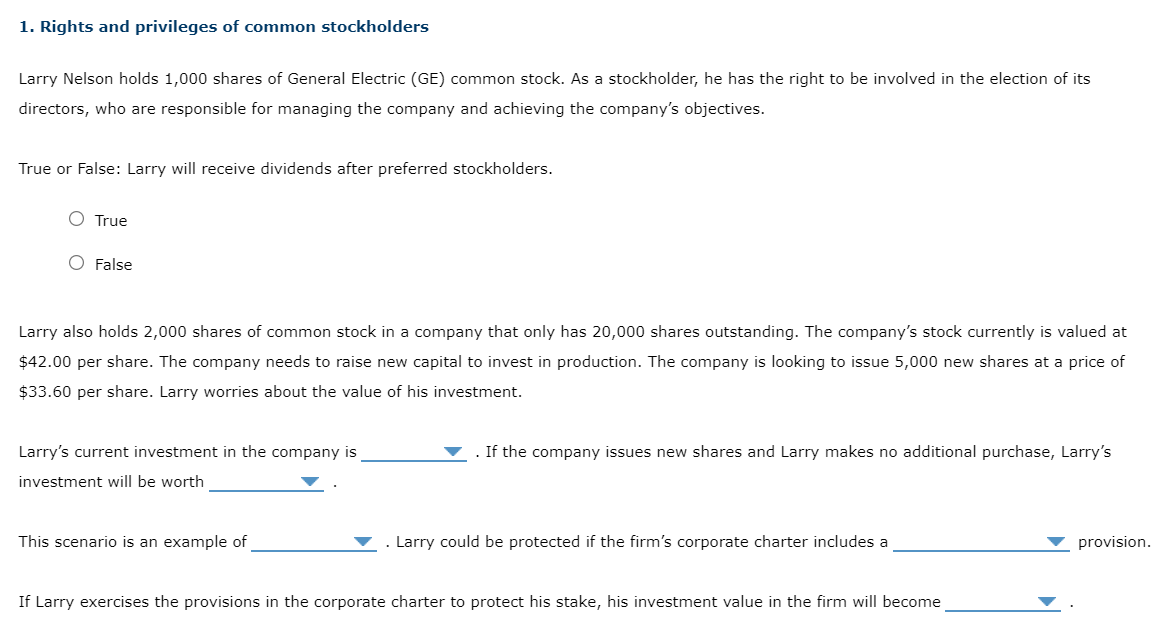

Larrys current investment in the company is A.) $50,400, B.) $84,000, C.) $92,400, D.) $33,600 If the company issues new shares and Larry makes no additional purchase, Larrys investment will be worth A.) $84,000, B.) $120,960, C.) $80,640, D.) $201,600.

This scenario is an example of A.) poison pill, B.) dilution, C.) a takeover, D.) a proxy. Larry could be protected if the firms corporate charter includes a A.) proxy, B.) preemptive right provision.

If Larry exercises the provisions in the corporate charter to protect his stake, his investment value in the firm will become A.)$100,800, B.)$101,800, C.) $75,600, D.) $151,200.

1. Rights and privileges of common stockholders Larry Nelson holds 1,000 shares of General Electric (GE) common stock. As a stockholder, he has the right to be involved in the election of its directors, who are responsible for managing the company and achieving the company's objectives. True or False: Larry will receive dividends after preferred stockholders. True False Larry also holds 2,000 shares of common stock in a company that only has 20,000 shares outstanding. The company's stock currently is valued at $42.00 per share. The company needs to raise new capital to invest in production. The company is looking to issue 5,000 new shares at a price of $33.60 per share. Larry worries about the value of his investment. Larry's current investment in the company is . If the company issues new shares and Larry makes no additional purchase, Larry's investment will be worth This scenario is an example of . Larry could be protected if the firm's corporate charter includes a provision. If Larry exercises the provisions in the corporate charter to protect his stake, his investment value in the firm will becomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started