Answered step by step

Verified Expert Solution

Question

1 Approved Answer

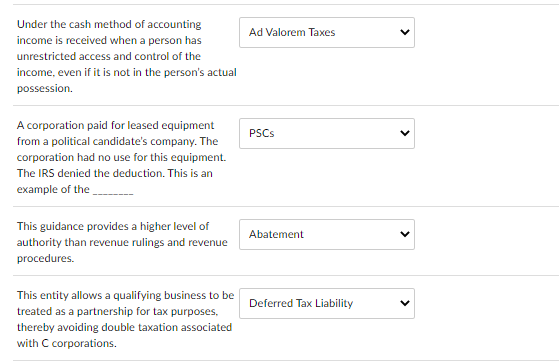

Choices: Substance over from Doctrine, Code Section Numbers, primary Authorities, Tax Advise Memo (TAM), Doctrine of Constructive Receipt, Treasury Regulations, US District Court Decision, Assignment

Choices: Substance over from Doctrine, Code Section Numbers, primary Authorities, Tax Advise Memo (TAM), Doctrine of Constructive Receipt, Treasury Regulations, US District Court Decision, Assignment of Income Doctrine, Ad Valorem Taxes, PSCs, Abatement, Deferred Tax Liability, Deferred Tax Asset, US Court Appeals Citation.

Ad Valorem Taxes Under the cash method of accounting income is received when a person has unrestricted access and control of the income, even if it is not in the person's actual possession PSCSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started