Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Choose a day between the release of the coursework and the submission (i.e. the day you answer this question or a previous working day).

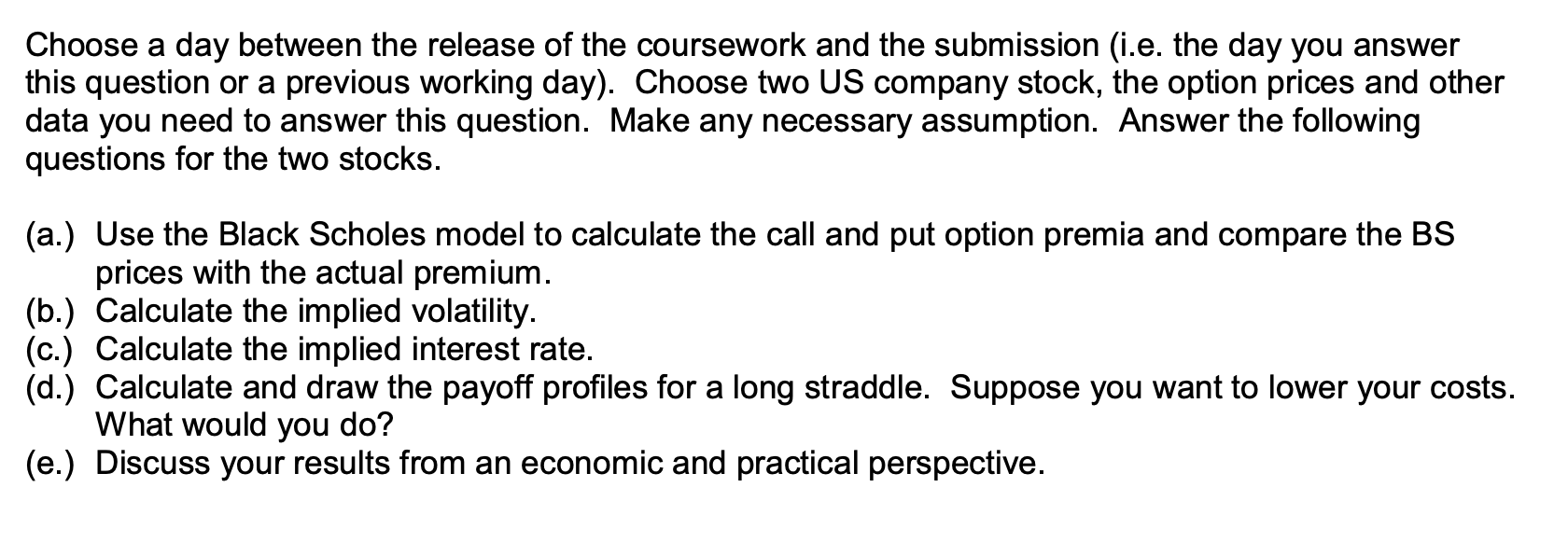

Choose a day between the release of the coursework and the submission (i.e. the day you answer this question or a previous working day). Choose two US company stock, the option prices and other data you need to answer this question. Make any necessary assumption. Answer the following questions for the two stocks. (a.) Use the Black Scholes model to calculate the call and put option premia and compare the BS prices with the actual premium. (b.) Calculate the implied volatility. (c.) Calculate the implied interest rate. (d.) Calculate and draw the payoff profiles for a long straddle. Suppose you want to lower your costs. What would you do? (e.) Discuss your results from an economic and practical perspective.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer this question lets assume that we are currently on April 14 2024 and that we are looking at two US company stocks Apple Inc AAPL and Microsoft Corporation MSFT We will use the Black Scholes ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started