Answered step by step

Verified Expert Solution

Question

1 Approved Answer

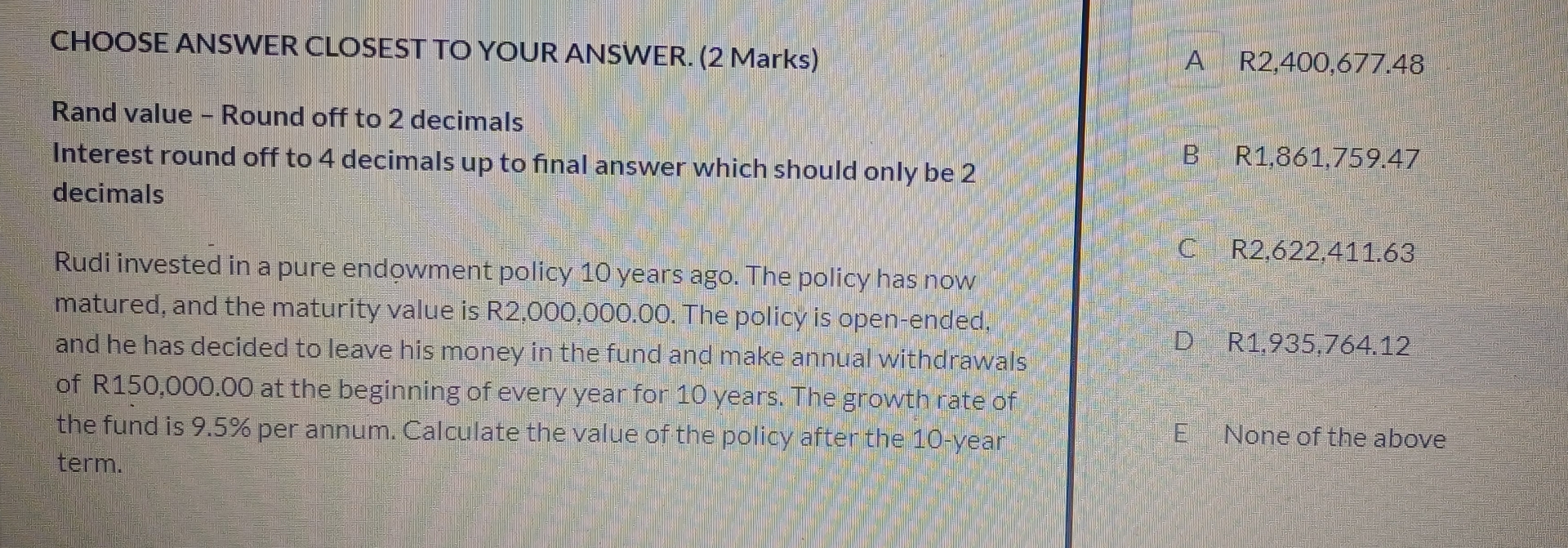

CHOOSE ANSWER CLOSEST TO YOUR ANSWER. ( 2 Marks ) Rand value - Round off to 2 decimals Interest round off to 4 decimals up

CHOOSE ANSWER CLOSEST TO YOUR ANSWER. Marks

Rand value Round off to decimals

Interest round off to decimals up to final answer which should only be decimals

Rudi invested in a pure endowment policy years ago. The policy has now matured, and the maturity value is R The policy is openended, and he has decided to leave his money in the fund and make annual withdrawals of R at the beginning of every year for years. The growth rate of the fund is per annum. Calculate the value of the policy after the year term.

A R

R

E None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started