Question

Choose between: Cash payments journal Cash receipts journal General journal Purchases journal Sales journal _______________________________________________________________________________________________________________________________________________________ _______________________________________________________________________________________________________________________________________________________ _______________________________________________________________________________________________________________________________________________________ _______________________________________________________________________________________________________________________________________________________ _______________________________________________________________________________________________________________________________________________________ _______________________________________________________________________________________________________________________________________________________ _______________________________________________________________________________________________________________________________________________________ _______________________________________________________________________________________________________________________________________________________ ______________________________________________________________________________________________________________________________________________________ ______________________________________________________________________________________________________________________________________________________ Wilcox

Choose between:

- Cash payments journal

- Cash receipts journal

- General journal

- Purchases journal

- Sales journal

_______________________________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________________________

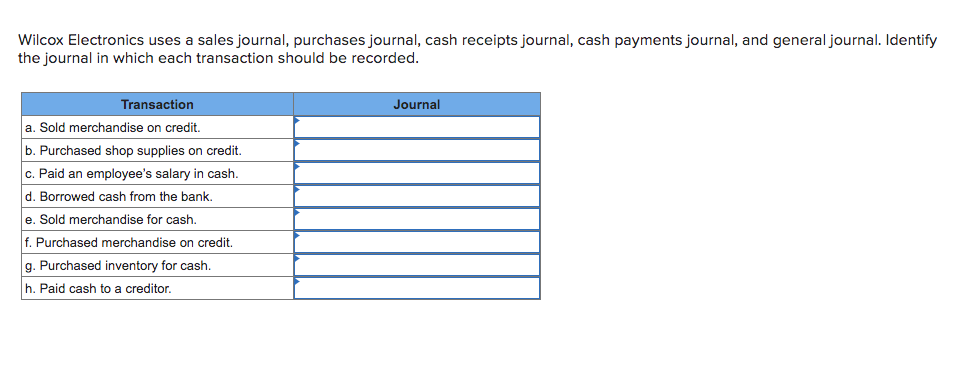

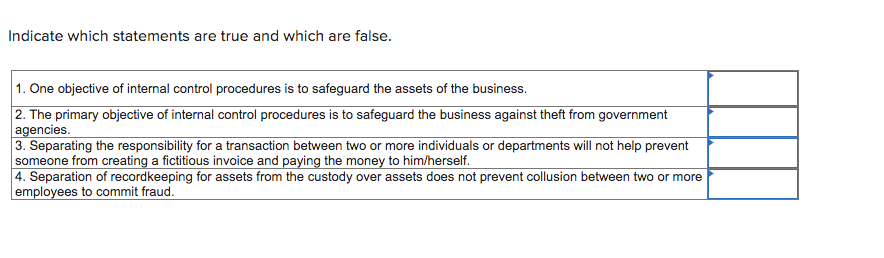

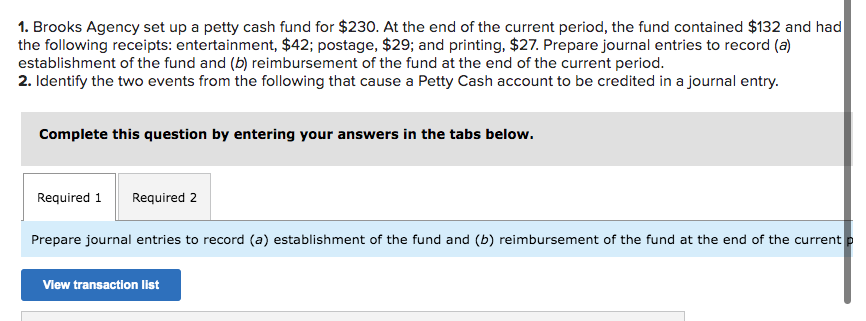

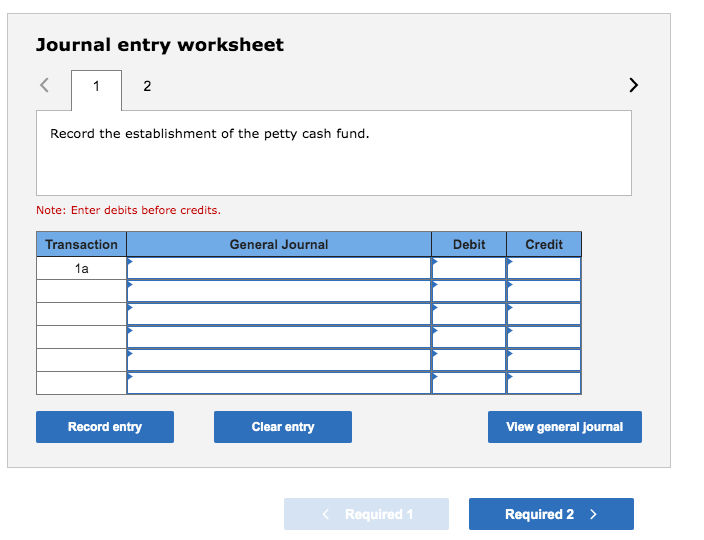

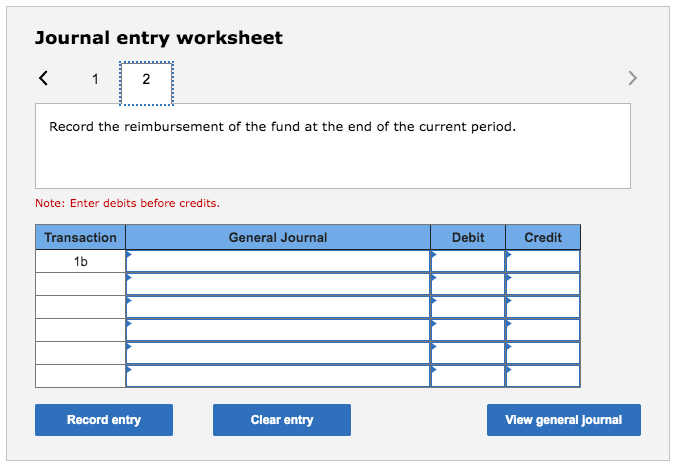

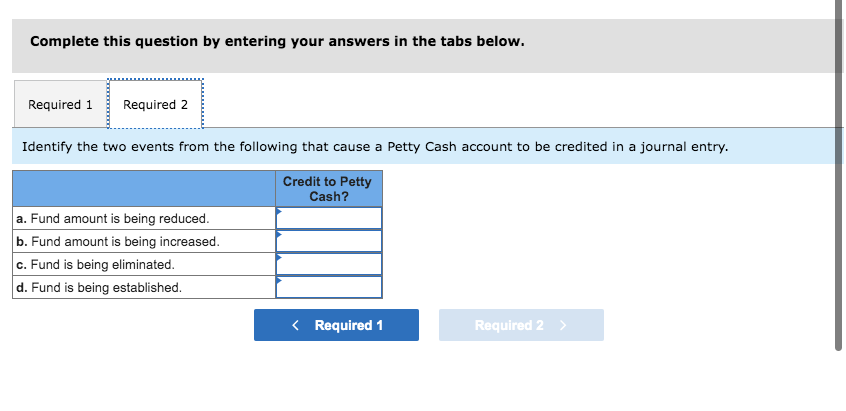

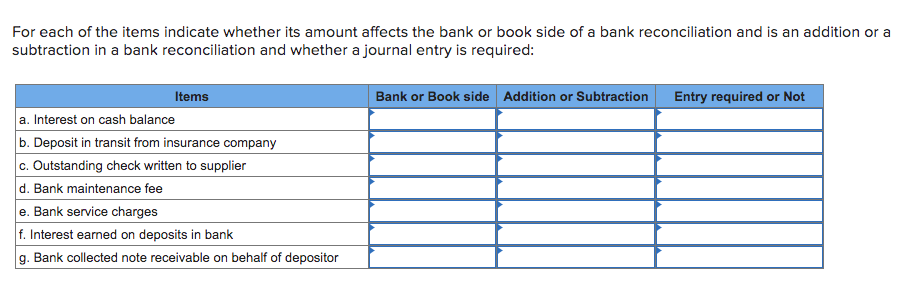

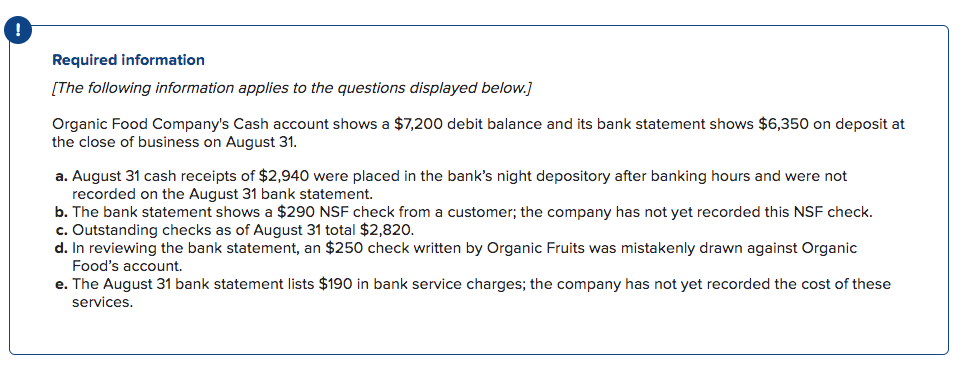

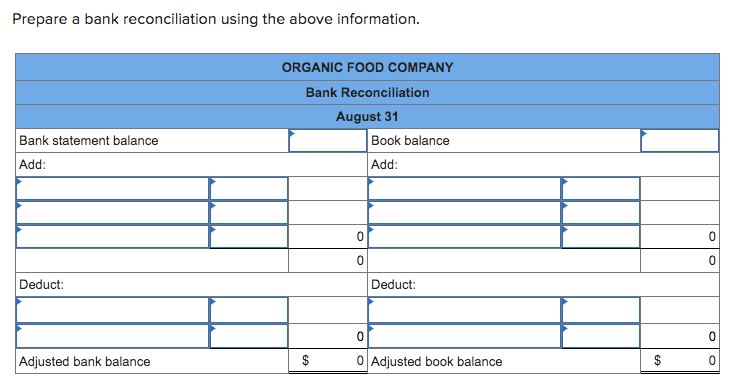

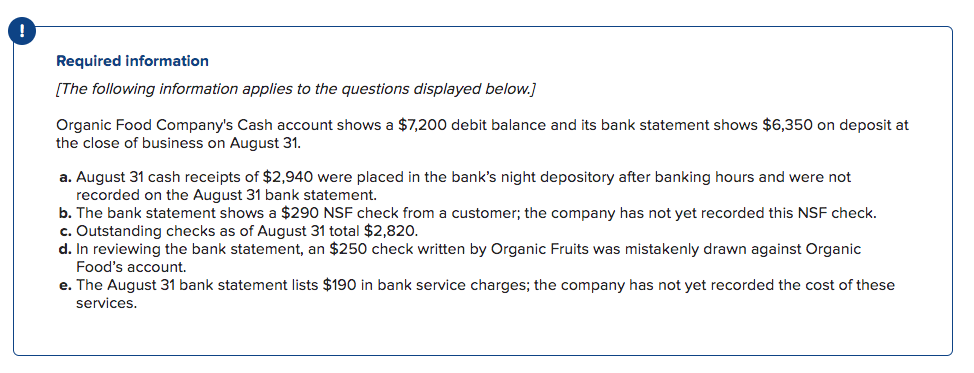

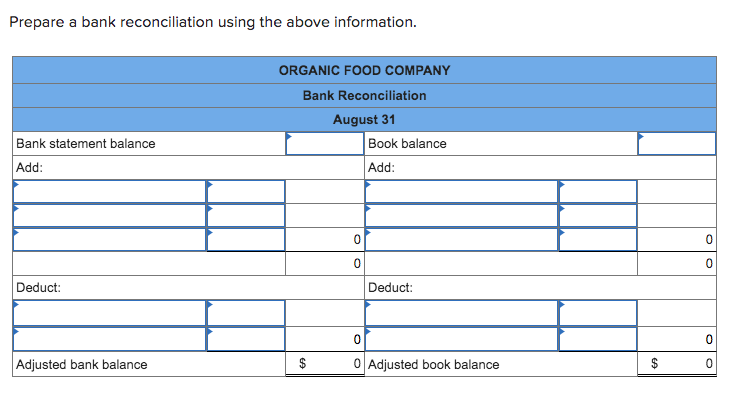

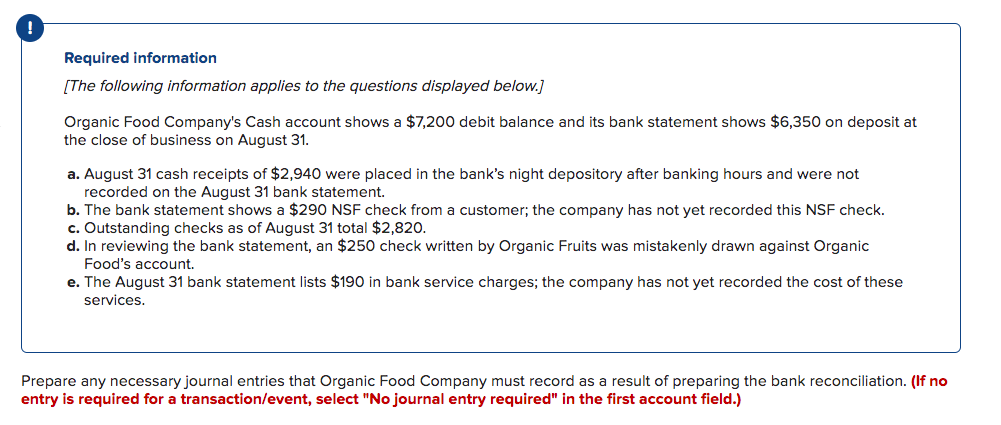

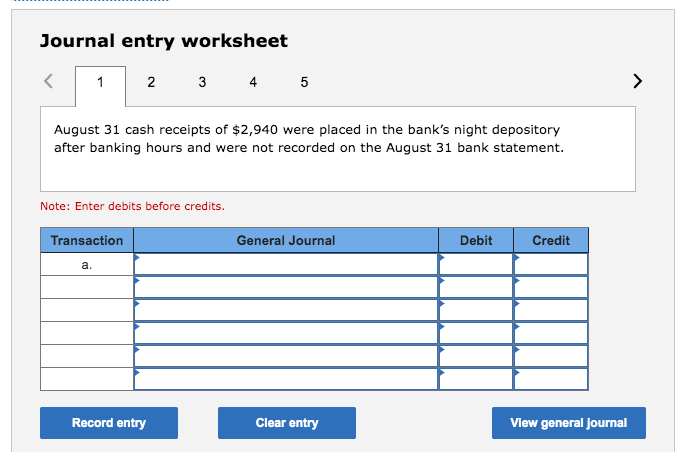

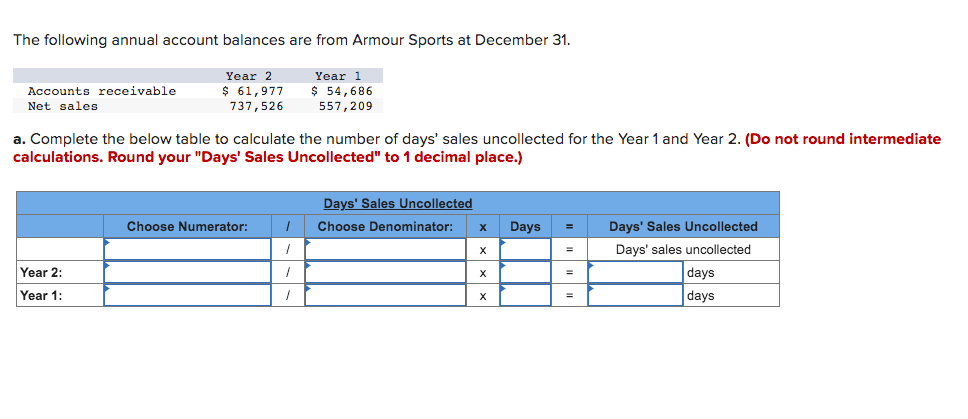

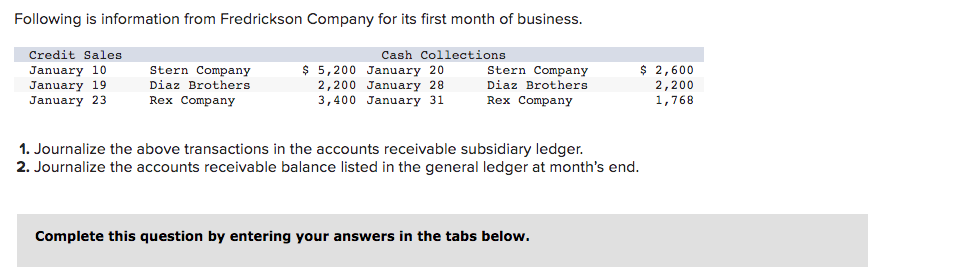

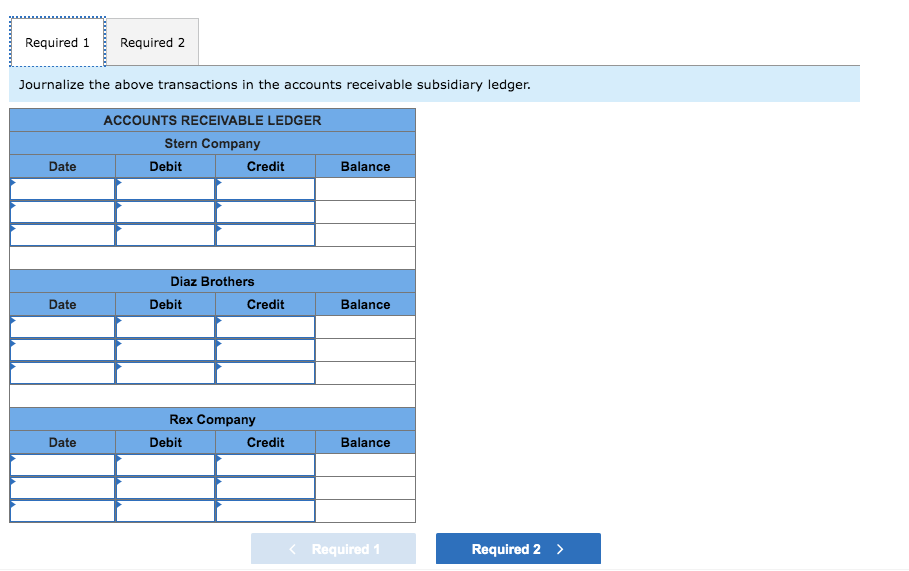

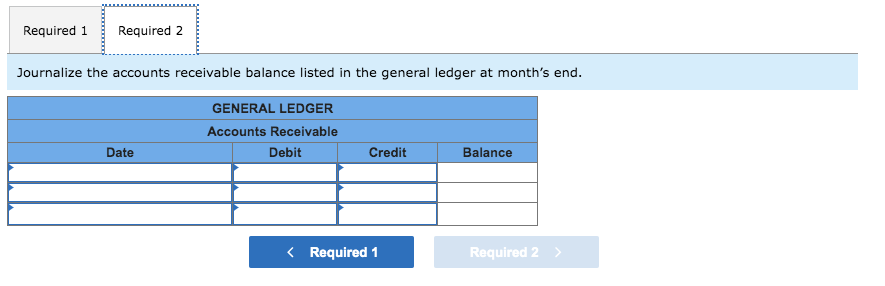

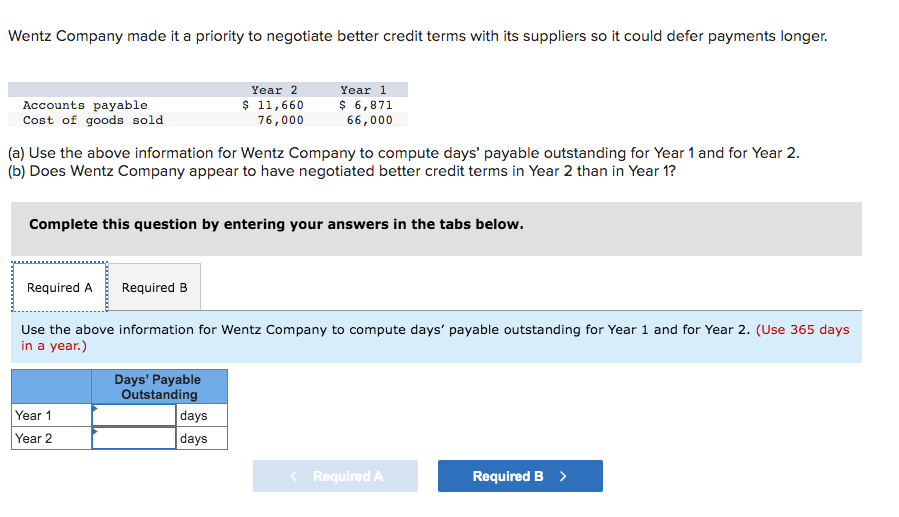

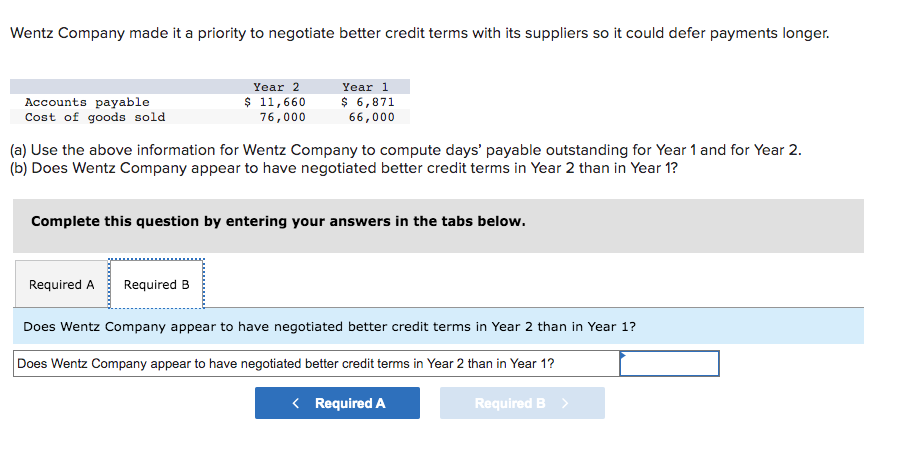

Wilcox Electronics uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Identify the journal in which each transaction should be recorded. Indicate which statements are true and which are false. 1. Brooks Agency set up a petty cash fund for $230. At the end of the current period, the fund contained $132 and hac the following receipts: entertainment, $42; postage, $29; and printing, $27. Prepare journal entries to record (a) establishment of the fund and (b) reimbursement of the fund at the end of the current period. 2. Identify the two events from the following that cause a Petty Cash account to be credited in a journal entry. Complete this question by entering your answers in the tabs below. Journal entry worksheet Record the establishment of the petty cash fund. Note: Enter debits before credits. Journal entry worksheet Record the reimbursement of the fund at the end of the current period. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Identify the two events from the following that cause a Petty Cash account to be credited in a journal entry For each of the items indicate whether its amount affects the bank or book side of a bank reconciliation and is an addition or a subtraction in a bank reconciliation and whether a journal entry is required: Required information [The following information applies to the questions displayed below.] Organic Food Company's Cash account shows a $7,200 debit balance and its bank statement shows $6,350 on deposit at the close of business on August 31. a. August 31 cash receipts of $2,940 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement. b. The bank statement shows a $290 NSF check from a customer; the company has not yet recorded this NSF check. c. Outstanding checks as of August 31 total $2,820. d. In reviewing the bank statement, an $250 check written by Organic Fruits was mistakenly drawn against Organic Food's account. e. The August 31 bank statement lists $190 in bank service charges; the company has not yet recorded the cost of these services. Prepare a bank reconciliation using the above information. Required information [The following information applies to the questions displayed below.] Organic Food Company's Cash account shows a $7,200 debit balance and its bank statement shows $6,350 on deposit at the close of business on August 31. a. August 31 cash receipts of $2,940 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement. b. The bank statement shows a $290 NSF check from a customer; the company has not yet recorded this NSF check. c. Outstanding checks as of August 31 total $2,820. d. In reviewing the bank statement, an $250 check written by Organic Fruits was mistakenly drawn against Organic Food's account. e. The August 31 bank statement lists $190 in bank service charges; the company has not yet recorded the cost of these services. Prepare a bank reconciliation using the above information. Required information [The following information applies to the questions displayed below.] Organic Food Company's Cash account shows a $7,200 debit balance and its bank statement shows $6,350 on deposit at the close of business on August 31. a. August 31 cash receipts of $2,940 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement. b. The bank statement shows a $290 NSF check from a customer; the company has not yet recorded this NSF check. c. Outstanding checks as of August 31 total $2,820. d. In reviewing the bank statement, an $250 check written by Organic Fruits was mistakenly drawn against Organic Food's account. e. The August 31 bank statement lists $190 in bank service charges; the company has not yet recorded the cost of these services. Prepare any necessary journal entries that Organic Food Company must record as a result of preparing the bank reconciliation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet August 31 cash receipts of $2,940 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement. Note: Enter debits before credits. The following annual account balances are from Armour Sports at December 31. a. Complete the below table to calculate the number of days' sales uncollected for the Year 1 and Year 2 . (Do not round intermediate calculations. Round your "Days' Sales Uncollected" to 1 decimal place.) Following is information from Fredrickson Company for its first month of business. 1. Journalize the above transactions in the accounts receivable subsidiary ledger. 2. Journalize the accounts receivable balance listed in the general ledger at month's end. Complete this question by entering your answers in the tabs below. ournalize the above transactions in the accounts receivable subsidiary ledger. Journalize the accounts receivable balance listed in the general ledger at month's end. Wentz Company made it a priority to negotiate better credit terms with its suppliers so it could defer payments longer. (a) Use the above information for Wentz Company to compute days' payable outstanding for Year 1 and for Year 2. (b) Does Wentz Company appear to have negotiated better credit terms in Year 2 than in Year 1 ? Complete this question by entering your answers in the tabs below. Use the above information for Wentz Company to compute days' payable outstanding for Year 1 and for Year 2 . (Use 365 days in a year.) Wentz Company made it a priority to negotiate better credit terms with its suppliers so it could defer payments longer. (a) Use the above information for Wentz Company to compute days' payable outstanding for Year 1 and for Year 2. (b) Does Wentz Company appear to have negotiated better credit terms in Year 2 than in Year 1 ? Complete this question by entering your answers in the tabs below. Does Wentz Company appear to have negotiated better credit terms in Year 2 than in Year 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started