Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Choose from any list or enter any number in the input fields and then click Check Answer. Please be detail. choose the options above. thank

Choose from any list or enter any number in the input fields and then click Check Answer.

Please be detail. choose the options above. thank you

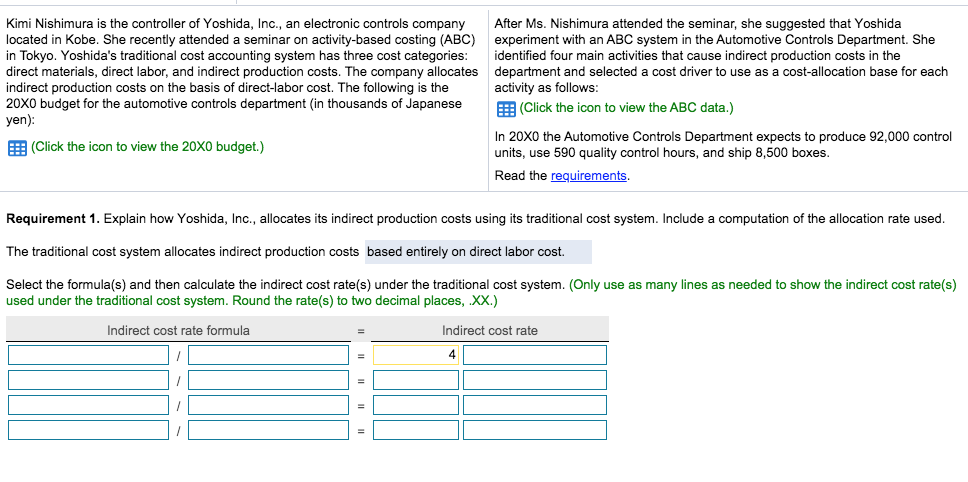

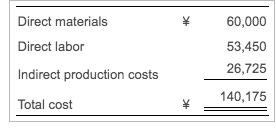

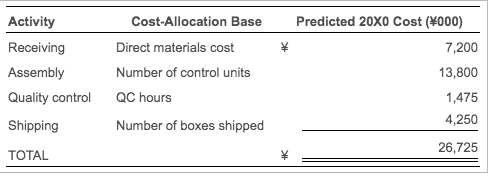

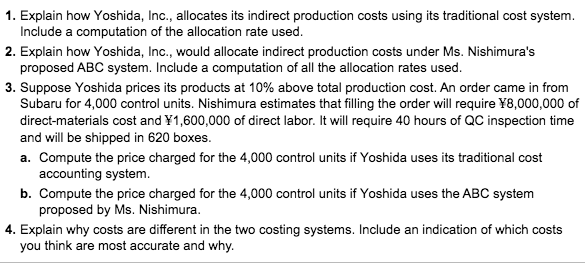

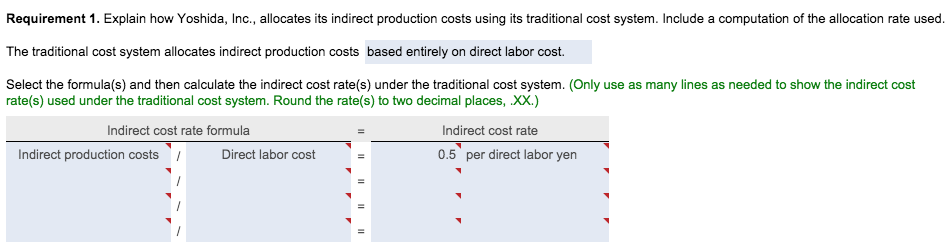

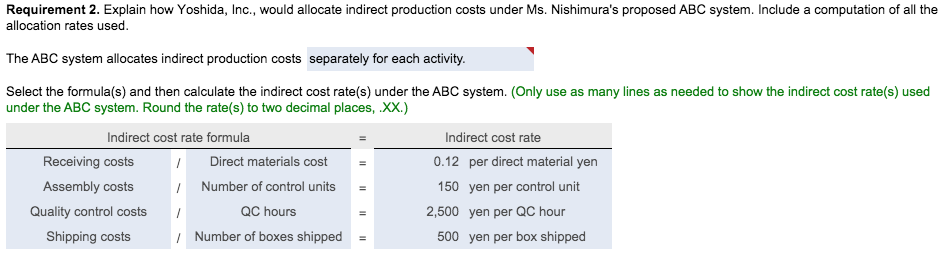

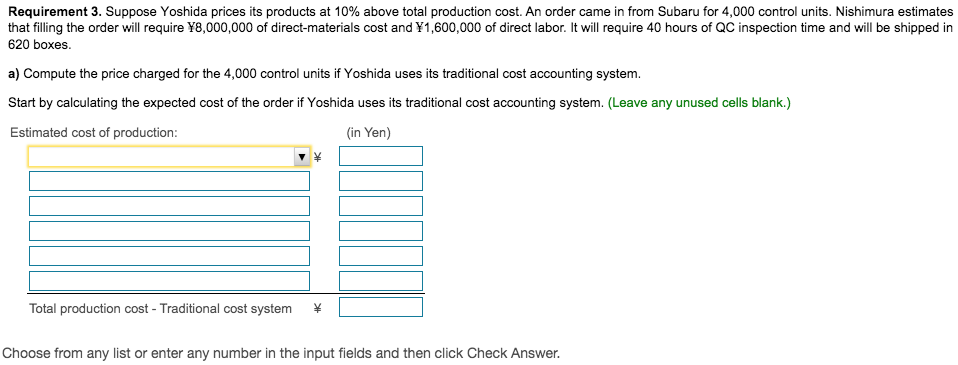

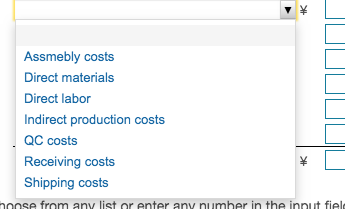

Kimi Nishimura is the controller of Yoshida, Inc., an electronic controls company After Ms. Nishimura attended the seminar, she suggested that Yoshida located in Kobe. She recently attended a seminar on activity-based costing (ABC) experiment with an ABC system in the Automotive Controls Department. She in Tokyo. Yoshida's traditional cost accounting system has three cost categories: identified four main activities that cause indirect production costs in the direct materials, direct labor, and indirect production costs. The company allocates department and selected a cost driver to use as a cost-allocation base for each indirect production costs on the basis of direct-labor cost. The following is the activity as follows: 20x0 budget for the automotive controls department (in thousands of Japanese (Click the icon to view the ABC data.) yen): In 20X0 the Automotive Controls Department expects to produce 92,000 control (Click the icon to view the 20/0 budget.) units, use 590 quality control hours, and ship 8,500 boxes. Read the requirements. Requirement 1. Explain how Yoshida, Inc., allocates its indirect production costs using its traditional cost system. Include a computation of the allocation rate used. The traditional cost system allocates indirect production costs based entirely on direct labor cost. Select the formula(s) and then calculate the indirect cost rate(s) under the traditional cost system. (Only use as many lines as needed to show the indirect cost rate(s) used under the traditional cost system. Round the rate(s) to two decimal places, XX.) Indirect cost rate formula Indirect cost rate 4 Direct materials Direct labor Indirect production costs Total cost 60,000 53,450 26,725 140,175 \ Activity Receiving Assembly Quality control Cost-Allocation Base Direct materials cost Number of control units QC hours Predicted 20x0 Cost (#000) 7,200 13,800 1,475 4,250 Shipping Number of boxes shipped TOTAL 26,725 1. Explain how Yoshida, Inc., allocates its indirect production costs using its traditional cost system. Include a computation of the allocation rate used. 2. Explain how Yoshida, Inc., would allocate indirect production costs under Ms. Nishimura's proposed ABC system. Include a computation of all the allocation rates used. 3. Suppose Yoshida prices its products at 10% above total production cost. An order came in from Subaru for 4,000 control units. Nishimura estimates that filling the order will require 48,000,000 of direct-materials cost and 1,600,000 of direct labor. It will require 40 hours of QC inspection time and will be shipped in 620 boxes. a. Compute the price charged for the 4,000 control units if Yoshida uses its traditional cost accounting system. b. Compute the price charged for the 4,000 control units if Yoshida uses the ABC system proposed by Ms. Nishimura. 4. Explain why costs are different in the two costing systems. Include an indication of which costs you think are most accurate and why. Requirement 1. Explain how Yoshida, Inc., allocates its indirect production costs using its traditional cost system. Include a computation of the allocation rate used. The traditional cost system allocates indirect production costs based entirely on direct labor cost. Select the formula(s) and then calculate the indirect cost rate(s) under the traditional cost system. (Only use as many lines as needed to show the indirect cost rate(s) used under the traditional cost system. Round the rate(s) to two decimal places, XX.) Indirect cost rate formula Indirect cost rate Indirect production costs Direct labor cost 0.5 per direct labor yen = II II Requirement 2. Explain how Yoshida, Inc., would allocate indirect production costs under Ms. Nishimura's proposed ABC system. Include a computation of all the allocation rates used. The ABC system allocates indirect production costs separately for each activity. Select the formula(s) and then calculate the indirect cost rate(s) under the ABC system. (Only use as many lines as needed to show the indirect cost rate(s) used under the ABC system. Round the rate(s) to two decimal places, XX.) Indirect cost rate formula Indirect cost rate Receiving costs Direct materials cost 0.12 per direct material yen Assembly costs 1 Number of control units 150 yen per control unit Quality control costs QC hours 2,500 yen per QC hour Shipping costs 1 Number of boxes shipped 500 yen per box shipped = Requirement 3. Suppose Yoshida prices its products at 10% above total production cost. An order came in from Subaru for 4,000 control units. Nishimura estimates that filling the order will require Y8,000,000 of direct-materials cost and 1,600,000 of direct labor. It will require 40 hours of QC inspection time and will be shipped in 620 boxes. a) Compute the price charged for the 4,000 control units if Yoshida uses its traditional cost accounting system. Start by calculating the expected cost of the order if Yoshida uses its traditional cost accounting system. (Leave any unused cells blank.) Estimated cost of production: (in Yen) Total production cost - Traditional cost system Choose from any list or enter any number in the input fields and then click Check Answer. * Assmebly costs Direct materials Direct labor Indirect production costs QC costs Receiving costs Shipping costs hoose from any list or enter any number in the input fiele *Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started