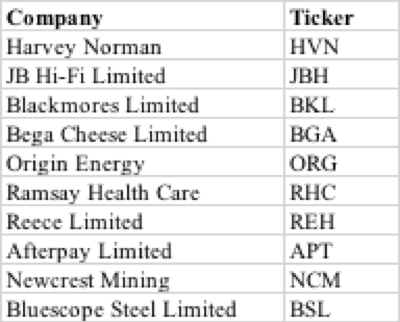

Choose one of the following company

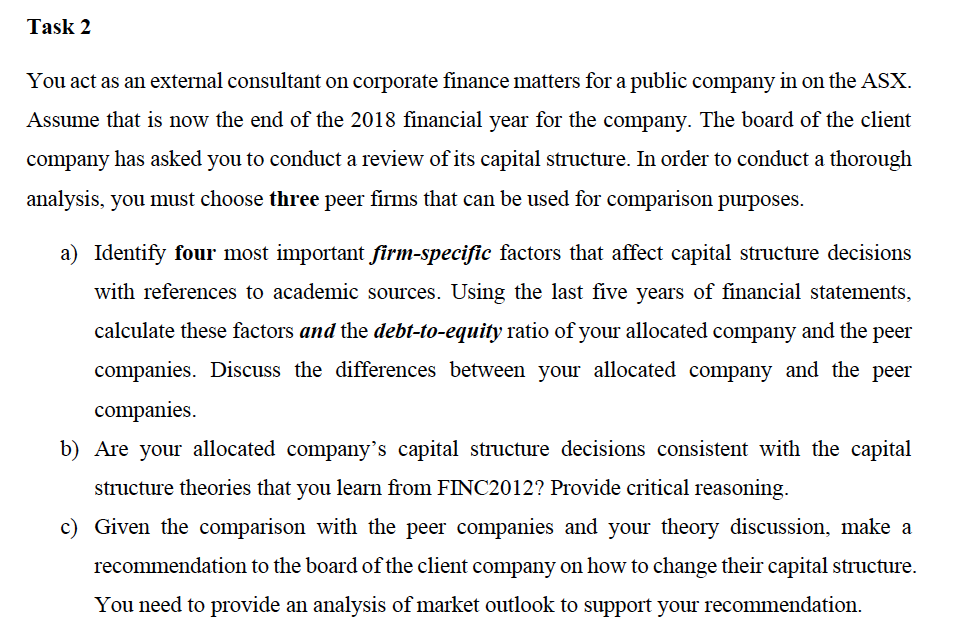

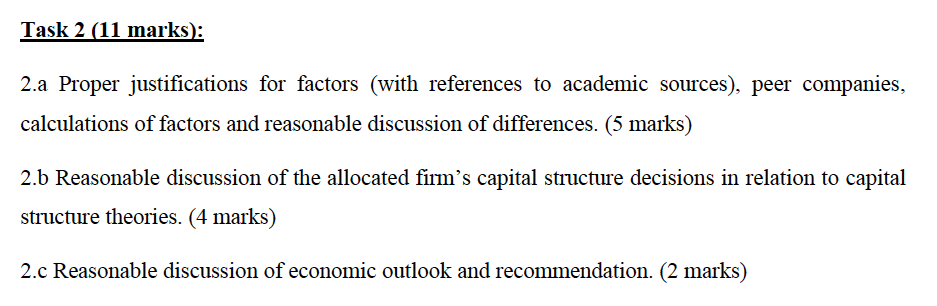

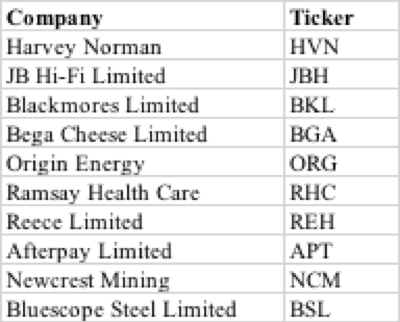

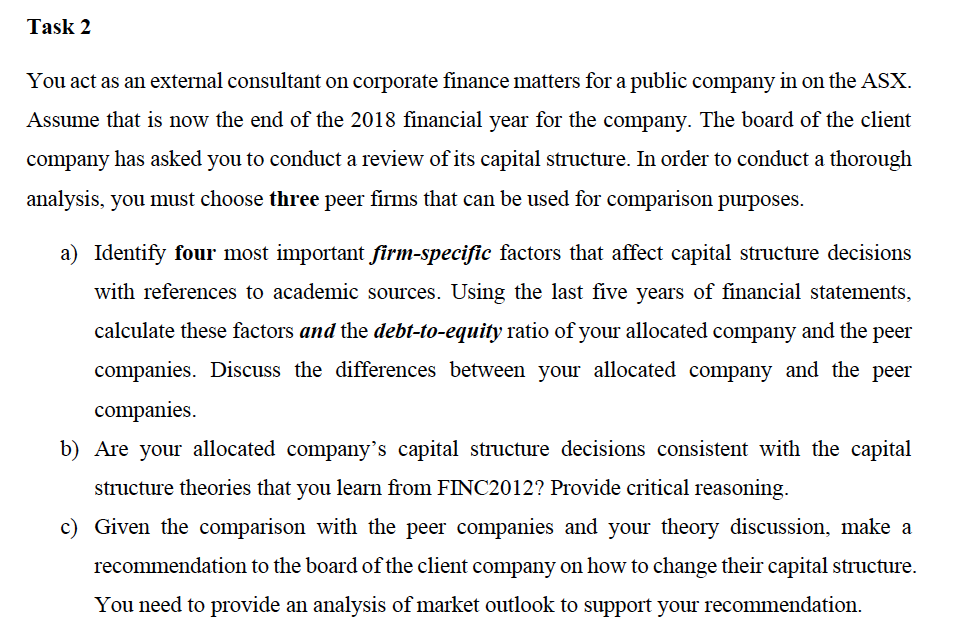

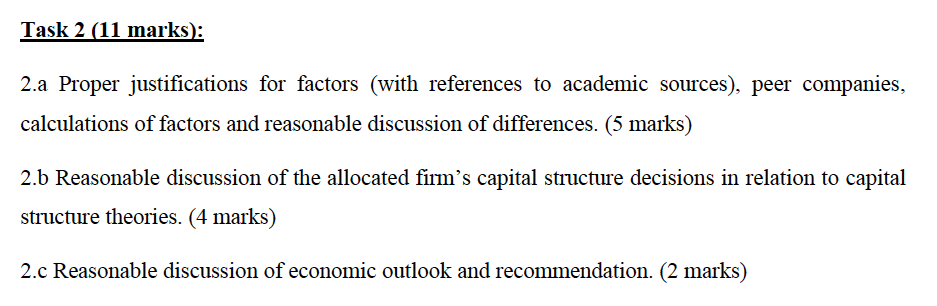

Company Harvey Norman JB Hi-Fi Limited Blackmores Limited Bega Cheese Limited Origin Energy Ramsay Health Care Reece Limited Afterpay Limited Newcrest Mining Bluescope Steel Limited Ticker HVN JBH BKL BGA ORG RHC REH NCM BSL Task 2 You act as an external consultant on corporate finance matters for a public company in on the ASX. Assume that is now the end of the 2018 financial year for the company. The board of the client company has asked you to conduct a review of its capital structure. In order to conduct a thorough analysis, you must choose three peer firms that can be used for comparison purposes. a) Identify four most important firm-specific factors that affect capital structure decisions with references to academic sources. Using the last five years of financial statements, calculate these factors and the debt-to-equity ratio of your allocated company and the peer companies. Discuss the differences between your allocated company and the peer companies. b) Are your allocated company's capital stiucture decisions consistent with the capital structure theories that you learn from FINC2012? Provide critical reasoning. c) Given the comparison with the peer companies and your theory discussion, make a recommendation to the board of the client company on how to change their capital structure. You need to provide an analysis of market outlook to support your recommendation. Task 2 (11 marks): 2.a Proper justifications for factors (with references to academic sources), peer companies, calculations of factors and reasonable discussion of differences. (5 marks) 2.b Reasonable discussion of the allocated firm's capital structure decisions in relation to capital structure theories. (4 marks) 2.c Reasonable discussion of economic outlook and recommendation. (2 marks) Company Harvey Norman JB Hi-Fi Limited Blackmores Limited Bega Cheese Limited Origin Energy Ramsay Health Care Reece Limited Afterpay Limited Newcrest Mining Bluescope Steel Limited Ticker HVN JBH BKL BGA ORG RHC REH NCM BSL Task 2 You act as an external consultant on corporate finance matters for a public company in on the ASX. Assume that is now the end of the 2018 financial year for the company. The board of the client company has asked you to conduct a review of its capital structure. In order to conduct a thorough analysis, you must choose three peer firms that can be used for comparison purposes. a) Identify four most important firm-specific factors that affect capital structure decisions with references to academic sources. Using the last five years of financial statements, calculate these factors and the debt-to-equity ratio of your allocated company and the peer companies. Discuss the differences between your allocated company and the peer companies. b) Are your allocated company's capital stiucture decisions consistent with the capital structure theories that you learn from FINC2012? Provide critical reasoning. c) Given the comparison with the peer companies and your theory discussion, make a recommendation to the board of the client company on how to change their capital structure. You need to provide an analysis of market outlook to support your recommendation. Task 2 (11 marks): 2.a Proper justifications for factors (with references to academic sources), peer companies, calculations of factors and reasonable discussion of differences. (5 marks) 2.b Reasonable discussion of the allocated firm's capital structure decisions in relation to capital structure theories. (4 marks) 2.c Reasonable discussion of economic outlook and recommendation. (2 marks)