Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Apollo Industrial is a French company that has recently purchased 210-day currency put options to hedge a 105,000 Australian dollar (AUD) receivable due to

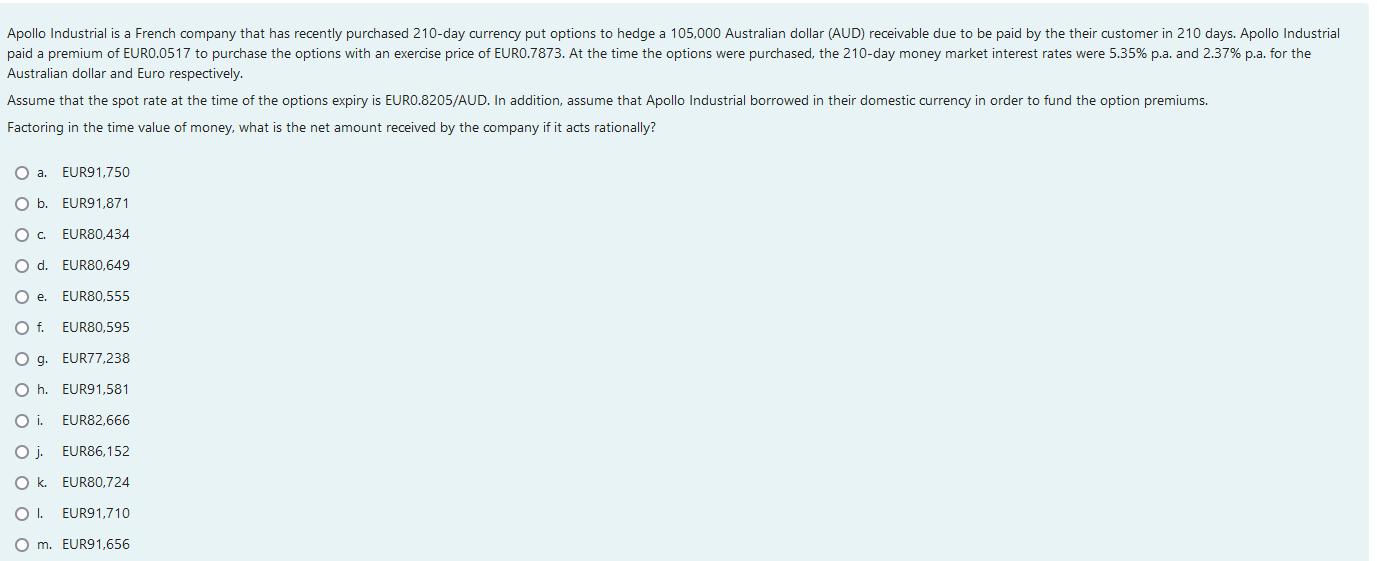

Apollo Industrial is a French company that has recently purchased 210-day currency put options to hedge a 105,000 Australian dollar (AUD) receivable due to be paid by the their customer in 210 days. Apollo Industrial paid a premium of EURO.0517 to purchase the options with an exercise price of EURO.7873. At the time the options were purchased, the 210-day money market interest rates were 5.35% p.a. and 2.37% p.a. for the Australian dollar and Euro respectively. Assume that the spot rate at the time of the options expiry is EURO.8205/AUD. In addition, assume that Apollo Industrial borrowed in their domestic currency in order to fund the option premiums. Factoring in the time value of money, what is the net amount received by the company if it acts rationally? O a. EUR91,750 O b. EUR91,871 0 . EUR80,434 O d. EUR80,649 O e. EUR80,555 O f. EUR80,595 O g. EUR77,238 Oh. EUR91,581 O i. EUR82,666 O j. EUR86,152 Ok. EUR80,724 O I. EUR91,710 O m. EUR91,656

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The amount of Australian dollars AUD receivable by Apollo Industrial in 210 days is 105000 AU...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started