choose one of these questions and answer it after reading the case online

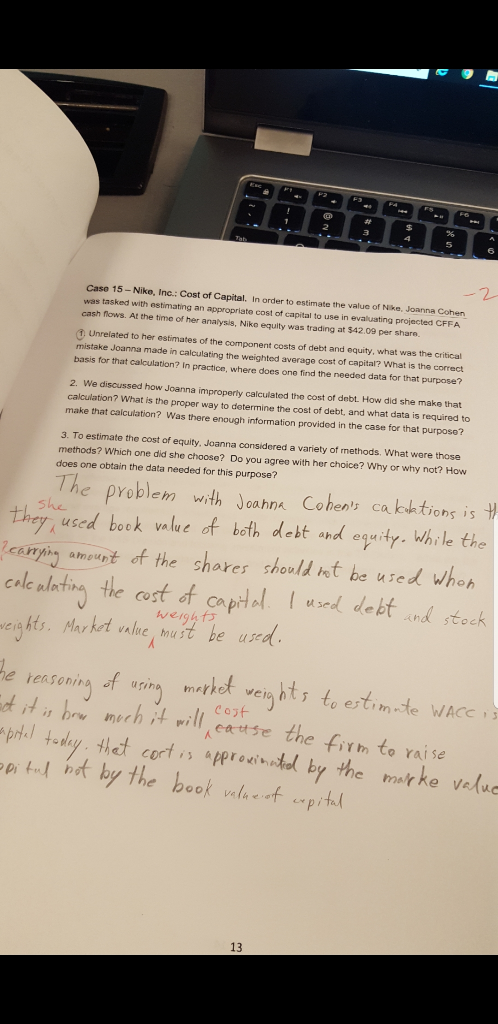

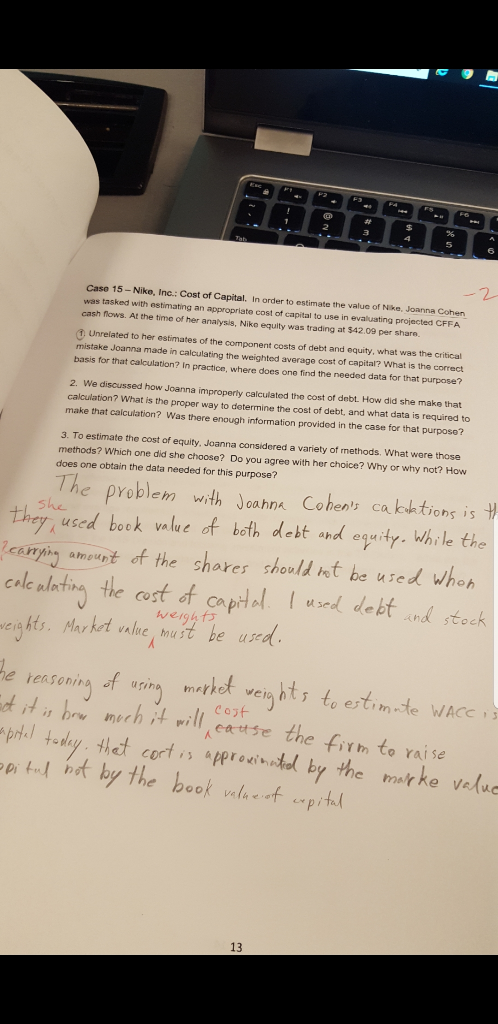

Case 15 - Nike, Inc.: Cost of Capital. In order to estimate the value of Nike Joanna Cohen was tasked with estimating an appropriate cost of capital to use in evaluating projected CFFA cash flows. At the time of her analysis, Nike equity was trading at $42.09 per share 1. Unrelated to her estimates of the component costs of debt and equity. what was the critical mistake Joanna made in calculating the weighted average cost of capital? What is the correct basis for that calculation? In practice, where does one find the needed data for that purpose? 2. We discussed how Joanna improperly calculated the cost of debt. How did she make that calculation? What is the proper way to determine the cost of debt and what data is required to make that calculation? Was there enough information provided in the case for that purpose? 3. To estimate the cost of equity, Joanna considered a variety of methods. What were those methods? Which one did she choose? Do you agree with her choice? Why or why not? How does one obtain the data needed for this purpose? she The problem with Joanna Cohen's cakolations is th they used book value of both debt and equity. While the Rearrying amount of the shares should not be used when calculating the cost of capital. I used debt and stock reights. Market value must be used. he reasoning of using market weights to estimate WACCA et it is bow much it will cause the firm to raise spital today that cort is approximated by the marke val piful hot by the book value of capital Case 15 - Nike, Inc.: Cost of Capital. In order to estimate the value of Nike Joanna Cohen was tasked with estimating an appropriate cost of capital to use in evaluating projected CFFA cash flows. At the time of her analysis, Nike equity was trading at $42.09 per share 1. Unrelated to her estimates of the component costs of debt and equity. what was the critical mistake Joanna made in calculating the weighted average cost of capital? What is the correct basis for that calculation? In practice, where does one find the needed data for that purpose? 2. We discussed how Joanna improperly calculated the cost of debt. How did she make that calculation? What is the proper way to determine the cost of debt and what data is required to make that calculation? Was there enough information provided in the case for that purpose? 3. To estimate the cost of equity, Joanna considered a variety of methods. What were those methods? Which one did she choose? Do you agree with her choice? Why or why not? How does one obtain the data needed for this purpose? she The problem with Joanna Cohen's cakolations is th they used book value of both debt and equity. While the Rearrying amount of the shares should not be used when calculating the cost of capital. I used debt and stock reights. Market value must be used. he reasoning of using market weights to estimate WACCA et it is bow much it will cause the firm to raise spital today that cort is approximated by the marke val piful hot by the book value of capital