Question

Choose one publicly traded stock and estimate its required rate of return according to CAPM. (Hint, from yahoo.com/finance, find its beta, and find 10 year

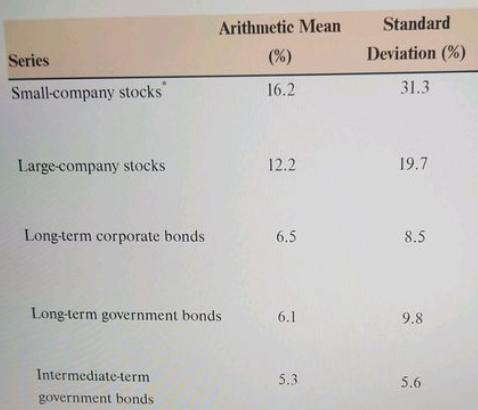

Choose one publicly traded stock and estimate its required rate of return according to CAPM. (Hint, from yahoo.com/finance, find its beta, and find 10 year Treasury note rate the day you are estimating the return (Current Risk-free rate); for (Rm Rf), use the historical average presented in the image below. For Rm use large company stock, and for Rf use long term government bond.

1. Use the same company in 1 and download 5 years of monthly data. Estimate the stand-alone risk of this company. (Hint: Estimate monthly return and then estimate Standard Deviation of the monthly returns).

SeriesArithmeticMean(%)16.2StandardDeviation(%)31.3 Large-company stocks 12.2 19.7 Long-term corporate bonds 6.5 8.5 Long-term government bonds 6.1 9.8 Intermediate-term government bonds 5.3 5.6 SeriesArithmeticMean(%)16.2StandardDeviation(%)31.3 Large-company stocks 12.2 19.7 Long-term corporate bonds 6.5 8.5 Long-term government bonds 6.1 9.8 Intermediate-term government bonds 5.3 5.6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started