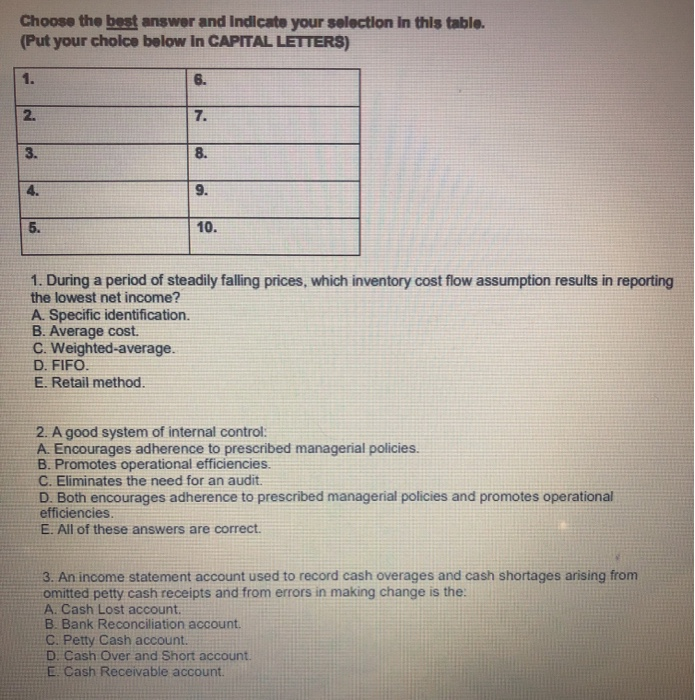

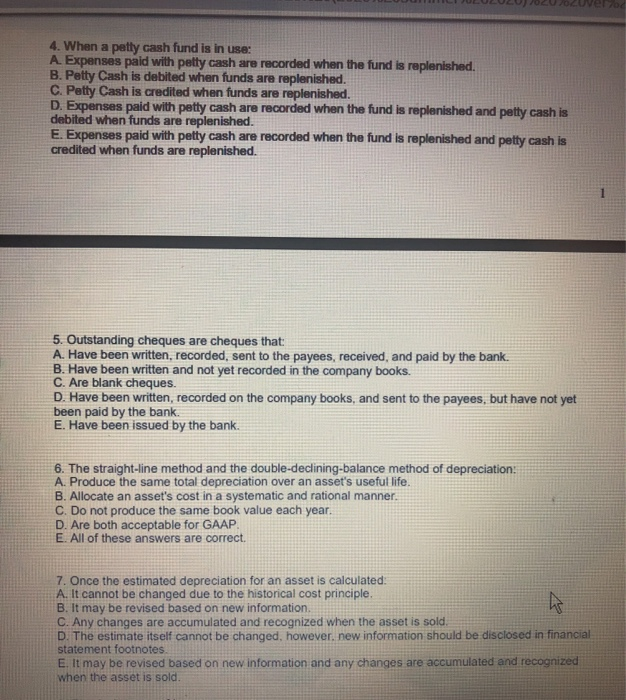

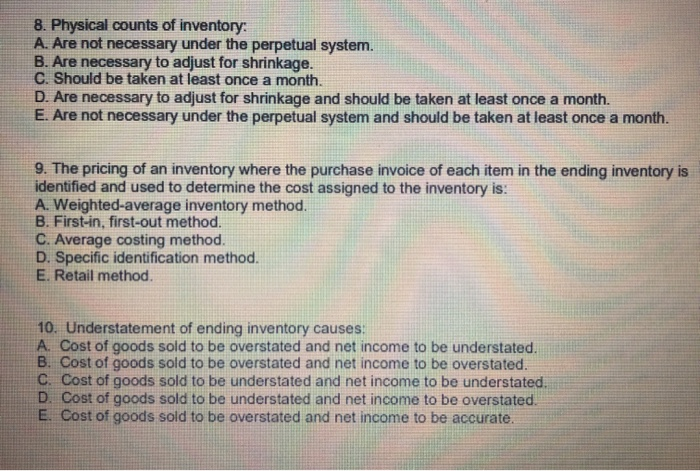

Choose the best answer and Indicate your selection in this table. (Put your choice below In CAPITAL LETTERS) 1. 6. 2 . 7. 3. 8. 4. 9. 5. 10. 1. During a period of steadily falling prices, which inventory cost flow assumption results in reporting the lowest net income? A. Specific identification. B. Average cost. C. Weighted average. D. FIFO. E. Retail method. 2. A good system of internal control A. Encourages adherence to prescribed managerial policies. B. Promotes operational efficiencies. C. Eliminates the need for an audit. D. Both encourages adherence to prescribed managerial policies and promotes operational efficiencies E. All of these answers are correct. 3. An income statement account used to record cash overages and cash shortages arising from omitted petty cash receipts and from errors in making change is the A. Cash Lost account. B. Bank Reconciliation account. C. Petty Cash account. D. Cash Over and Short account. E. Cash Receivable account 4. When a petty cash fund is in use: A. Expenses paid with petty cash are recorded when the fund is replenished. B. Petty Cash is debited when funds are replenished. C. Petty Cash is credited when funds are replenished. D. Expenses paid with petty cash are recorded when the fund is replenished and petty cash is debited when funds are replenished. E. Expenses paid with petty cash are recorded when the fund is replenished and petty cash is credited when funds are replenished. 5. Outstanding cheques are cheques that: A. Have been written, recorded, sent to the payees, received and paid by the bank. B. Have been written and not yet recorded in the company books. C. Are blank cheques. D. Have been written, recorded on the company books, and sent to the payees, but have not yet been paid by the bank. E. Have been issued by the bank. 6. The straight-line method and the double-declining balance method of depreciation: A. Produce the same total depreciation over an asset's useful life. B. Allocate an asset's cost in a systematic and rational manner. C. Do not produce the same book value each year. D. Are both acceptable for GAAP. E. All of these answers are correct. h 7. Once the estimated depreciation for an asset is calculated A. It cannot be changed due to the historical cost principle. B. It may be revised based on new information C. Any changes are accumulated and recognized when the asset is sold D. The estimate itself cannot be changed, however, new information should be disclosed in financial statement footnotes E. It may be revised based on new information and any changes are accumulated and recognized when the asset is sold. 8. Physical counts of inventory: A. Are not necessary under the perpetual system. B. Are necessary to adjust for shrinkage. C. Should be taken at least once a month. D. Are necessary to adjust for shrinkage and should be taken at least once a month. E. Are not necessary under the perpetual system and should be taken at least once a month. 9. The pricing of an inventory where the purchase invoice of each item in the ending inventory is identified and used to determine the cost assigned to the inventory is: A. Weighted average inventory method. B. First-in, first-out method. C. Average costing method. D. Specific identification method. E. Retail method. 10. Understatement of ending inventory causes! A. Cost of goods sold to be overstated and net income to be understated. B. Cost of goods sold to be overstated and net income to be overstated. C. Cost of goods sold to be understated and net income to be understated. D. Cost of goods sold to be understated and net income to be overstated. E. Cost of goods sold to be overstated and net income to be accurate