Answered step by step

Verified Expert Solution

Question

1 Approved Answer

choose the best mc, and answer 8,9,10 8. Assume the firm that you are analyzing has convertible debt with the following characteristics: Face value: $200

choose the best mc, and answer 8,9,10

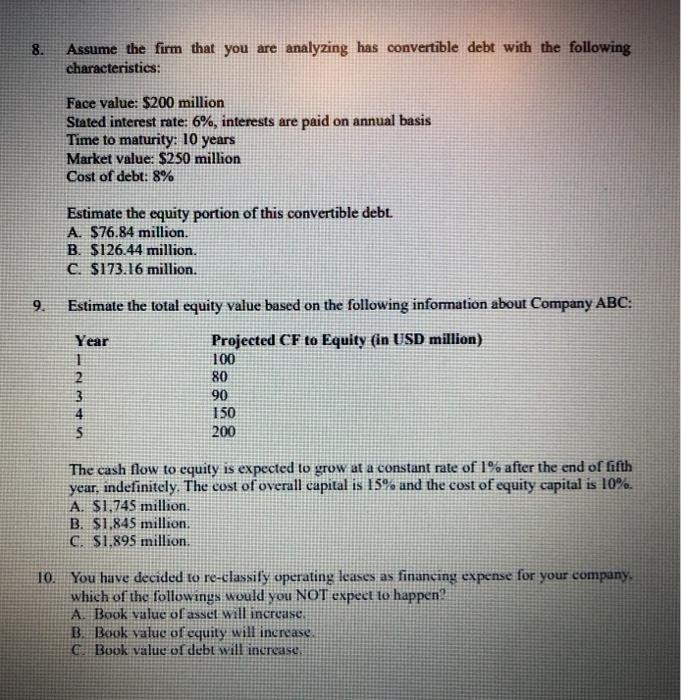

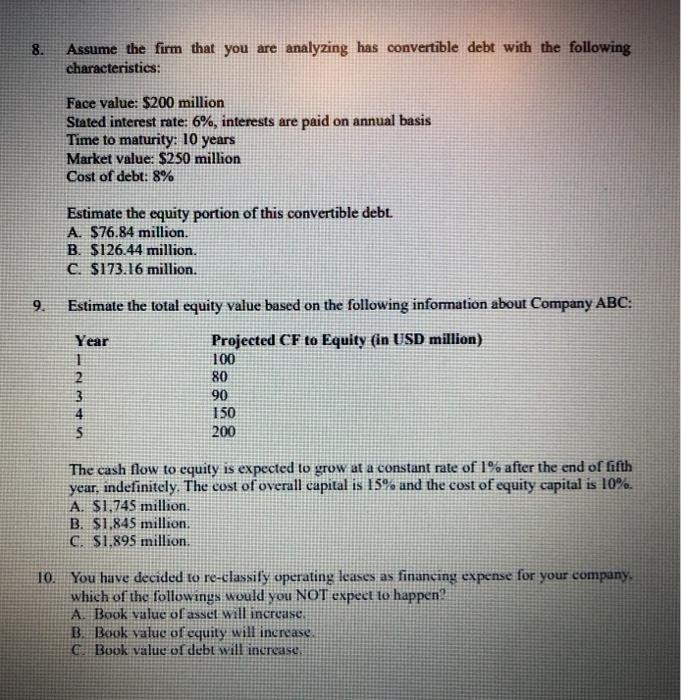

8. Assume the firm that you are analyzing has convertible debt with the following characteristics: Face value: $200 million Stated interest rate: 6%, interests are paid on annual basis Time to maturity: 10 years Market value: $250 million Cost of debt: 8% Estimate the equity portion of this convertible debt. A. $76.84 million. B. $126.44 million. C. $173.16 million. 9. Estimate the total equity value based on the following information about Company ABC: Year 1 2 3 4 S Projected CF to Equity (in USD million) 100 80 90 150 200 The cash flow to equity is expected to grow at a constant rate of 1% after the end of fifth year, indefinitely. The cost of overall capital is 15% and the cost of equity capital is 10%. A. $1,745 million. B. $1,845 million. C. $1,895 million. 10. You have decided to re-classily operating leases as financing expense for your company which of the followings would you NOT expect to happen! A. Book value of asset will increase. B. Book value of equity will increase Book value of debt will increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started