Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Choose the correct answer only without explanation. I have a specific time, please answer everyone, please Muscat Co. just starting business made the following four

Choose the correct answer only without explanation.

I have a specific time, please answer everyone, please

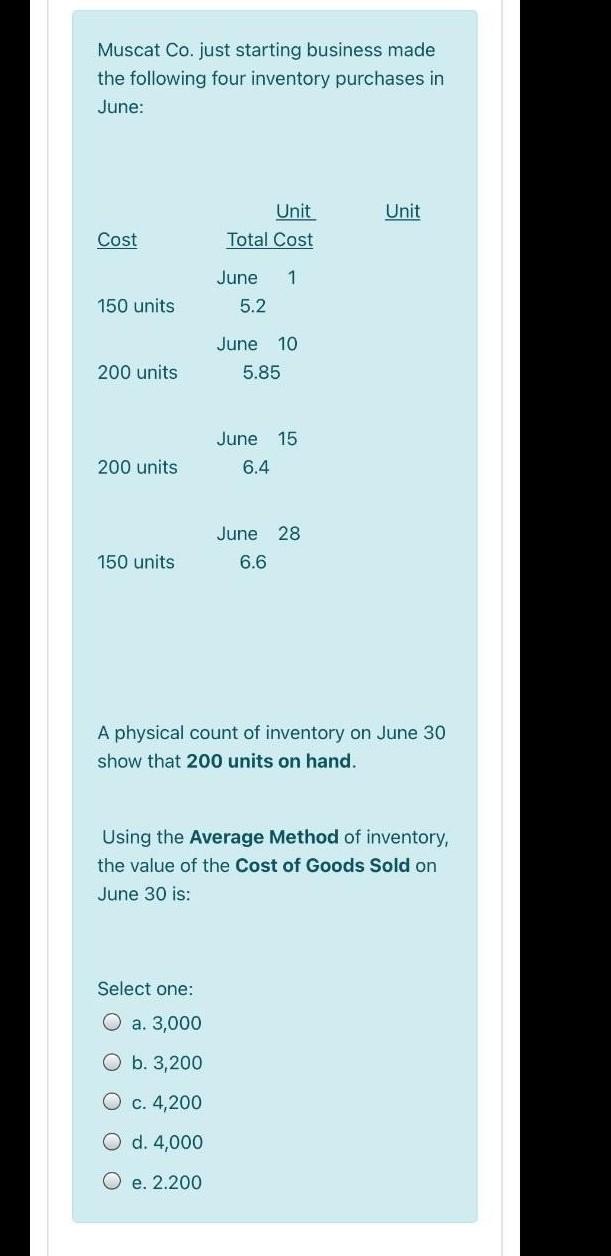

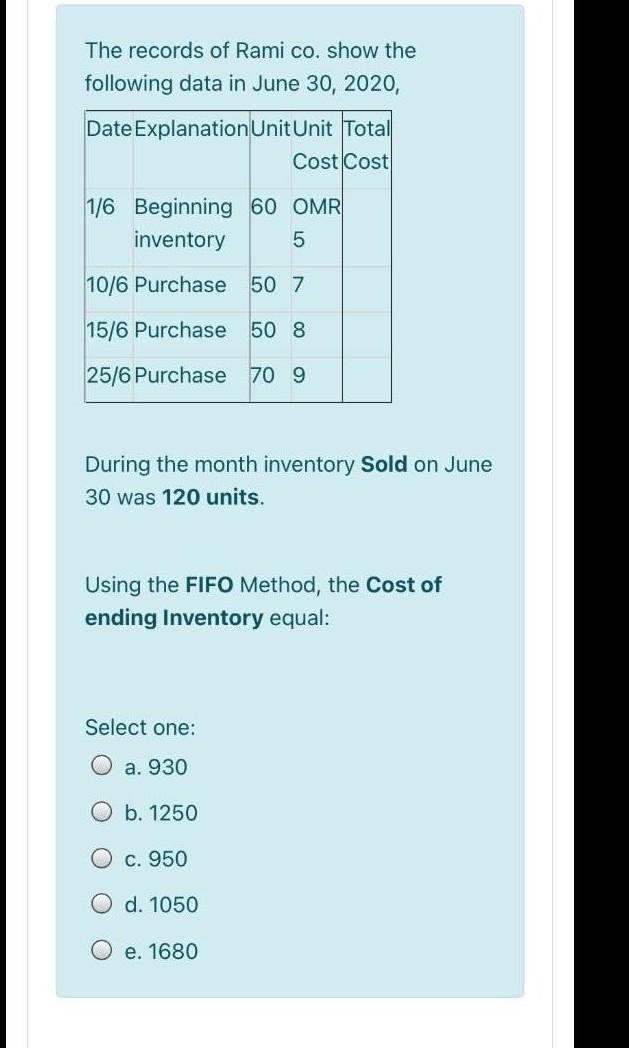

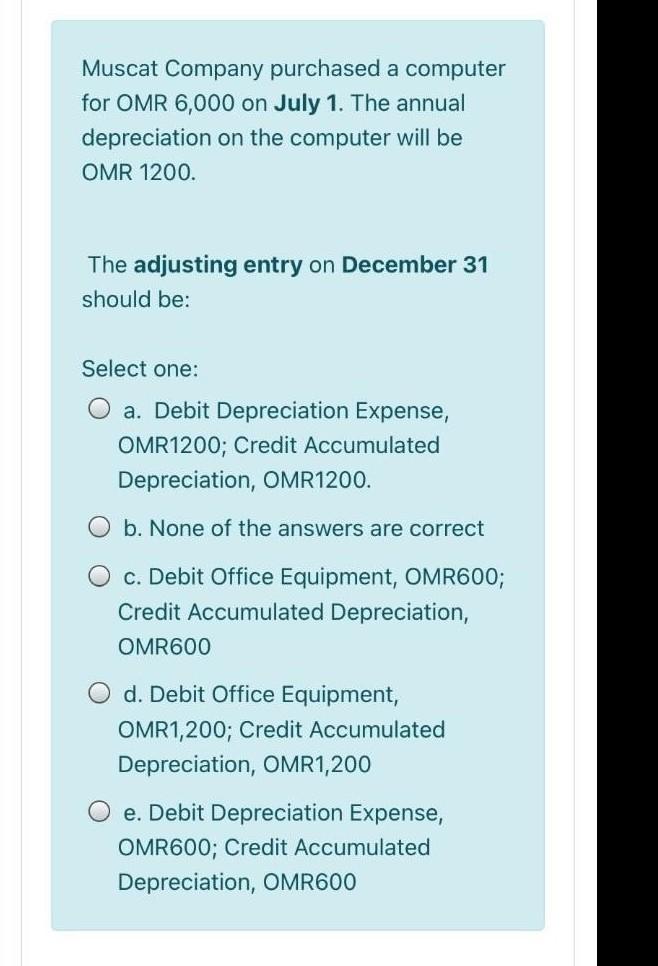

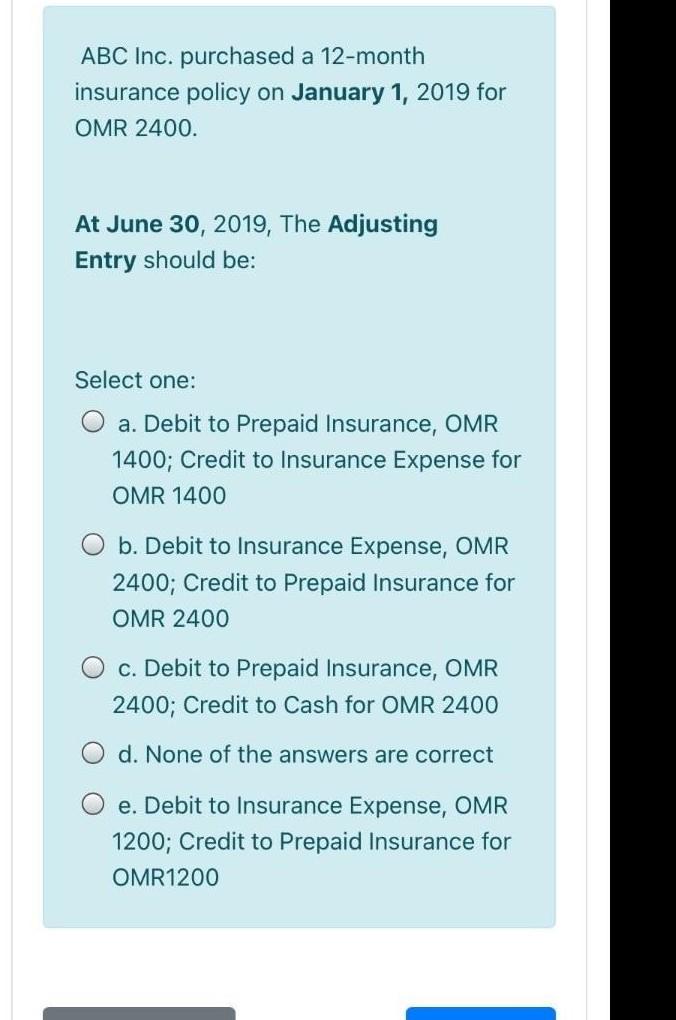

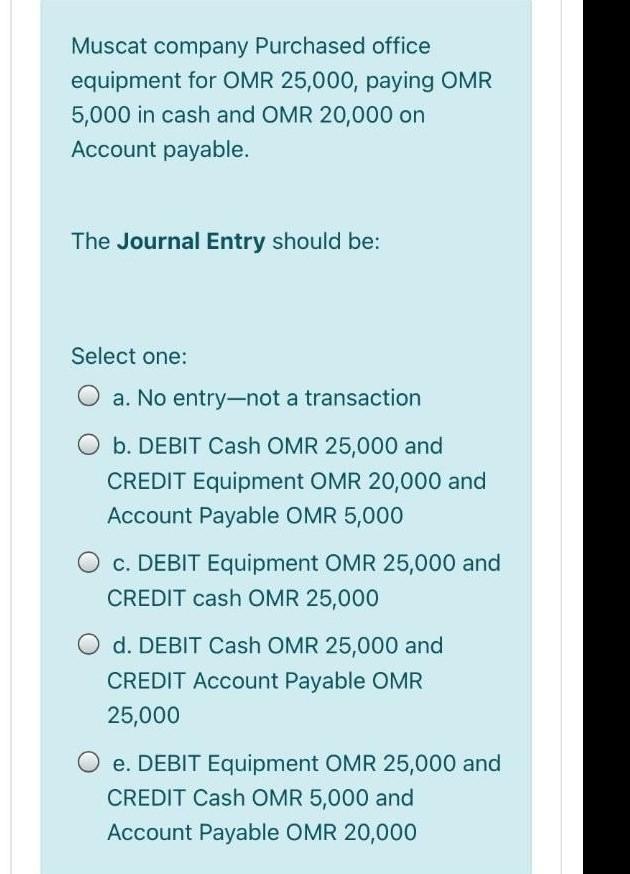

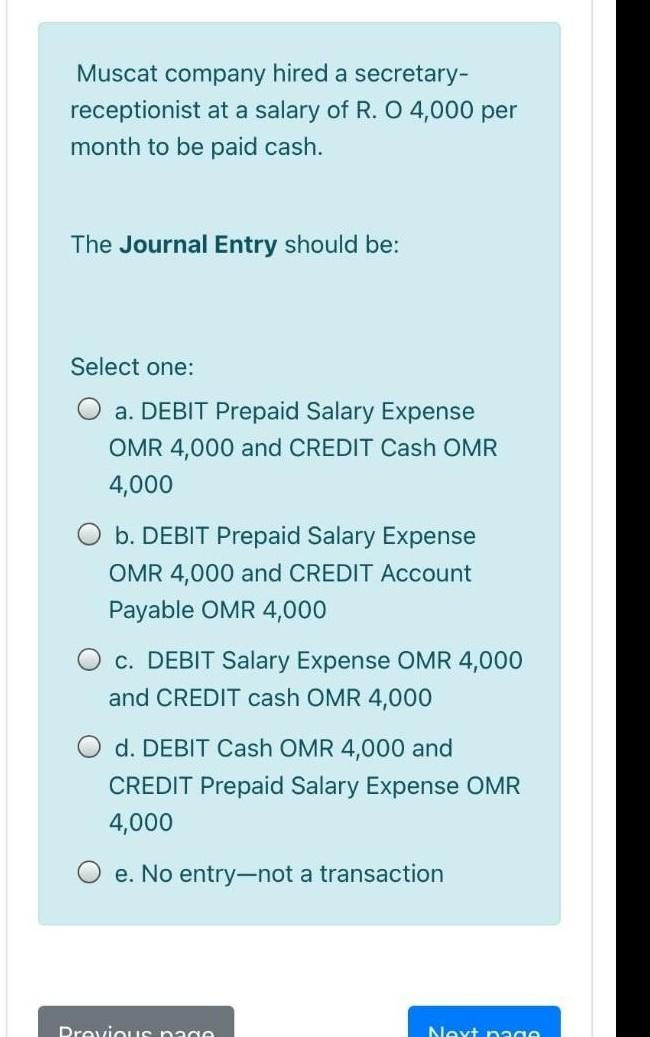

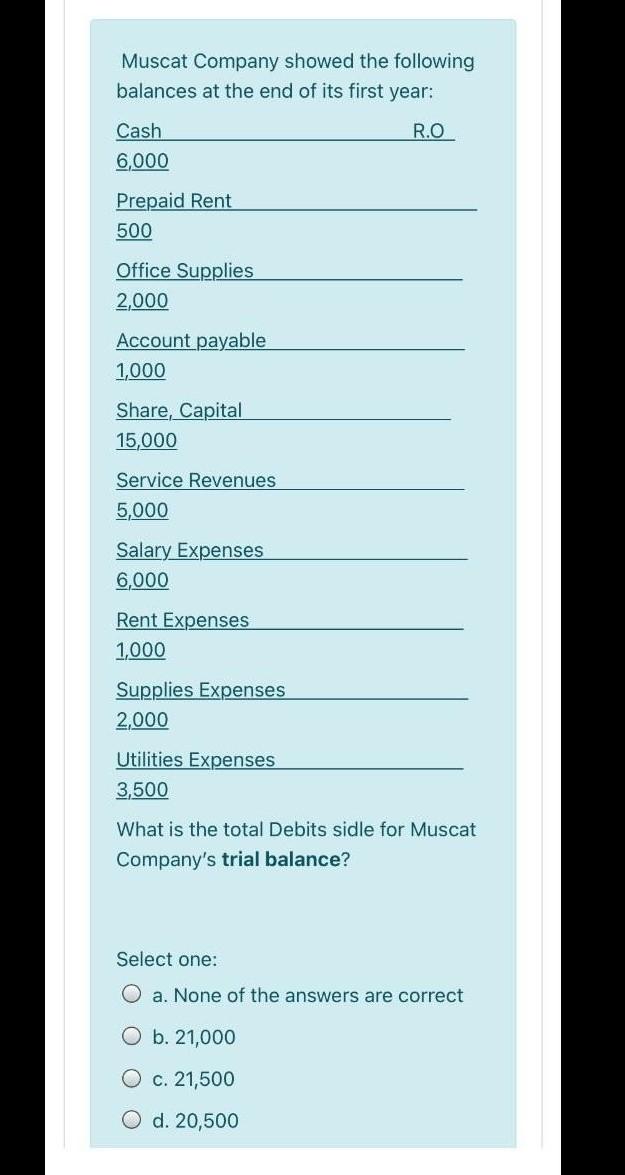

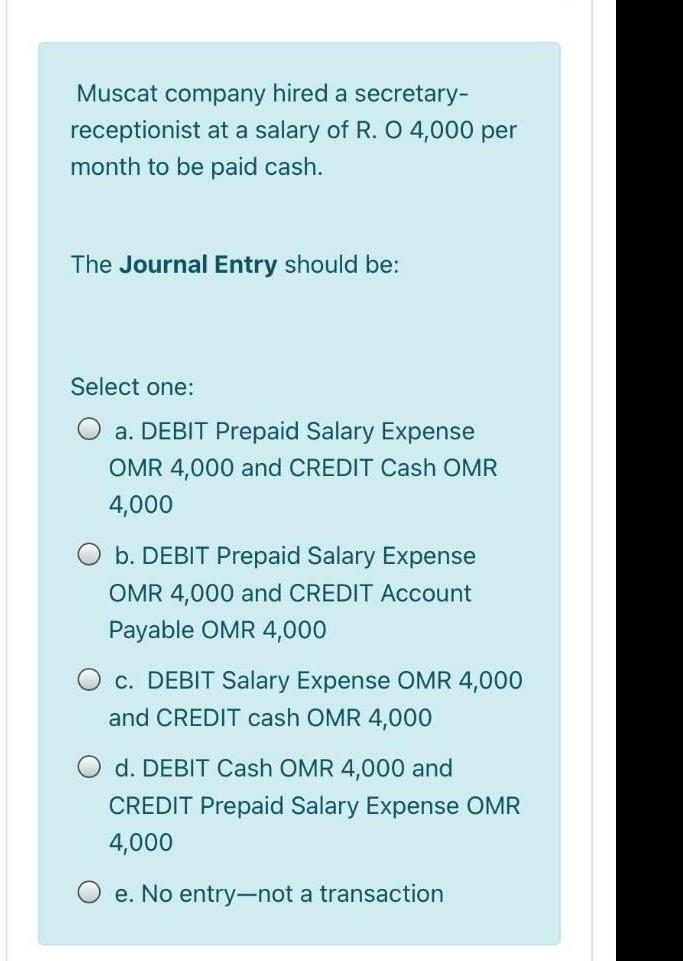

Muscat Co. just starting business made the following four inventory purchases in June: Unit Unit Total Cost Cost June 1 150 units 5.2 June 10 5.85 200 units June 15 6.4 200 units June 28 6.6 150 units A physical count of inventory on June 30 show that 200 units on hand. Using the Average Method of inventory, the value of the Cost of Goods Sold on June 30 is: Select one: O a. 3,000 O b.3,200 O c. 4,200 O d. 4,000 O e. 2.200 The records of Rami co. show the following data in June 30, 2020, Date Explanation Unit Unit Total Cost Cost 1/6 Beginning 60 OMR inventory 5 10/6 Purchase 50 7 15/6 Purchase 50 8 25/6 Purchase 70 9 During the month inventory Sold on June 30 was 120 units. Using the FIFO Method, the Cost of ending Inventory equal: Select one: a. 930 b. 1250 c. 950 d. 1050 O e. 1680 Muscat Company purchased a computer for OMR 6,000 on July 1. The annual depreciation on the computer will be OMR 1200. The adjusting entry on December 31 should be: Select one: a. Debit Depreciation Expense, OMR1200; Credit Accumulated Depreciation, OMR1200. O b. None of the answers are correct c. Debit Office Equipment, OMR600; Credit Accumulated Depreciation, OMR600 O d. Debit Office Equipment, OMR1,200; Credit Accumulated Depreciation, OMR1,200 e. Debit Depreciation Expense, OMR600; Credit Accumulated Depreciation, OMR600 ABC Inc. purchased a 12-month insurance policy on January 1, 2019 for OMR 2400. At June 30, 2019, The Adjusting Entry should be: Select one: O a. Debit to Prepaid Insurance, OMR 1400; Credit to Insurance Expense for OMR 1400 O b. Debit to Insurance Expense, OMR 2400; Credit to Prepaid Insurance for OMR 2400 C. Debit to Prepaid Insurance, OMR 2400; Credit to Cash for OMR 2400 O d. None of the answers are correct e. Debit to Insurance Expense, OMR 1200; Credit to Prepaid Insurance for OMR1200 Muscat company Purchased office equipment for OMR 25,000, paying OMR 5,000 in cash and OMR 20,000 on Account payable. The Journal Entry should be: Select one: O a. No entry-not a transaction b. DEBIT Cash OMR 25,000 and CREDIT Equipment OMR 20,000 and Account Payable OMR 5,000 O c. DEBIT Equipment OMR 25,000 and CREDIT cash OMR 25,000 d. DEBIT Cash OMR 25,000 and CREDIT Account Payable OMR 25,000 e. DEBIT Equipment OMR 25,000 and CREDIT Cash OMR 5,000 and Account Payable OMR 20,000 Muscat company hired a secretary- receptionist at a salary of R. O 4,000 per month to be paid cash. The Journal Entry should be: Select one: a. DEBIT Prepaid Salary Expense OMR 4,000 and CREDIT Cash OMR 4,000 b. DEBIT Prepaid Salary Expense OMR 4,000 and CREDIT Account Payable OMR 4,000 O c. DEBIT Salary Expense OMR 4,000 and CREDIT cash OMR 4,000 d. DEBIT Cash OMR 4,000 and CREDIT Prepaid Salary Expense OMR 4,000 O e. No entry-not a transaction Previous nage Meyt naaa Muscat Company showed the following balances at the end of its first year: R.O Cash 6,000 Prepaid Rent 500 Office Supplies 2,000 Account payable 1,000 Share, Capital 15,000 Service Revenues 5,000 Salary Expenses 6,000 Rent Expenses 1,000 Supplies Expenses 2,000 Utilities Expenses 3,500 What is the total Debits sidle for Muscat Company's trial balance? Select one: O a. None of the answers are correct O b. 21,000 O c. 21,500 O d. 20,500 Muscat company hired a secretary- receptionist at a salary of R. O 4,000 per month to be paid cash. The Journal Entry should be: Select one: O a. DEBIT Prepaid Salary Expense OMR 4,000 and CREDIT Cash OMR 4,000 O b. DEBIT Prepaid Salary Expense OMR 4,000 and CREDIT Account Payable OMR 4,000 c. DEBIT Salary Expense OMR 4,000 and CREDIT cash OMR 4,000 d. DEBIT Cash OMR 4,000 and CREDIT Prepaid Salary Expense OMR 4,000 e. No entry-not a transaction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started