Answered step by step

Verified Expert Solution

Question

1 Approved Answer

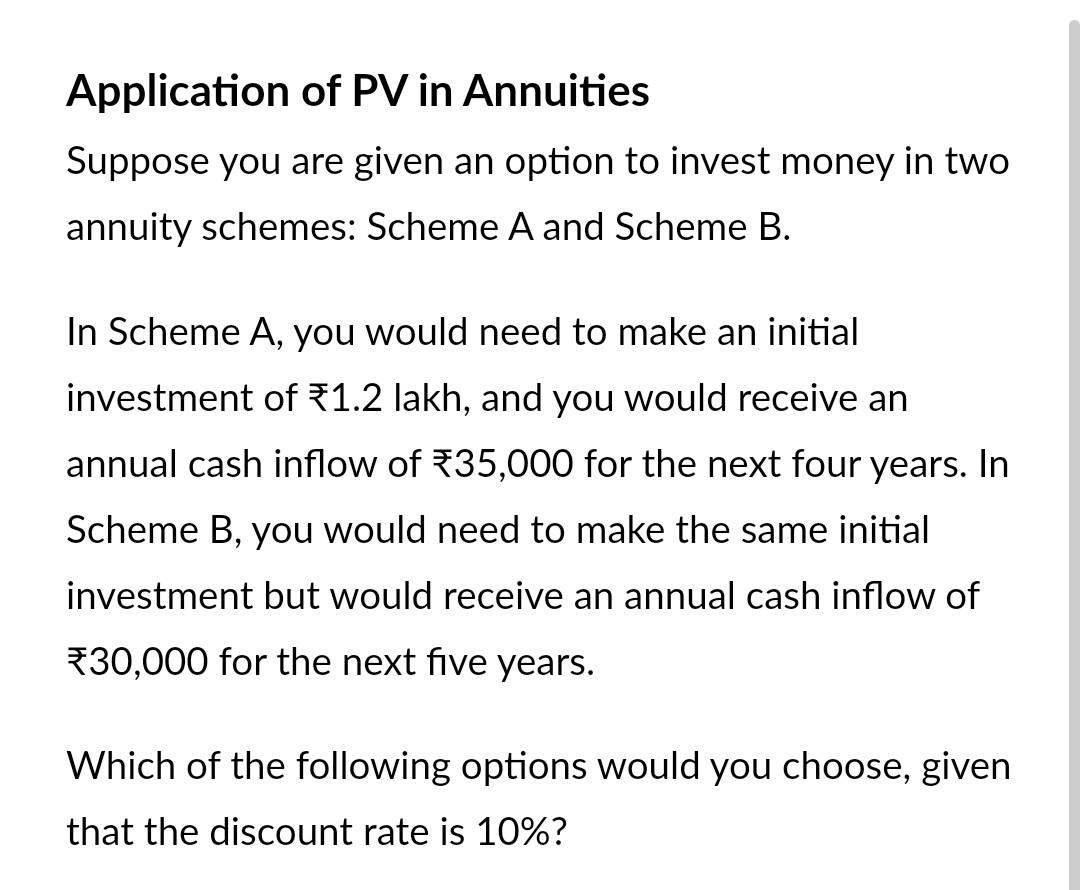

choose the correct option Application of PV in Annuities Suppose you are given an option to invest money in two annuity schemes: Scheme A and

choose the correct option

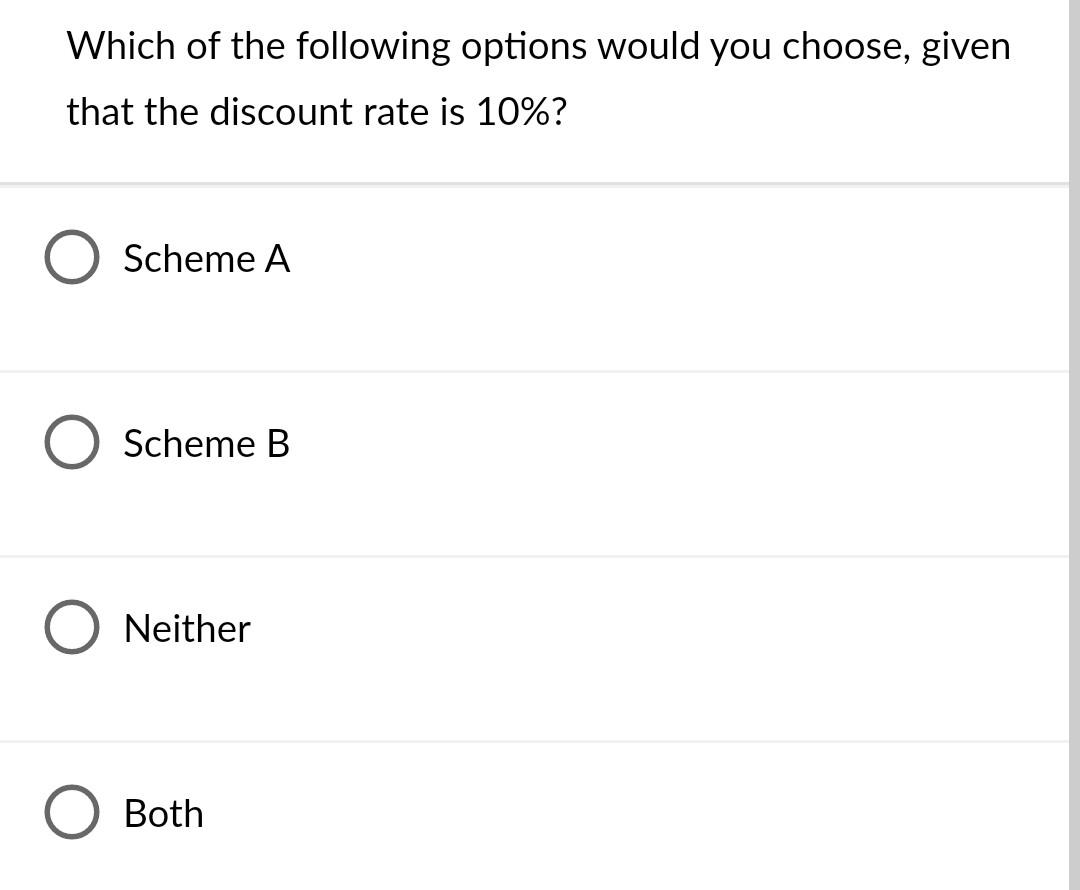

Application of PV in Annuities Suppose you are given an option to invest money in two annuity schemes: Scheme A and Scheme B. In Scheme A, you would need to make an initial investment of 1.2 lakh, and you would receive an annual cash inflow of 35,000 for the next four years. In Scheme B, you would need to make the same initial investment but would receive an annual cash inflow of 30,000 for the next five years. Which of the following options would you choose, given that the discount rate is 10%? Which of the following options would you choose, given that the discount rate is 10%? Scheme A Scheme B Neither BothStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started