Answered step by step

Verified Expert Solution

Question

1 Approved Answer

chose any value (random value), just explain the procedure, for a, b and c. I want to understand procedure thanks Problem description: Assume the risk

chose any value (random value), just explain the procedure, for a, b and c.

chose any value (random value), just explain the procedure, for a, b and c.

I want to understand procedure

thanks

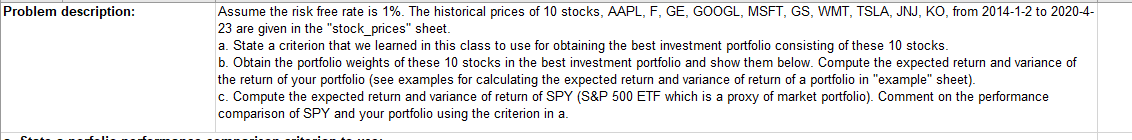

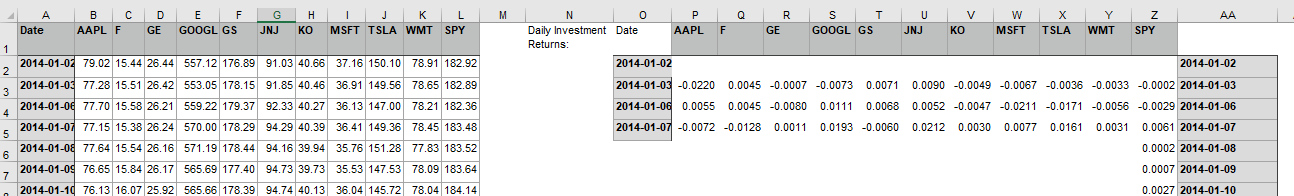

Problem description: Assume the risk free rate is 1%. The historical prices of 10 stocks, AAPL, F, GE, GOOGL, MSFT, GS, WMT, TSLA, JNJ, KO, from 2014-1-2 to 2020-4- 23 are given in the "stock_prices" sheet. a. State a criterion that we learned in this class to use for obtaining the best investment portfolio consisting of these 10 stocks. b. Obtain the portfolio weights of these 10 stocks in the best investment portfolio and show them below. Compute the expected return and variance of the return of your portfolio (see examples for calculating the expected return and variance of return of a portfolio in "example" sheet). c. Compute the expected return and variance of return of SPY (S&P 500 ETF which is a proxy of market portfolio). Comment on the performance comparison of SPY and your portfolio using the criterion in a M Q AA A Date B AAPL F D GE E F GOOGL GS G JNJ H 1 J L KO MSFT TSLA WMT SPY N 0 Daily Investment Date Returns P AAPL R GE S T GOOGL GS U JNJ v W MSFT TSLA Y WMT Z SPY F 1 2014-01-02 2014-01-02 2 3 4 2014-01-02 79.02 15.44 26.44 557.12 176.89 91.03 40.66 37.16 150.10 78.91 182.92 2014-01-03 77.28 15.51 26.42 553.05 178.15 91.85 40.46 36.91 149.56 78.65 182.89 2014-01-0 77.70 15.58 26.21 559.22 179.37 92.33 40.27 36.13 147.00 78.21 182.36 2014-01-07 77.15 15.38 26.24 570.00 178.29 94.29 40.39 36.41 149.36 78.45 183.48 2014-01-08 77.64 15.54 26.16 571.19 178.44 94.16 39.94 35.76 151.28 77.83 183.52 2014-01-09 76.65 15.84 26.17 565.69 177.40 94.73 39.73 35.53 147.53 78.09 183.64 2014-01-10 76.13 16.07 25.92 565.66 178.39 94.74 40.13 36.04 145.72 78.04 184.14 2014-01-03 -0.0220 0.0045 -0.0007 -0.0073 0.0071 0.0090 -0.0049 -0.0067 -0.0036 -0.0033 -0.0002 2014-01-03 2014-01-06 0.0055 0.0045 -0.0080 0.0111 0.0068 0.0052 -0.0047 -0.0211 -0.0171 -0.0056 -0.0029 2014-01-06 2014-01-07 -0.0072 -0.0128 0.0011 0.0193 -0.0060 0.0212 0.0030 0.0077 0.0161 0.0031 0.0061 2014-01-07 0.0002 2014-01-08 0.0007 2014-01-09 5 6 7 7 0.0027 2014-01-10 Problem description: Assume the risk free rate is 1%. The historical prices of 10 stocks, AAPL, F, GE, GOOGL, MSFT, GS, WMT, TSLA, JNJ, KO, from 2014-1-2 to 2020-4- 23 are given in the "stock_prices" sheet. a. State a criterion that we learned in this class to use for obtaining the best investment portfolio consisting of these 10 stocks. b. Obtain the portfolio weights of these 10 stocks in the best investment portfolio and show them below. Compute the expected return and variance of the return of your portfolio (see examples for calculating the expected return and variance of return of a portfolio in "example" sheet). c. Compute the expected return and variance of return of SPY (S&P 500 ETF which is a proxy of market portfolio). Comment on the performance comparison of SPY and your portfolio using the criterion in a M Q AA A Date B AAPL F D GE E F GOOGL GS G JNJ H 1 J L KO MSFT TSLA WMT SPY N 0 Daily Investment Date Returns P AAPL R GE S T GOOGL GS U JNJ v W MSFT TSLA Y WMT Z SPY F 1 2014-01-02 2014-01-02 2 3 4 2014-01-02 79.02 15.44 26.44 557.12 176.89 91.03 40.66 37.16 150.10 78.91 182.92 2014-01-03 77.28 15.51 26.42 553.05 178.15 91.85 40.46 36.91 149.56 78.65 182.89 2014-01-0 77.70 15.58 26.21 559.22 179.37 92.33 40.27 36.13 147.00 78.21 182.36 2014-01-07 77.15 15.38 26.24 570.00 178.29 94.29 40.39 36.41 149.36 78.45 183.48 2014-01-08 77.64 15.54 26.16 571.19 178.44 94.16 39.94 35.76 151.28 77.83 183.52 2014-01-09 76.65 15.84 26.17 565.69 177.40 94.73 39.73 35.53 147.53 78.09 183.64 2014-01-10 76.13 16.07 25.92 565.66 178.39 94.74 40.13 36.04 145.72 78.04 184.14 2014-01-03 -0.0220 0.0045 -0.0007 -0.0073 0.0071 0.0090 -0.0049 -0.0067 -0.0036 -0.0033 -0.0002 2014-01-03 2014-01-06 0.0055 0.0045 -0.0080 0.0111 0.0068 0.0052 -0.0047 -0.0211 -0.0171 -0.0056 -0.0029 2014-01-06 2014-01-07 -0.0072 -0.0128 0.0011 0.0193 -0.0060 0.0212 0.0030 0.0077 0.0161 0.0031 0.0061 2014-01-07 0.0002 2014-01-08 0.0007 2014-01-09 5 6 7 7 0.0027 2014-01-10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started