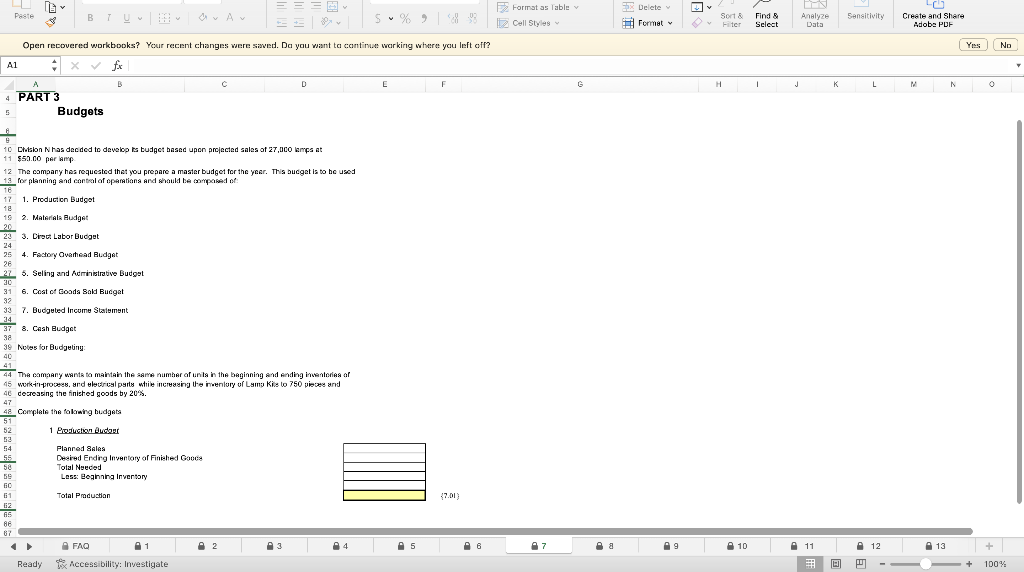

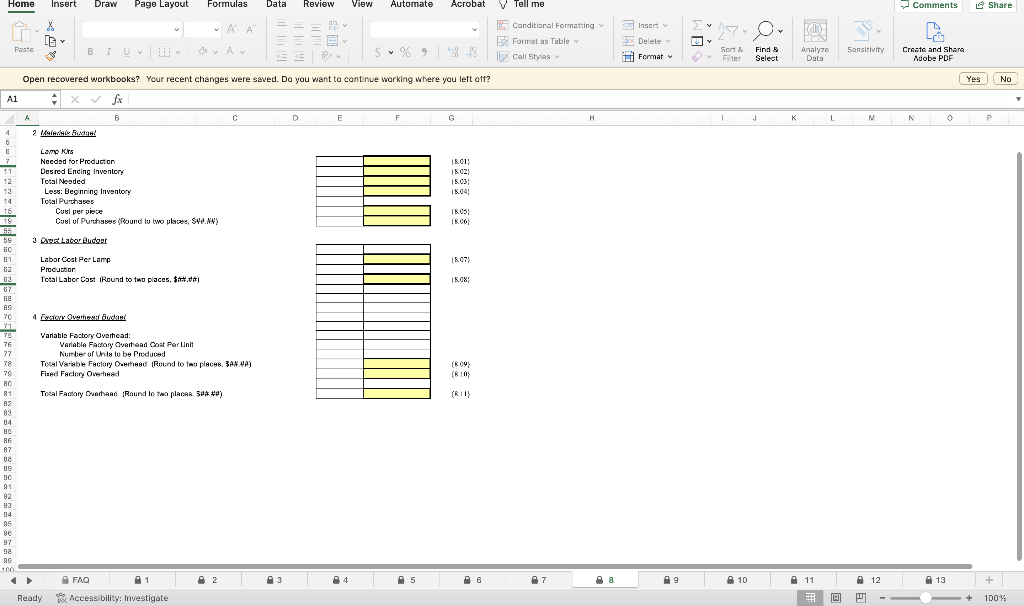

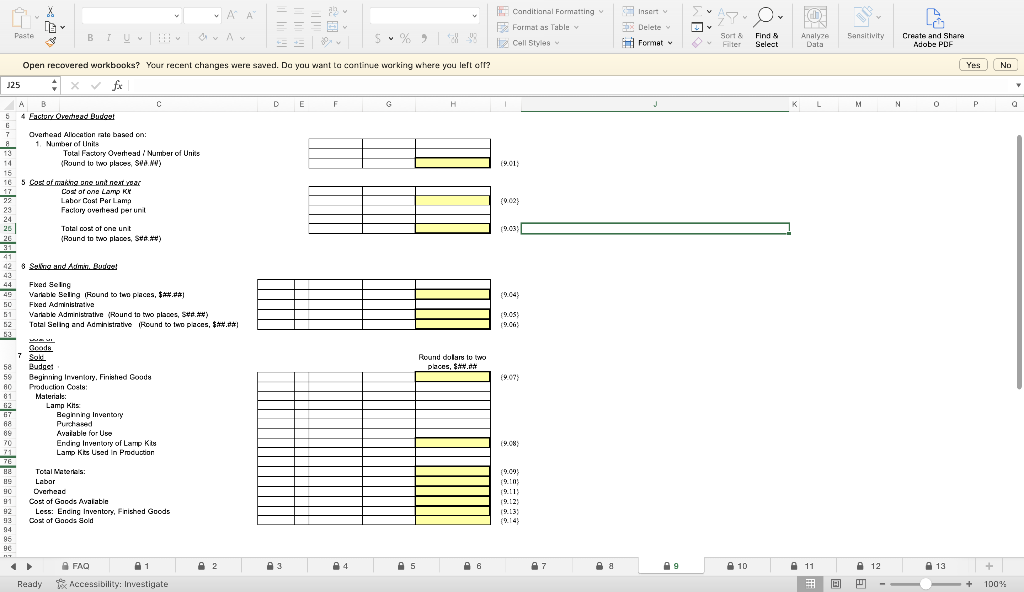

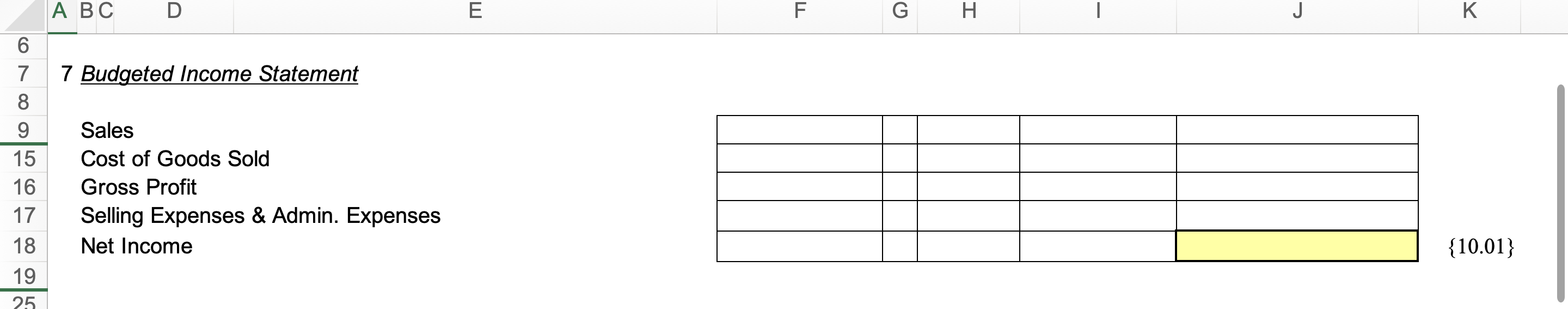

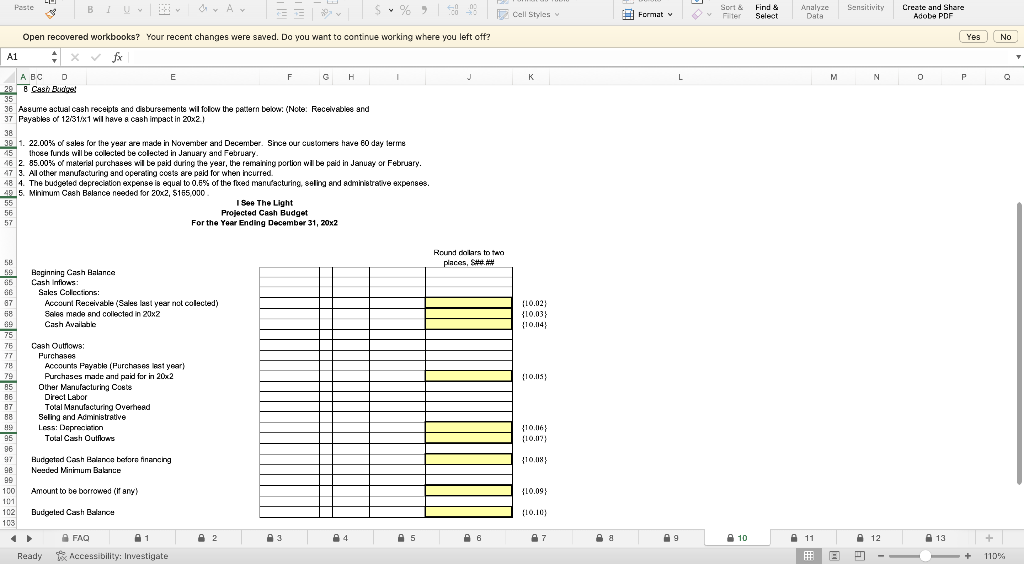

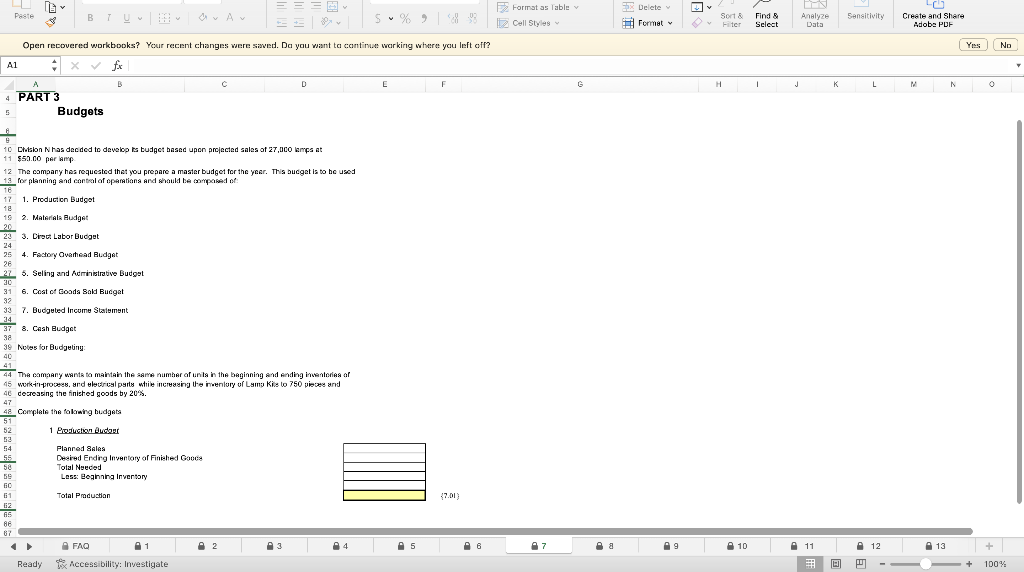

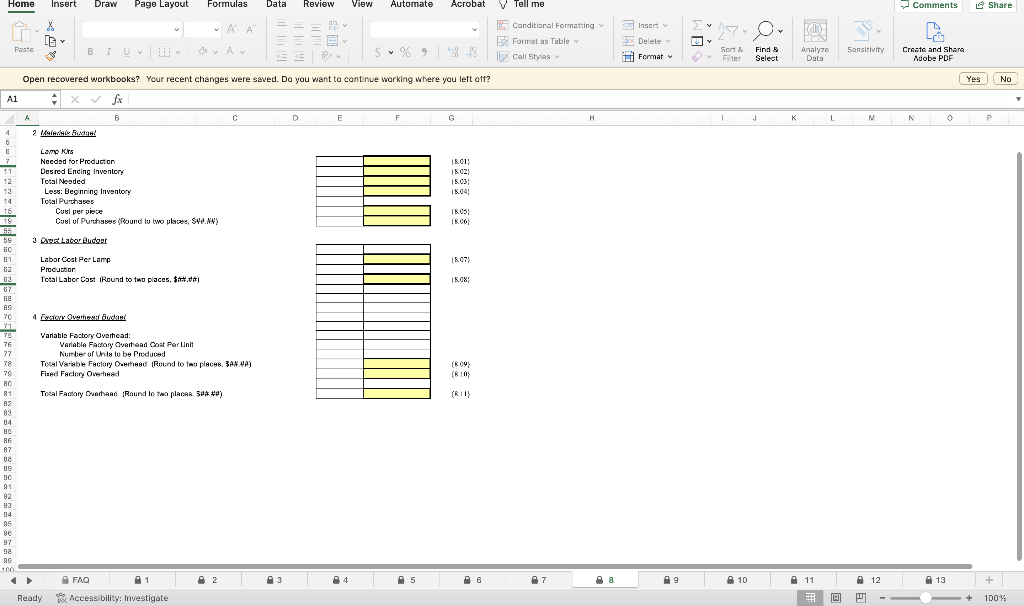

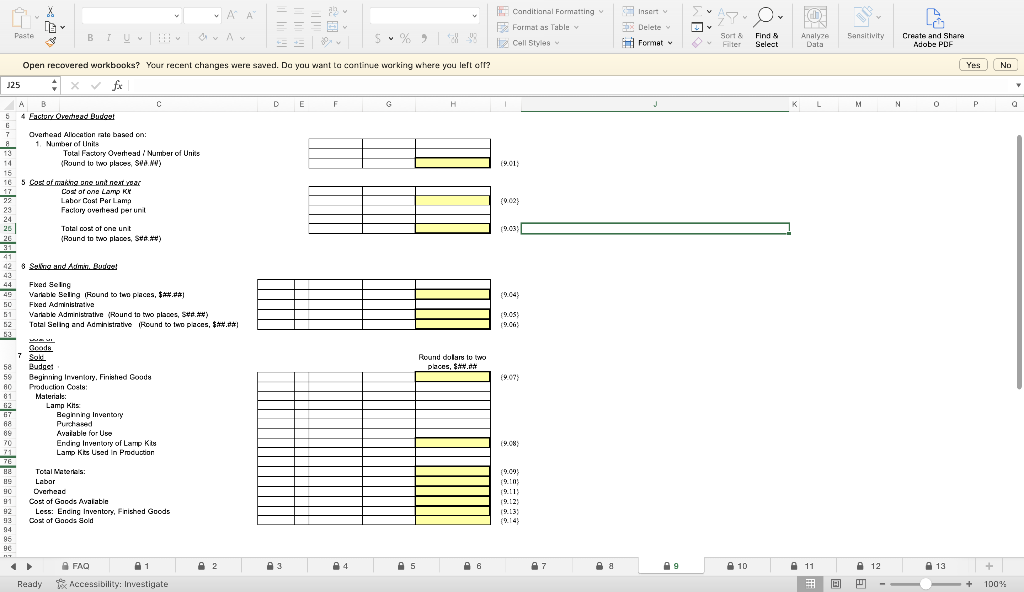

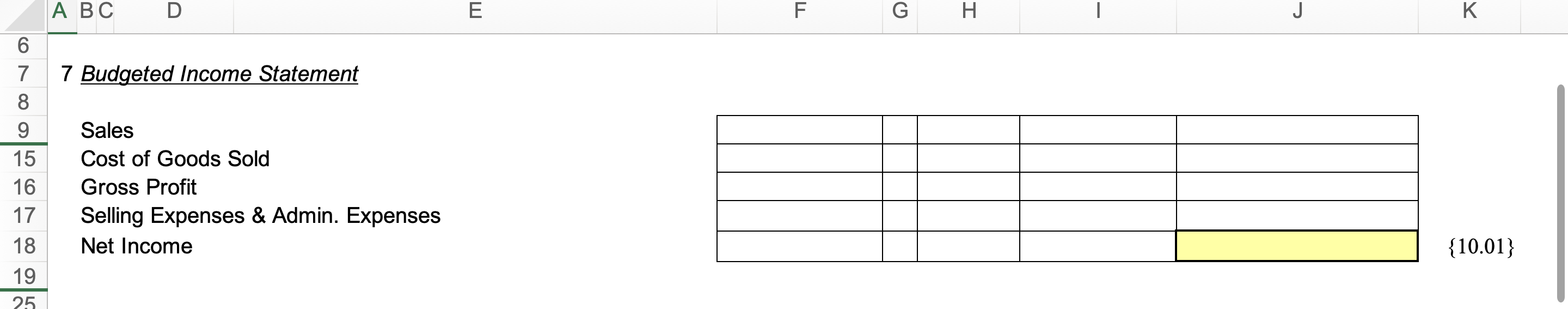

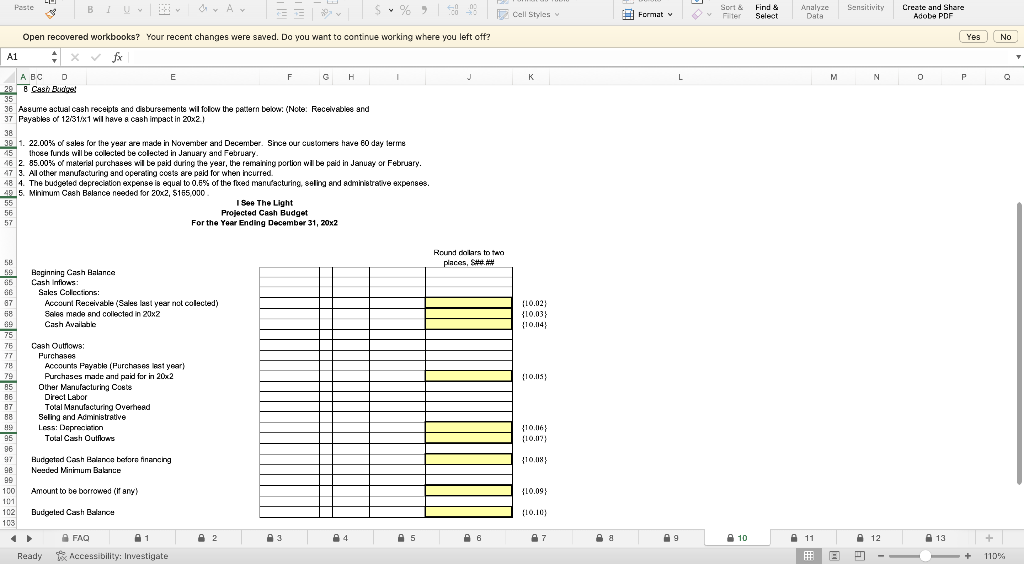

Chotabn N has dec ded to develop ra budgct based upen projected salea of 2T, aco knps at \$5.00 par simp. 12 The comanny has requcsted thet you prepare a master budget for the year. This bucgat is bo he usod 1. Production Budgot 2. Materiala Rudget 3. Direct Lator Budget 4. Fachory Quatiad Budgat 5. Seling and Auminisirative Budget 6. Cost od coada Bald Bucgat 7. Budgeted Incume Statement 8. Cash Budget Movas far Budguting: 1901 (0,0} (204) (907) 19.05 7 Budgeted Income Statement Sales Cost of Goods Sold Gross Profit Selling Expenses \& Admin. Expenses Net Income \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} {10.01} ABsume acbual cash receipts and dibursemente wil folow the patiern below: (Note: Recelvablee and Payablas of 12/31/x1 wil have a cash impact in 202. 1. 22.00\% of salas for the year are made in November ard December. Since our customers have co day lerms thcee funds wil be colacted be colected in Jariuary and February. 2. 85.00% of material purchases wil be paid curing the yegr, the remaining portion wil be paid in Januay or Febuary. 3. Al other manufachufing and operating coets are paid for when incurred. 4. The budgeted depreciation expense is equal to 0.6% of the ficed manulacturing seling and admiristraive expenses. 5. Mhinum Ceah Belance needed for 2002,$165,000 Chotabn N has dec ded to develop ra budgct based upen projected salea of 2T, aco knps at \$5.00 par simp. 12 The comanny has requcsted thet you prepare a master budget for the year. This bucgat is bo he usod 1. Production Budgot 2. Materiala Rudget 3. Direct Lator Budget 4. Fachory Quatiad Budgat 5. Seling and Auminisirative Budget 6. Cost od coada Bald Bucgat 7. Budgeted Incume Statement 8. Cash Budget Movas far Budguting: 1901 (0,0} (204) (907) 19.05 7 Budgeted Income Statement Sales Cost of Goods Sold Gross Profit Selling Expenses \& Admin. Expenses Net Income \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} {10.01} ABsume acbual cash receipts and dibursemente wil folow the patiern below: (Note: Recelvablee and Payablas of 12/31/x1 wil have a cash impact in 202. 1. 22.00\% of salas for the year are made in November ard December. Since our customers have co day lerms thcee funds wil be colacted be colected in Jariuary and February. 2. 85.00% of material purchases wil be paid curing the yegr, the remaining portion wil be paid in Januay or Febuary. 3. Al other manufachufing and operating coets are paid for when incurred. 4. The budgeted depreciation expense is equal to 0.6% of the ficed manulacturing seling and admiristraive expenses. 5. Mhinum Ceah Belance needed for 2002,$165,000