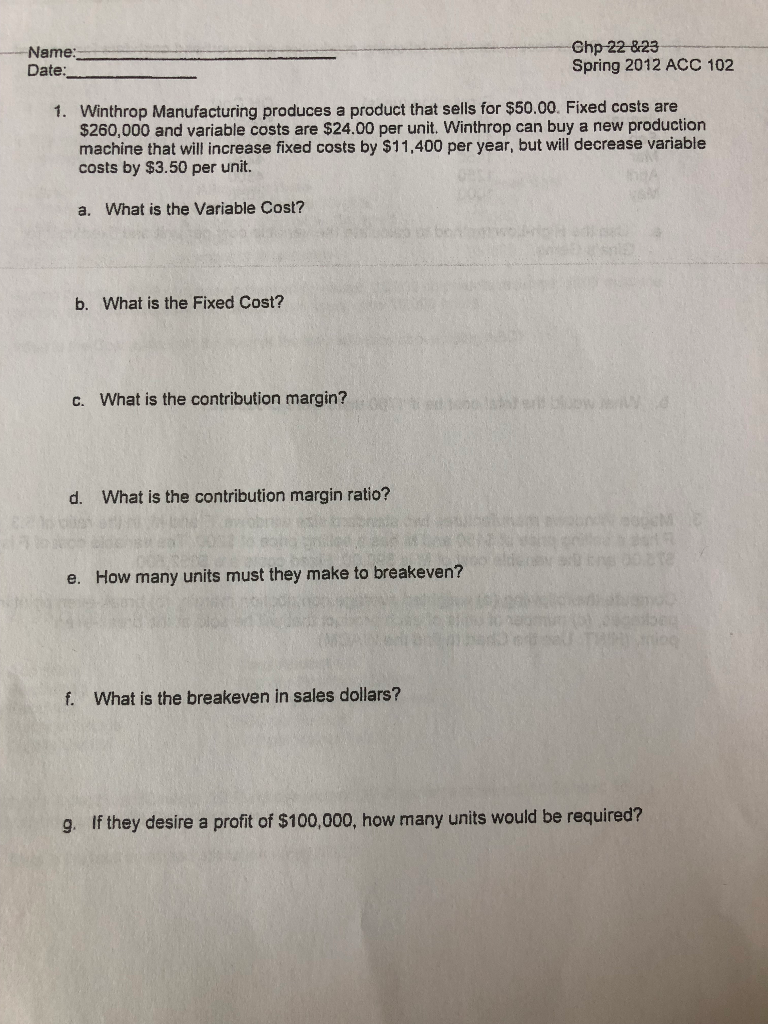

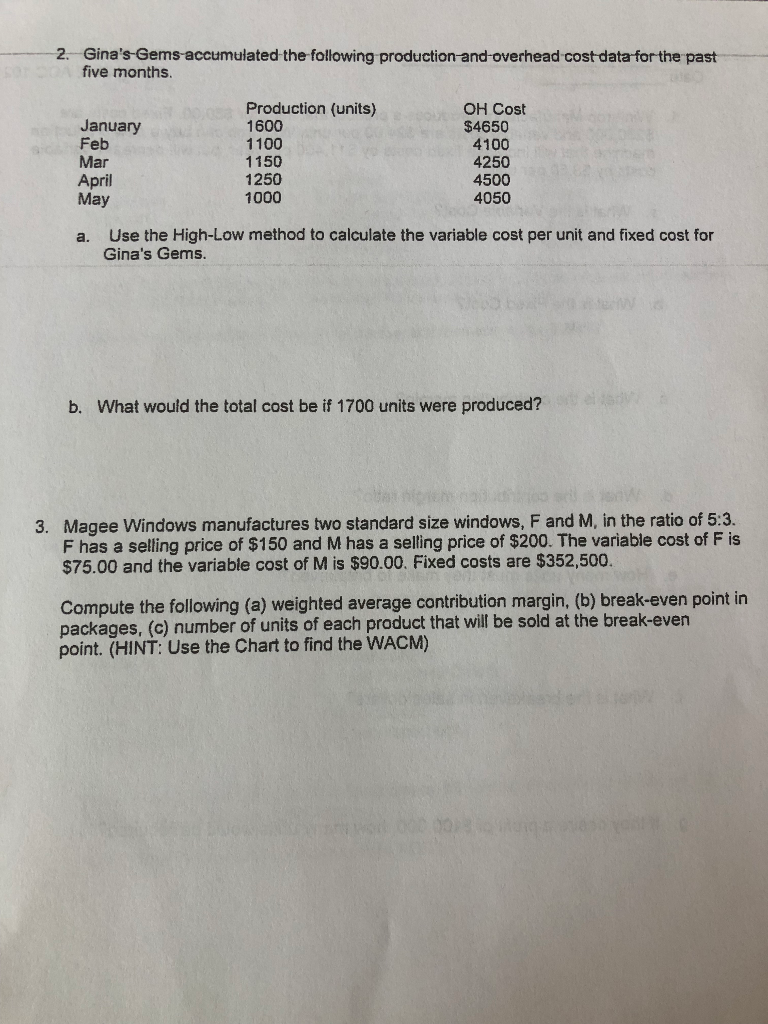

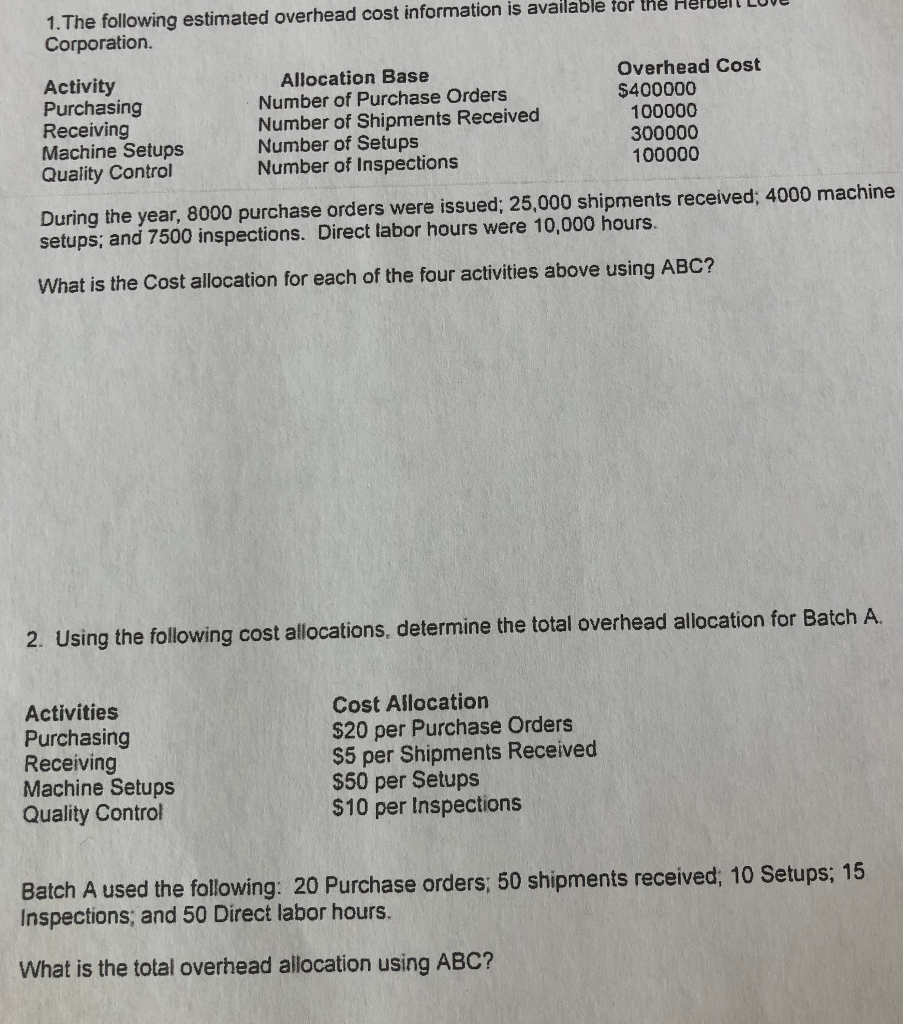

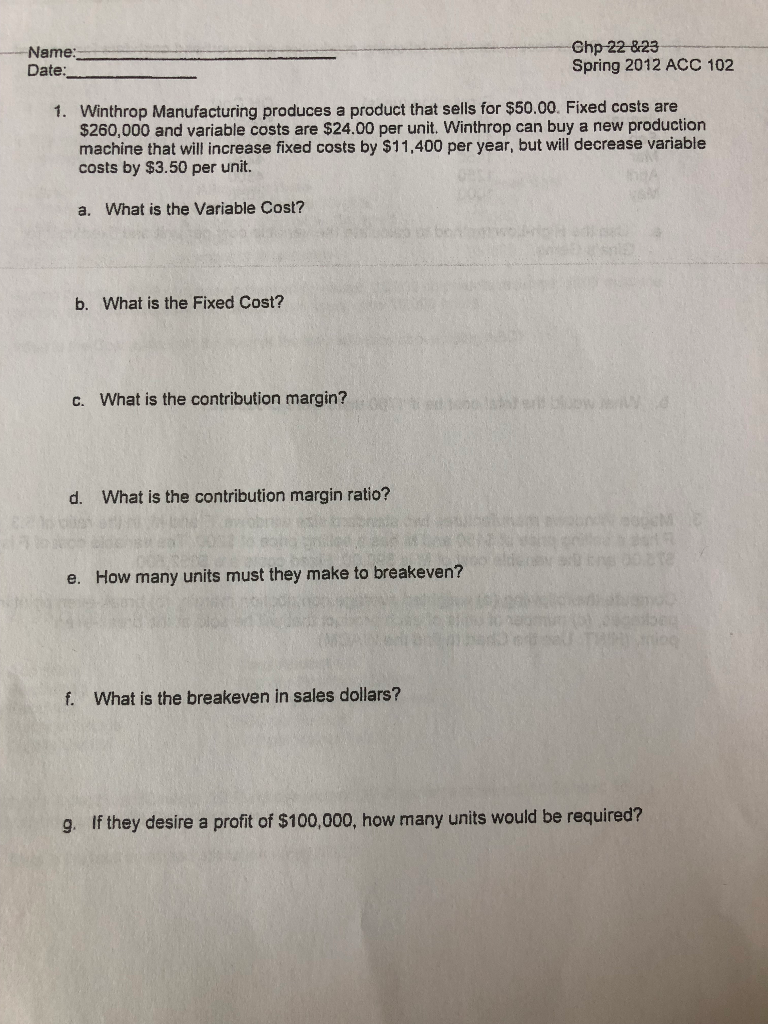

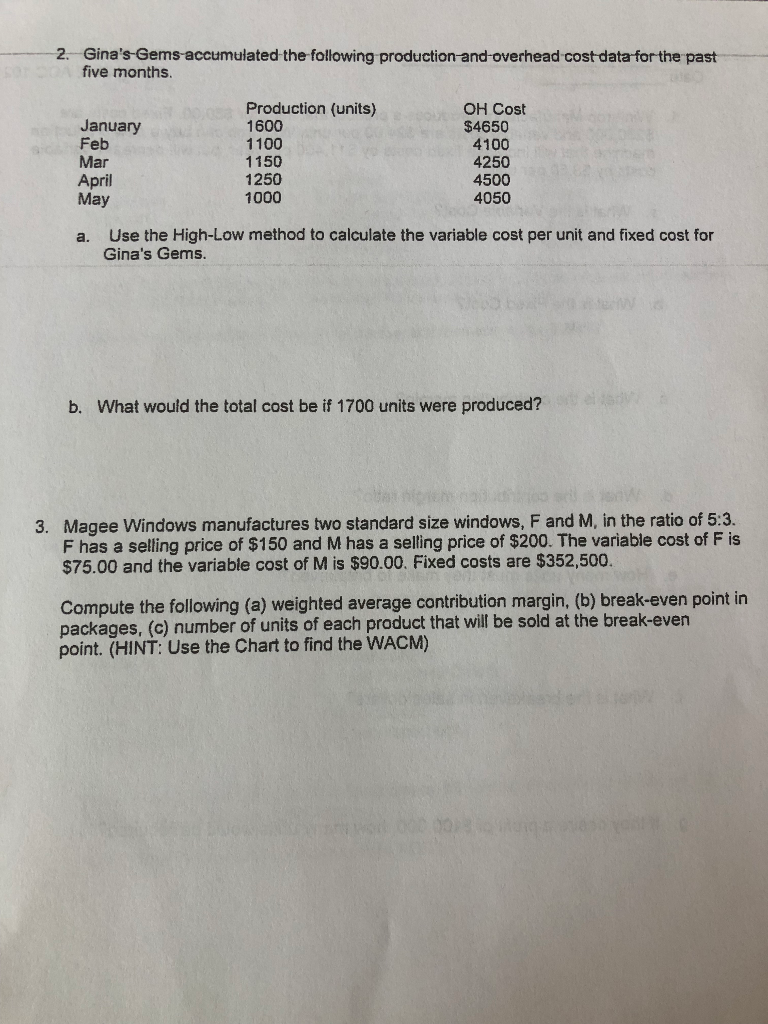

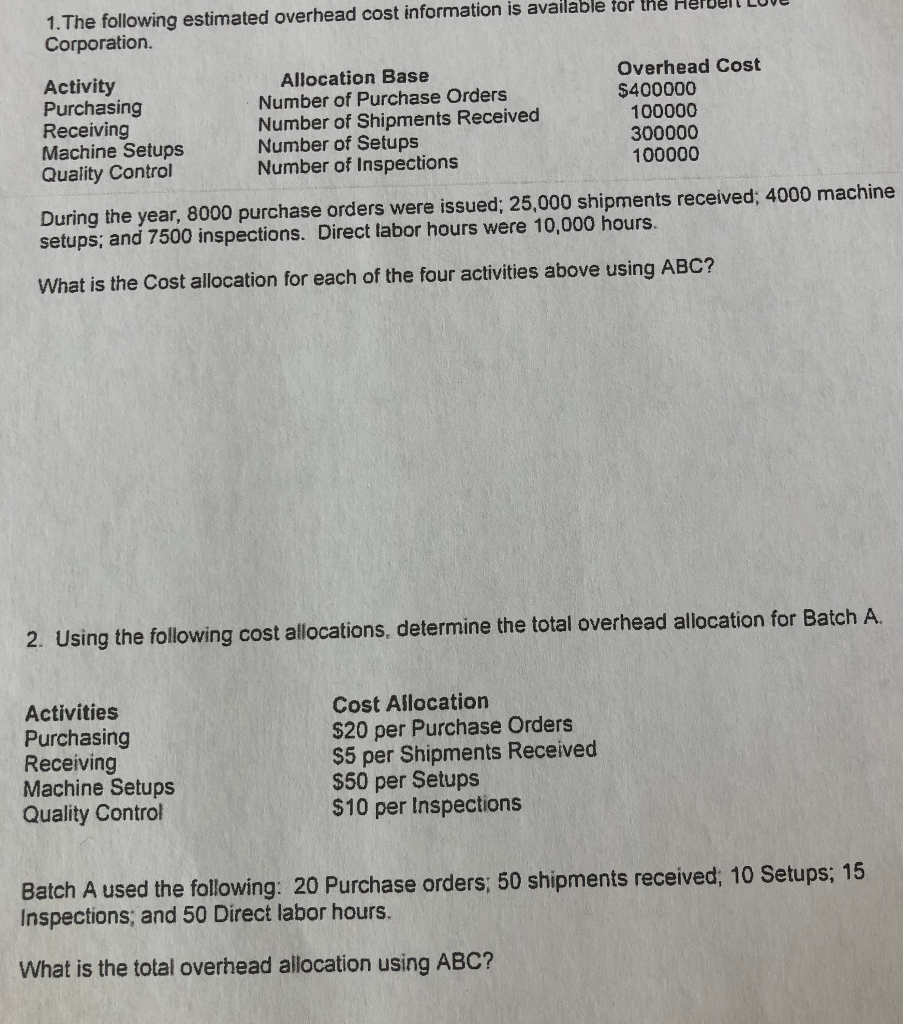

Chp 22 &23 Spring 2012 ACC 102 Name: Date: 1. Winthrop Manufacturing produces a product that sells for $50.00. Fixed costs are $260,000 and variable costs are $24.00 per unit. Winthrop can buy a new production machine that will increase fixed costs by $11,400 per year, but will decrease variable costs by $3.50 per unit. a. What is the Variable Cost? b. What is the Fixed Cost? c. What is the contribution margin? rad oo lan)er w d. What is the contribution margin ratio? neeoocM! tns 00218 e. How many units must they make to breakeven? edhaeo 101 0 ad THN e f What is the breakeven in sales dollars? If they desire a profit of $100,000, how many units would be required? 9. 2. Gina's-Gems-accumulated the following production-and-overhead cost data-for the past or 20A five months. T T Production (units) 1600 1100 1150 1250 1000 OH Cost $4650 4100 4250 4500 4050 January Feb Mar April May Use the High-Low method to calculate the variable cost per unit and fixed cost for Gina's Gems. a. b. What would the total cost be if 1700 units were produced? 3. Magee Windows manufactures two standard size windows, F and M, in the ratio of 5:3. F has a selling price of $150 and M has a selling price of $200. The variable cost of F is $75.00 and the variable cost of M is $90.00. Fixed costs are $352,500 Compute the following (a) weighted average contribution margin, (b) break-even point in packages, (c) number of units of each product that will be sold at the break-even point. (HINT: Use the Chart to find the WACM) soycnt w 00 1.The following estimated overhead cost information is available tor the H Corporation Overhead Cost Allocation Base Number of Purchase Orders Number of Shipments Received Number of Setups Number of Inspections Activity Purchasing Receiving Machine Setups Quality Control $400000 100000 300000 100000 During the year, 8000 purchase orders were issued; 25,000 shipments received; 4000 machine setups; and 7500 inspections. Direct labor hours were 10,000 hours. What is the Cost allocation for each of the four activities above using ABC? 2. Using the following cost allocations, determine the total overhead allocation for Batch A Cost Allocation $20 per Purchase Orders $5 per Shipments Received $50 per Setups $10 per Inspections Activities Purchasing Receiving Machine Setups Quality Control Batch A used the following: 20 Purchase orders; 50 shipments received; 10 Setups; 15 Inspections; and 50 Direct labor hours. What is the total overhead allocation using ABC