chp 6 interest rates

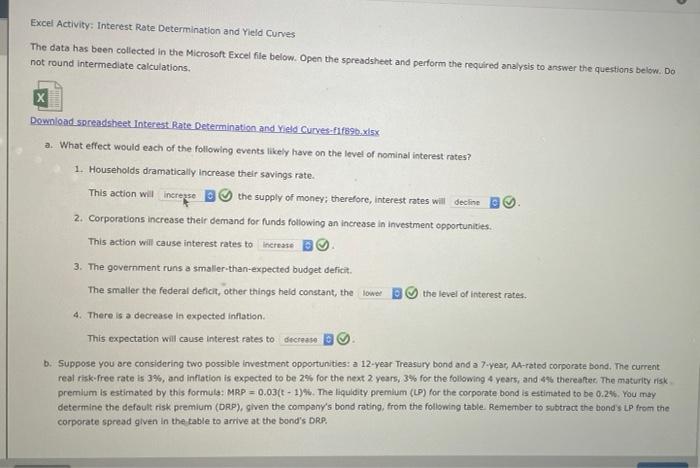

ONLY ANSWER B, D, and F

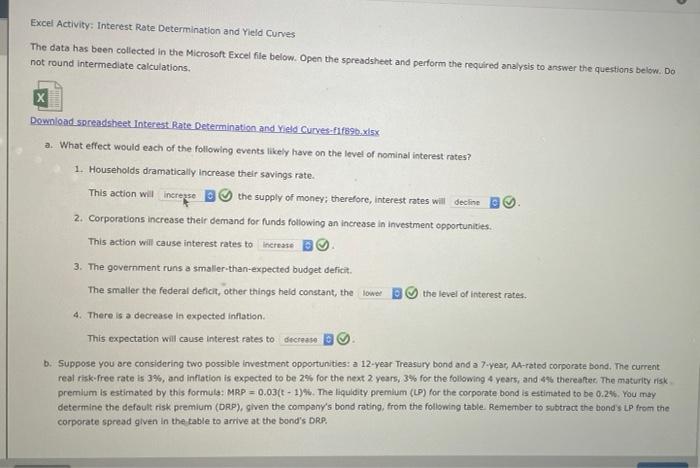

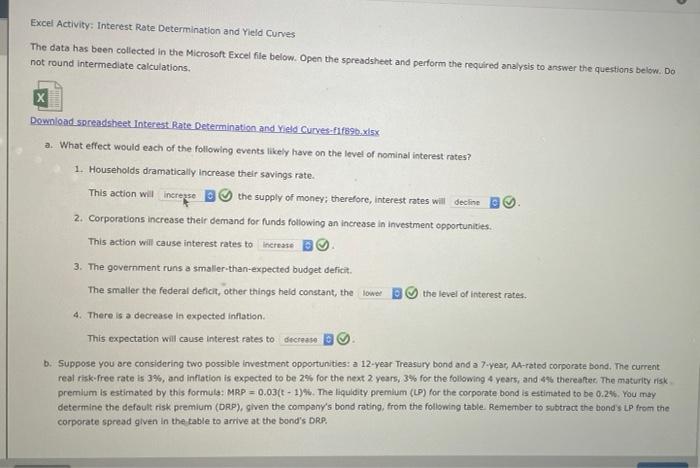

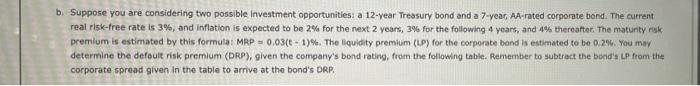

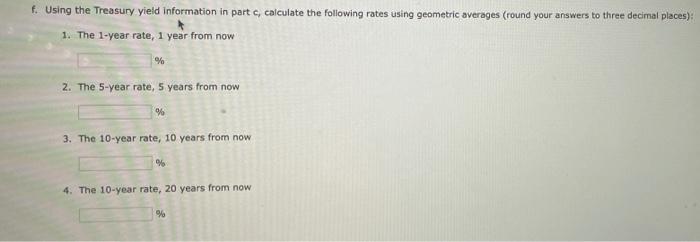

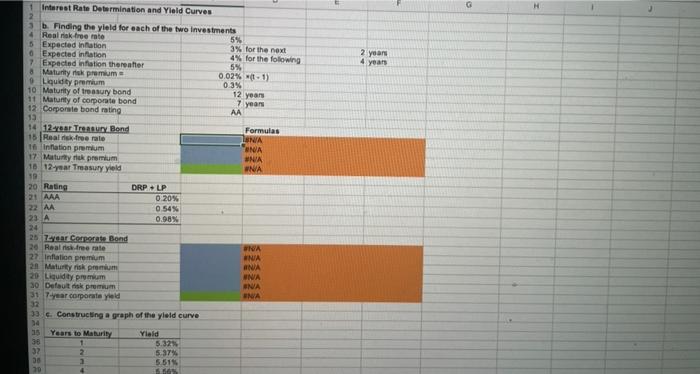

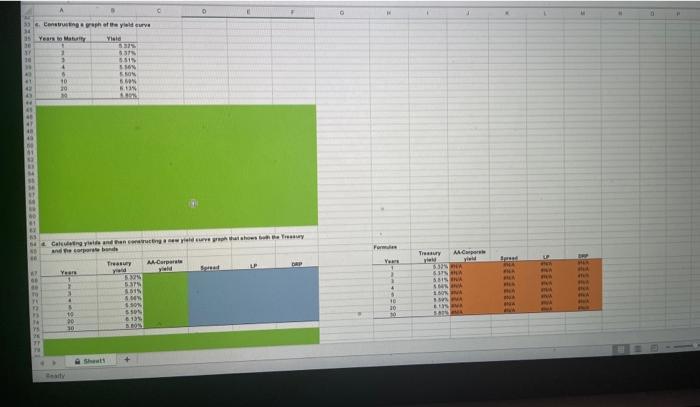

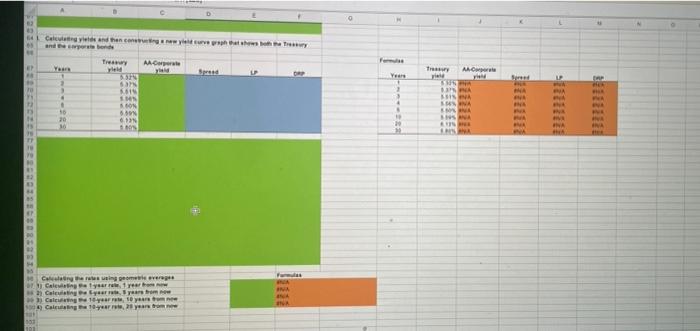

Excel Activity: Interest Rate Determination and Yield Curves The data has been collected in the Microsoft Excel file below. Open the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. X Download spreadsheet Interest Rate Determination and Yield Curves-f1f89.xlsx a. What effect would each of the following events likely have on the level of nominal interest rates? 1. Households dramatically increase their savings rate. This action will increpare the supply of money; therefore, interest rates will decline og 2. Corporations increase their demand for funds following an increase in investment opportunities This action will cause interest rates to increase 3. The government runs a smaller-than-expected budget deficit. The smaller the federal deficit, other things held constant, the lower B the level of interest rates. 4. There is a decrease in expected inflation This expectation will cause interest rates to decrease b. Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7year, AA-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 2% for the next 2 years, 3% for the following 4 years, and 4% thereafter. The maturity risk premlum is estimated by this formule: MRP = 0.03(t-1)%. The liquidity premium (LP) for the corporate bond is estimated to be 0.2%. You may determine the default risk premium (DRP), given the company's bond rating, from the following table Remember to subtract the bonds LP from the corporate spread given in the table to arrive at the bond's DRA. b. Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, AA-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 2% for the next 2 years, 3% for the following 4 years, and 4% thereafter. The maturity risk premium is estimated by this formula: MRP = 0.03(t. 19%. The liquidity premium (LP) for the corporate bond is estimated to be 0.296. You may determine the default risk premium (DRP), given the company's bond rating from the following table. Remember to subtract the bond's LP from the corporate spread given in the table to arrive at the bond's DRP. 1 d. Based on the Information arout the corporate bond provided in part b, calculate yields and then construct a new yield curve graph that shows both the Treasury and the corporate bonds. Round your answers to two decimal places. AA-corporate Years Treasury yield yield 5.27% % 2 5.32% 3 5.45% 5.51% 5 5.44% % 10 5.56% %6 6.13% % 30 5.74% RRRR 4 20 f. Using the Treasury yield information in parte, calculate the following rates using geometric averages (round your answers to three decimal places) 1. The 1-year rate, 1 year from now % 2. The 5-year rate, 5 years from now % 3. The 10-year rate, 10 years from now % 4. The 10-year rate, 20 years from now % 1 Interest Rate Determination and Yield Curves G 2 years 4 years 3. Finding the yield for each of the two investments 4 Realak tree rate 5% 8 Expected ination 3% for the next 0 Expected Inflation 4% for the following 7 Expected Inflation thereafter 5% 8 Maturity risk premium 0.02% -1) 0 Liquidity premium 0.3% 10 Maturity of treasury bond 12 years 11 Maturty of corporate bond 7 years 12 Corporate bond rating AA 13 14 12year Treasury Bond Formulas 15 Realisree rate SNIA 16 Inflation premium NA 17 Maturtytek premium #N/A 18 12-year Treasury yield NA 19 20 Rating ERP-LP 21 AAA 0,20% 22 AA 0.54% 23 A 0.98% 24 25 Or Corporate Bond 20 Realtree rate NA 27. Inflation premium NA 20 Maturtyrisk premium ANA 20 Liquidty promium WNA 30 Default premium NA 31 7-year corporate yield ANA 33 6. Constructing a graph of the yield curve 34 16 Years to Maturity Yield 36 5:32 32 5.37% 38 5515 20 0 Censup of yel curve Yield GE BE 27 10 3 4 5 10 NICE ISO W NO 5 51 19 41 4 4 Forme Truy Van 33 - VES WISS Calenge and thing we show and Recorde Try Merpart Yen yield 1 5 53 3515 . SON SSON 30 8.13 30 To TE 5 3 10 10 WENT NE W 1 75 ht Cele leds and then concretary and word Trawy AAC ORT 55 2 EP 8 TY AAC Year UP MES SI HS WEB Y . 3 VA w SINA SINA KAINA 13 10 20 30 SOON 6. 6 IN MA NA SE VE TP INA Catherine On Calling year 1 year Calengyearbo Cele 10 years Calcung 10,2 years NE Excel Activity: Interest Rate Determination and Yield Curves The data has been collected in the Microsoft Excel file below. Open the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. X Download spreadsheet Interest Rate Determination and Yield Curves-f1f89.xlsx a. What effect would each of the following events likely have on the level of nominal interest rates? 1. Households dramatically increase their savings rate. This action will increpare the supply of money; therefore, interest rates will decline og 2. Corporations increase their demand for funds following an increase in investment opportunities This action will cause interest rates to increase 3. The government runs a smaller-than-expected budget deficit. The smaller the federal deficit, other things held constant, the lower B the level of interest rates. 4. There is a decrease in expected inflation This expectation will cause interest rates to decrease b. Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7year, AA-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 2% for the next 2 years, 3% for the following 4 years, and 4% thereafter. The maturity risk premlum is estimated by this formule: MRP = 0.03(t-1)%. The liquidity premium (LP) for the corporate bond is estimated to be 0.2%. You may determine the default risk premium (DRP), given the company's bond rating, from the following table Remember to subtract the bonds LP from the corporate spread given in the table to arrive at the bond's DRA. b. Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, AA-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 2% for the next 2 years, 3% for the following 4 years, and 4% thereafter. The maturity risk premium is estimated by this formula: MRP = 0.03(t. 19%. The liquidity premium (LP) for the corporate bond is estimated to be 0.296. You may determine the default risk premium (DRP), given the company's bond rating from the following table. Remember to subtract the bond's LP from the corporate spread given in the table to arrive at the bond's DRP. 1 d. Based on the Information arout the corporate bond provided in part b, calculate yields and then construct a new yield curve graph that shows both the Treasury and the corporate bonds. Round your answers to two decimal places. AA-corporate Years Treasury yield yield 5.27% % 2 5.32% 3 5.45% 5.51% 5 5.44% % 10 5.56% %6 6.13% % 30 5.74% RRRR 4 20 f. Using the Treasury yield information in parte, calculate the following rates using geometric averages (round your answers to three decimal places) 1. The 1-year rate, 1 year from now % 2. The 5-year rate, 5 years from now % 3. The 10-year rate, 10 years from now % 4. The 10-year rate, 20 years from now % 1 Interest Rate Determination and Yield Curves G 2 years 4 years 3. Finding the yield for each of the two investments 4 Realak tree rate 5% 8 Expected ination 3% for the next 0 Expected Inflation 4% for the following 7 Expected Inflation thereafter 5% 8 Maturity risk premium 0.02% -1) 0 Liquidity premium 0.3% 10 Maturity of treasury bond 12 years 11 Maturty of corporate bond 7 years 12 Corporate bond rating AA 13 14 12year Treasury Bond Formulas 15 Realisree rate SNIA 16 Inflation premium NA 17 Maturtytek premium #N/A 18 12-year Treasury yield NA 19 20 Rating ERP-LP 21 AAA 0,20% 22 AA 0.54% 23 A 0.98% 24 25 Or Corporate Bond 20 Realtree rate NA 27. Inflation premium NA 20 Maturtyrisk premium ANA 20 Liquidty promium WNA 30 Default premium NA 31 7-year corporate yield ANA 33 6. Constructing a graph of the yield curve 34 16 Years to Maturity Yield 36 5:32 32 5.37% 38 5515 20 0 Censup of yel curve Yield GE BE 27 10 3 4 5 10 NICE ISO W NO 5 51 19 41 4 4 Forme Truy Van 33 - VES WISS Calenge and thing we show and Recorde Try Merpart Yen yield 1 5 53 3515 . SON SSON 30 8.13 30 To TE 5 3 10 10 WENT NE W 1 75 ht Cele leds and then concretary and word Trawy AAC ORT 55 2 EP 8 TY AAC Year UP MES SI HS WEB Y . 3 VA w SINA SINA KAINA 13 10 20 30 SOON 6. 6 IN MA NA SE VE TP INA Catherine On Calling year 1 year Calengyearbo Cele 10 years Calcung 10,2 years NE