Chris and Amy are married and will file a joint tax return. Amy is a 50% partner in A&A Partnership (not a specified services

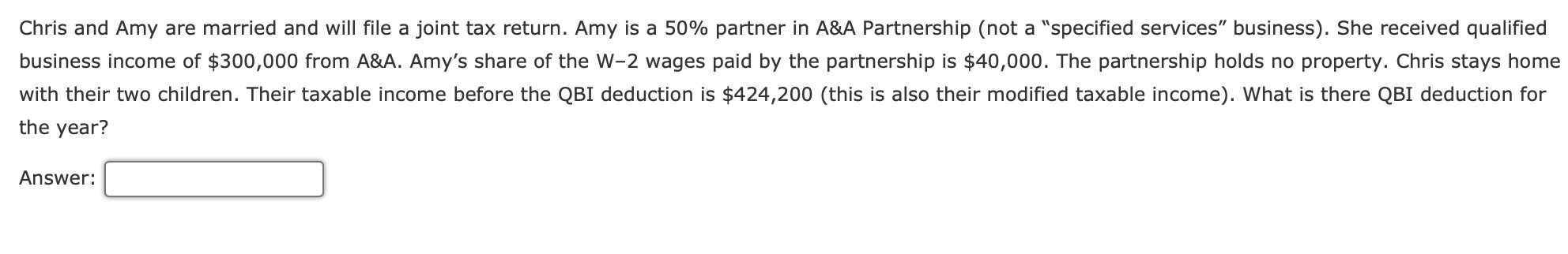

Chris and Amy are married and will file a joint tax return. Amy is a 50% partner in A&A Partnership (not a "specified services" business). She received qualified business income of $300,000 from A&A. Amy's share of the W-2 wages paid by the partnership is $40,000. The partnership holds no property. Chris stays home with their two children. Their taxable income before the QBI deduction is $424,200 (this is also their modified taxable income). What is there QBI deduction for the year? Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the QBI deduction for Chris and Amy we need to consider the limitations and calculation...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started