Question

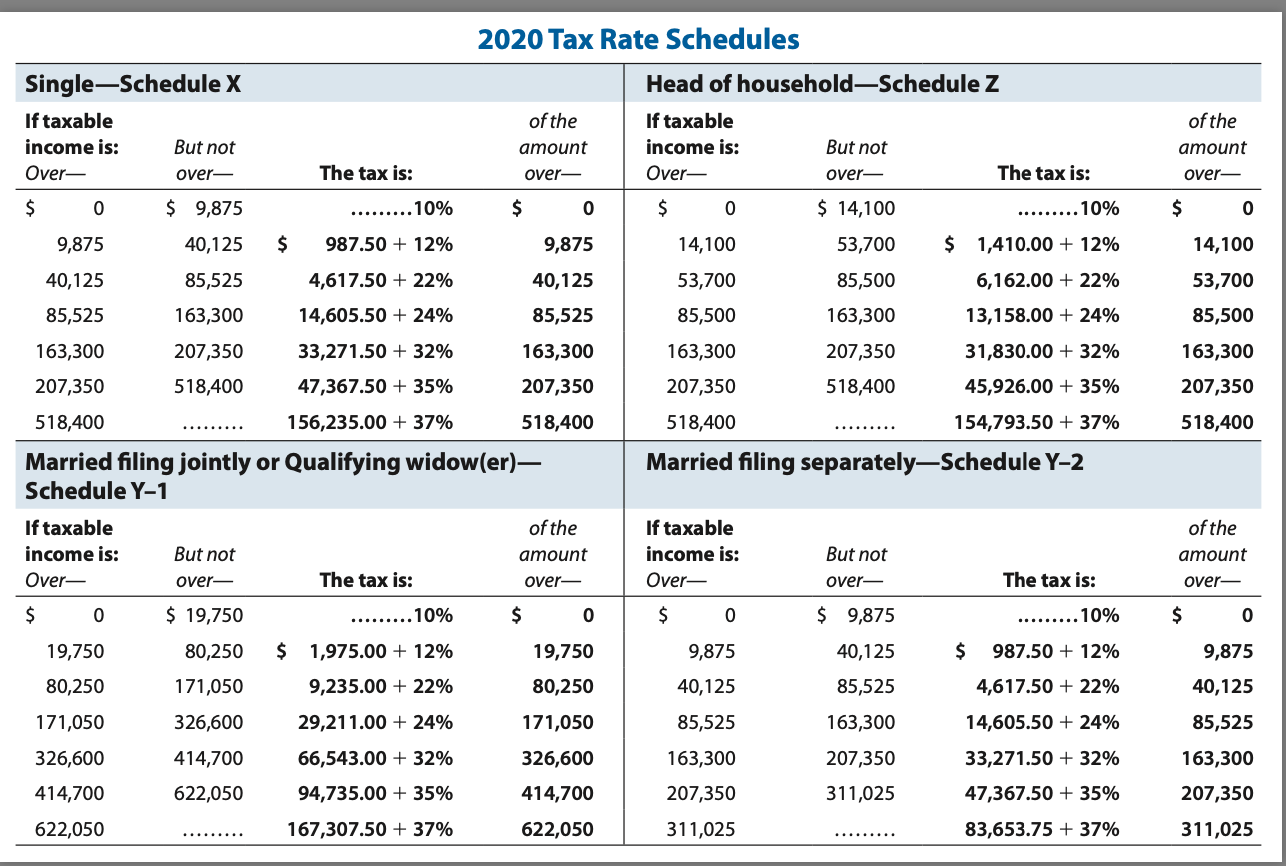

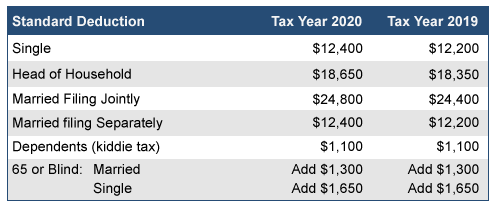

Chris and Heather are engaged and plan to get married. During 2020, Chris is a full-time student and earns $8,500 from a part-time job. With

Chris and Heather are engaged and plan to get married. During 2020, Chris is a full-time student and earns $8,500 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Heather is employed and has wages of $83,600.

| Chris | Heather | |

| Filing Single | Filing Single | |

| Gross Income and AGI | 8500 | 83600 |

| Standard Deduction | 12400 | 12400 |

| Taxable Income | 0 | 71200 |

| Income Tax | 0 | 11454 |

b. Assume that Chris and Heather get married in 2020 and file a joint return. What is their taxable income and income tax? Round your final answer to nearest whole dollar.

| Heather | |

| Filing Jointly | |

| Gross Income & AGI | 92,100 |

| Standard Deduction | 24,800 |

| Taxable Income | 67,300 |

| Income Tax | ??? |

c. How much income tax can Chris and Heather save if they get married in 2020 and file a joint return? _______

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started