Answered step by step

Verified Expert Solution

Question

1 Approved Answer

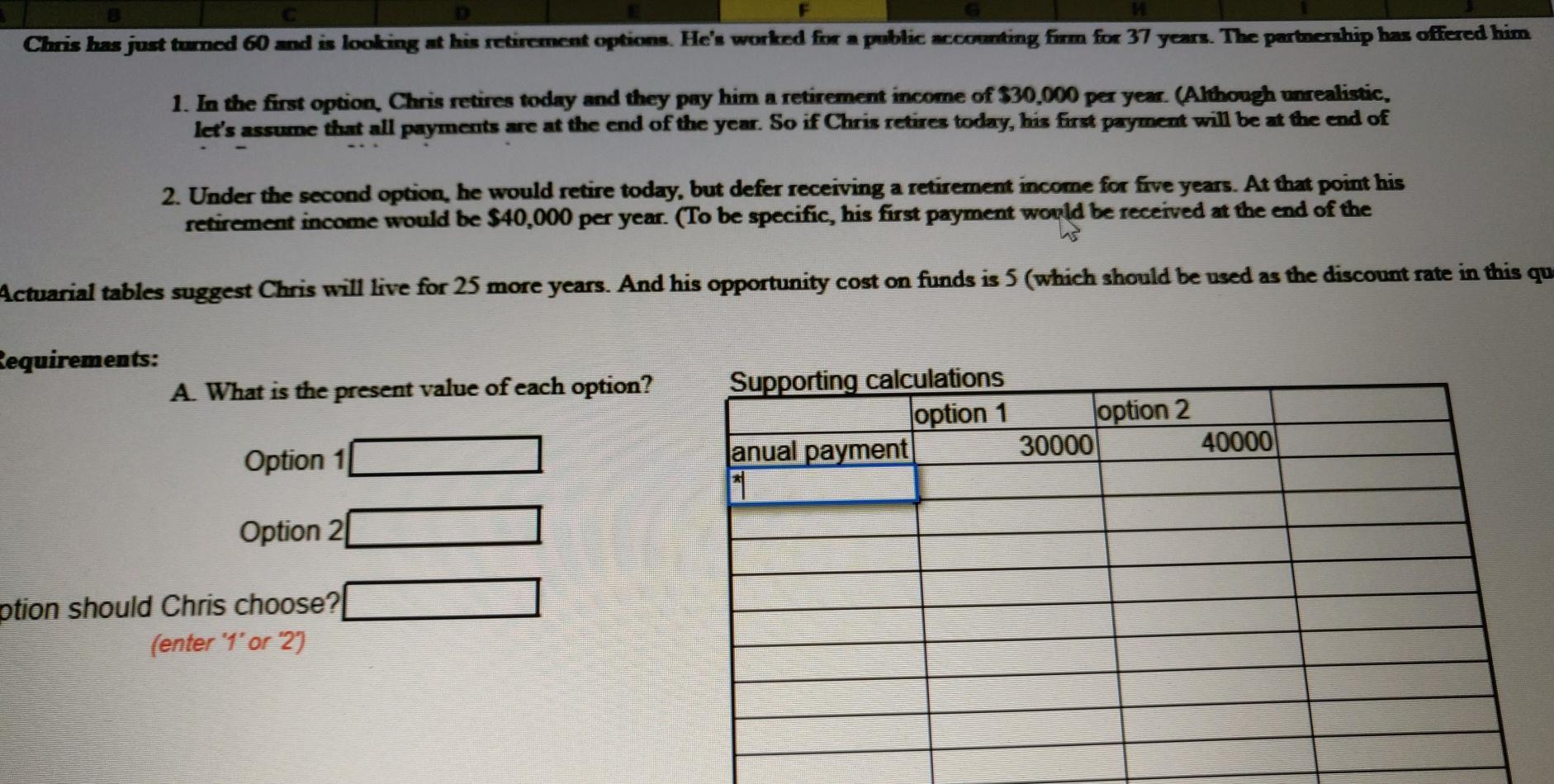

Chris has just tumed 60 and is looking at his retirement options. He's worked for a public accounting foran for 37 years. The partnexhip has

Chris has just tumed 60 and is looking at his retirement options. He's worked for a public accounting foran for 37 years. The partnexhip has offered him 1. In the first option, Chris retires today and they pay him a retirement income of $30,000 per year. (Although unrealistic, let's assume that all payments are at the end of the year. So if Chris retires today, his first payment will be at the end of 2. Under the second option, he would retire today, but defer receiving a retirement income for five years. At that point his retirement income would be $40,000 per year. (To be specific, his first payment world be received at the end of the Actuarial tables suggest Chris will live for 25 more years. And his opportunity cost on funds is 5 (which should be used as the discount rate in this que Requirements: A What is the present value of each option? Supporting calculations option 1 anual payment 11 option 2 30000 40000 Option 1 Option 21 ption should Chris choose? (enter '1' or 2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started