Question

Chris Legstrong is an avid bicycler and the CEO of the RollingRubber Company, a producer of bicycle frames. Chris budgeted tosell 10,000 frames this year.

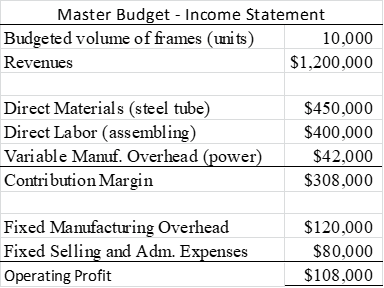

Chris Legstrong is an avid bicycler and the CEO of the RollingRubber Company, a producer of bicycle frames. Chris budgeted tosell 10,000 frames this year. He also provided you with thefollowing budgeting data:

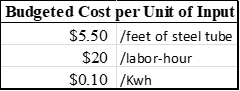

In addition, Chris provided you with the standard variable costsper unit of input:

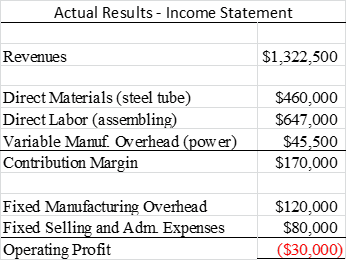

The actual performance of the firm, however, did not measure upto his expectations. Chris was worried. He mentioned that theactual number of frames sold was 15% more than the budgeted volume,but the results were quite negative. Chris was very puzzled aboutthis outcome because he implanted a somewhat more complex newassembly method to save on steel tube. He was very proud of howhard his people had worked and also of his changes on the marketingstrategy, which he thought worked very well. Chris provided youwith the following statement about the actual results:

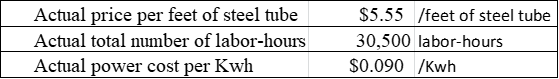

Finally, Chris was also able to obtain the followinginformation:

Requirements

Part A

Chris wants you to help him figure out how he could be so wrongwhen forecasting the performance of the firm. In particular, hewants you to calculate the following:

- How much profit should the Rolling Rubber Company have madewith the actual sales volume (number of frames) if everything elsewas as budgeted (i.e., the flexible budget profit)?

- Calculate the Total Sales Volume Variance and Total FlexibleBudget Variance.

- Calculate the Sales Price Variance.

Make sure to tell Chris whether thevariances are favorable orunfavorable.

Part B

Chris wants you to help him find out more about the underlyingcauses of the flexible-budget variance. In particular, he wants youto calculate the following variances:

- Price and efficiency variances for direct materials.

- Price and efficiency variances for direct labor.

- Price and efficiency variances for variable manufacturingoverhead.

Make sure to tell Chris whether thevariances are favorable orunfavorable.

Part C

Chris wants you to help him to interpret the variances you justcalculated. Based on the variances you calculated in parts A and B,tell Chris what you think happened in his firm. Focus on the bigproblems. There is no need to talk about the small variances. Therecould be multiple stories that fit the same variances. All you haveto do is provide one story that makes sense and is consistent withthe variances you obtained. Make sure to refer to the variances inparts A and B.

Master Budget - Income Statement Budgeted volume of frames (units) Revenues Direct Materials (steel tube) Direct Labor (assembling) Variable Manuf. Overhead (power) Contribution Margin Fixed Manufacturing Overhead Fixed Selling and Adm. Expenses Operating Profit 10,000 $1,200,000 $450,000 $400,000 $42,000 $308,000 $120,000 $80,000 $108,000

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Part A a To calculate the profit with the actual sales volume number of frames if everything else was as budgeted we need to calculate the flexible budget profit Flexible Budget Profit Revenues ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started