Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chris Nowicki was employed by Real Co. in 2021. Chris earned $35,000 from January 1 to October 10 before transferring with the company to

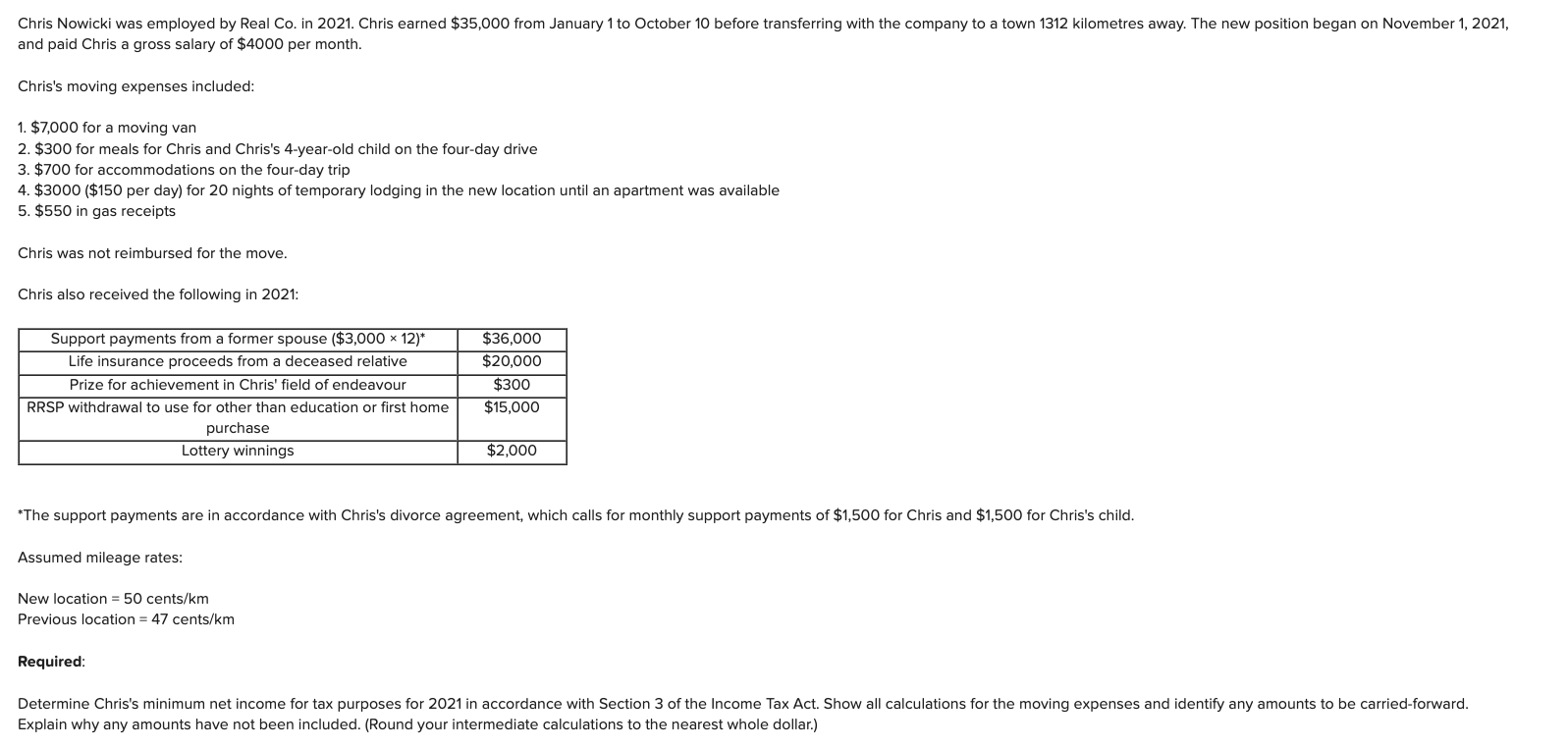

Chris Nowicki was employed by Real Co. in 2021. Chris earned $35,000 from January 1 to October 10 before transferring with the company to a town 1312 kilometres away. The new position began on November 1, 2021, and paid Chris a gross salary of $4000 per month. Chris's moving expenses included: 1. $7,000 for a moving van 2. $300 for meals for Chris and Chris's 4-year-old child on the four-day drive 3. $700 for accommodations on the four-day trip 4. $3000 ($150 per day) for 20 nights of temporary lodging in the new location until an apartment was available 5. $550 in gas receipts Chris was not reimbursed for the move. Chris also received the following in 2021: Support payments from a former spouse ($3,000 x 12)* $36,000 Life insurance proceeds from a deceased relative $20,000 Prize for achievement in Chris' field of endeavour $300 RRSP withdrawal to use for other than education or first home $15,000 purchase Lottery winnings $2,000 *The support payments are in accordance with Chris's divorce agreement, which calls for monthly support payments of $1,500 for Chris and $1,500 for Chris's child. Assumed mileage rates: New location = 50 cents/km Previous location = 47 cents/km Required: Determine Chris's minimum net income for tax purposes for 2021 in accordance with Section 3 of the Income Tax Act. Show all calculations for the moving expenses and identify any amounts to be carried-forward. Explain why any amounts have not been included. (Round your intermediate calculations to the nearest whole dollar.)

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

ITA 30 Employment income 35000 8000 43000 Other income 18000 support payments f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started