Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chrome File Edit View History Bookmarks Profiles Tab Window Help PG Campus MT217 Finance 22 23 24 Question 1 Question list Question 2 O

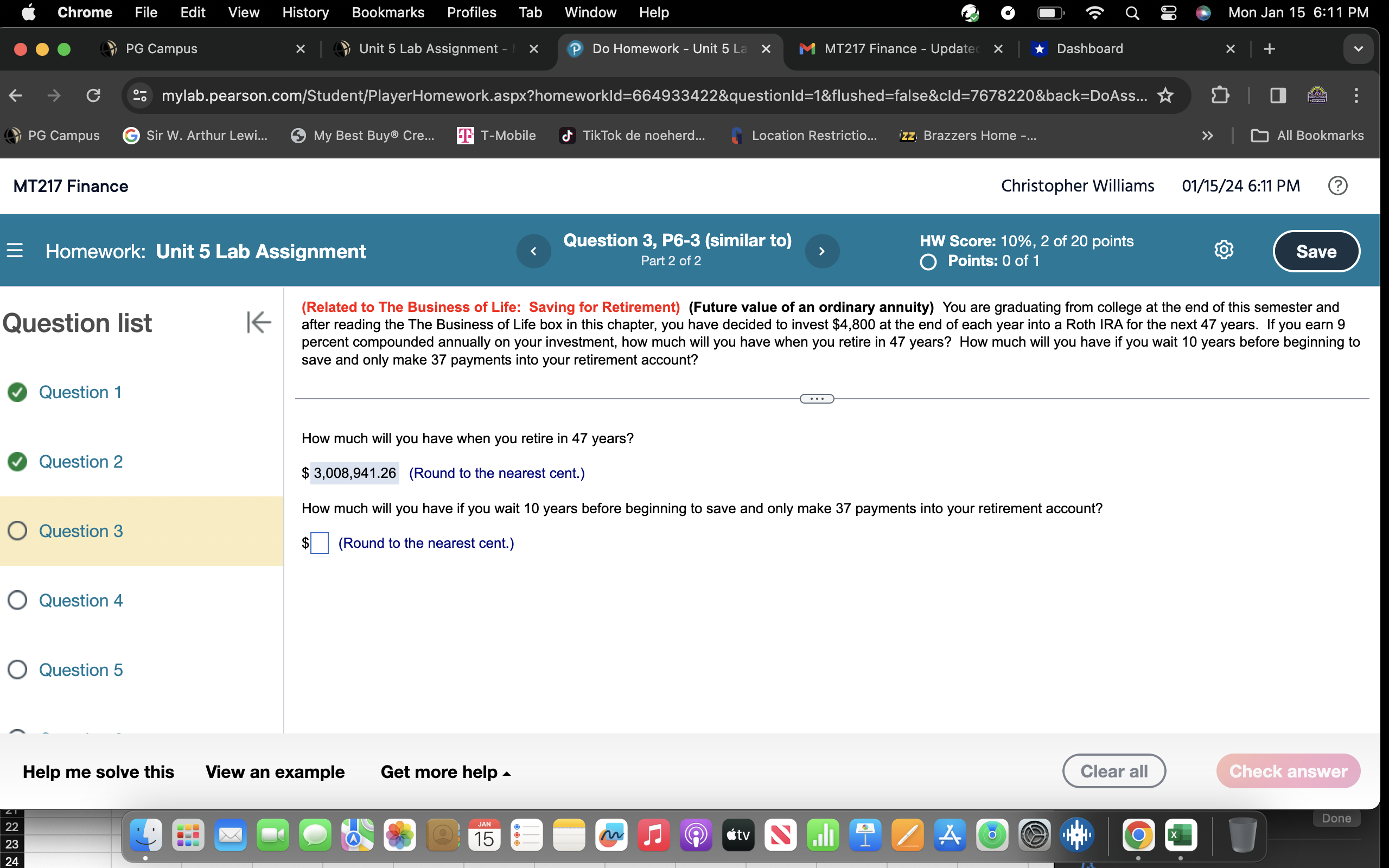

Chrome File Edit View History Bookmarks Profiles Tab Window Help PG Campus MT217 Finance 22 23 24 Question 1 Question list Question 2 O Question 3 PG Campus Question 4 O Question 5 -O Homework: Unit 5 Lab Assignment Sir W. Arthur Lewi... | Unit 5 Lab Assignment - X P Do Homework - Unit 5 La X mylab.pearson.com/Student/PlayerHomework.aspx?homeworkId=664933422&questionId=1&flushed=false&cid=7678220&back=DoAss... Help me solve this K My Best Buy Cre... TT-Mobile TikTok de noeherd... View an example Get more help. JAN 15 Question 3, P6-3 (similar to) Part 2 of 2 MT217 Finance - Update X ` Location Restrictio... izz Brazzers Home -... tv > How much will you have when you retire in 47 years? $ 3,008,941.26 (Round to the nearest cent.) How much will you have if you wait 10 years before beginning to save and only make 37 payments into your retirement account? (Round to the nearest cent.) Dashboard Sall HW Score: 10%, 2 of 20 points O Points: 0 of 1 Christopher Williams (Related to The Business of Life: Saving for Retirement) (Future value of an ordinary annuity) You are graduating from college at the end of this semester and after reading the The Business of Life box in this chapter, you have decided to invest $4,800 at the end of each year into a Roth IRA for the next 47 years. If you earn 9 percent compounded annually on your investment, how much will you have when you retire in 47 years? How much will you have if you wait 10 years before beginning to save and only make 37 payments into your retirement account? A O Mon Jan 15 6:11 PM Clear all x + All Bookmarks 01/15/24 6:11 PM Save Check answer Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Amount after 47 years Annual Investment P 4800 Period of investmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started