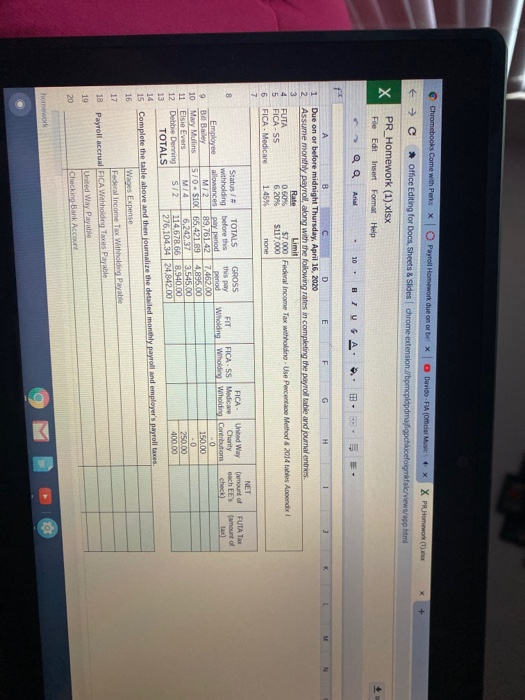

Chromebooks Come with Perke x Payroll Homework due on or be x Davido - FIA (O Music* X PRO (1) Office Editing for Docs, Sheets & Slides chrome extension:/bpmcpldpdmafiqchicefigmfalc/views/app html + PR_Homework (1).xlsx File Edit Insert Format Help 10. BIUSA.. . E J K L M N 1 ABC F G H I Due on or before midnight Thursday, April 16, 2020 Assume monthly payrol, along with the following rafes in completing the p rod table and journal entries. Limit 0.606 $7.000 Federal Income Tax withholding. Use Percent Method & 2014 Tables Acondix FICA-55 6.2017 $117.000 FICA - Medicare 145% none Rate United Way FIT FICA. SS Medica Wholding WholdW iholding Contbutons Camount of eachts FUTA TAX amount of 150.00 9 10 11 Status TOTALS GROSS withholding before this this pay Employee allowances pay period perod Bill Bailey MIZ 89,761.427.462.00 Mary Mullins S70 $10% 65,421.894.895.00 Elsie Evers MI46,242.373.545.00 Debbie Derning S12 114.678.668.940.00 TOTALS 276.104.34 24.842.00 400.00 Complete the table above and then journalize the detailed monthly payroll and employers payroll taxe Wages Expense Federal Income with holding Payable Payroll accrual FICA Wahholding taxes Payable United Way Payable Checking Bank Account homework Chromebooks Come with Perke x Payroll Homework due on or be x Davido - FIA (O Music* X PRO (1) Office Editing for Docs, Sheets & Slides chrome extension:/bpmcpldpdmafiqchicefigmfalc/views/app html + PR_Homework (1).xlsx File Edit Insert Format Help 10. BIUSA.. . E J K L M N 1 ABC F G H I Due on or before midnight Thursday, April 16, 2020 Assume monthly payrol, along with the following rafes in completing the p rod table and journal entries. Limit 0.606 $7.000 Federal Income Tax withholding. Use Percent Method & 2014 Tables Acondix FICA-55 6.2017 $117.000 FICA - Medicare 145% none Rate United Way FIT FICA. SS Medica Wholding WholdW iholding Contbutons Camount of eachts FUTA TAX amount of 150.00 9 10 11 Status TOTALS GROSS withholding before this this pay Employee allowances pay period perod Bill Bailey MIZ 89,761.427.462.00 Mary Mullins S70 $10% 65,421.894.895.00 Elsie Evers MI46,242.373.545.00 Debbie Derning S12 114.678.668.940.00 TOTALS 276.104.34 24.842.00 400.00 Complete the table above and then journalize the detailed monthly payroll and employers payroll taxe Wages Expense Federal Income with holding Payable Payroll accrual FICA Wahholding taxes Payable United Way Payable Checking Bank Account