Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chromex Ltd is a manufacturing company that wishes to evaluate an investment in new production machinery. The company plans to buy a new machine to

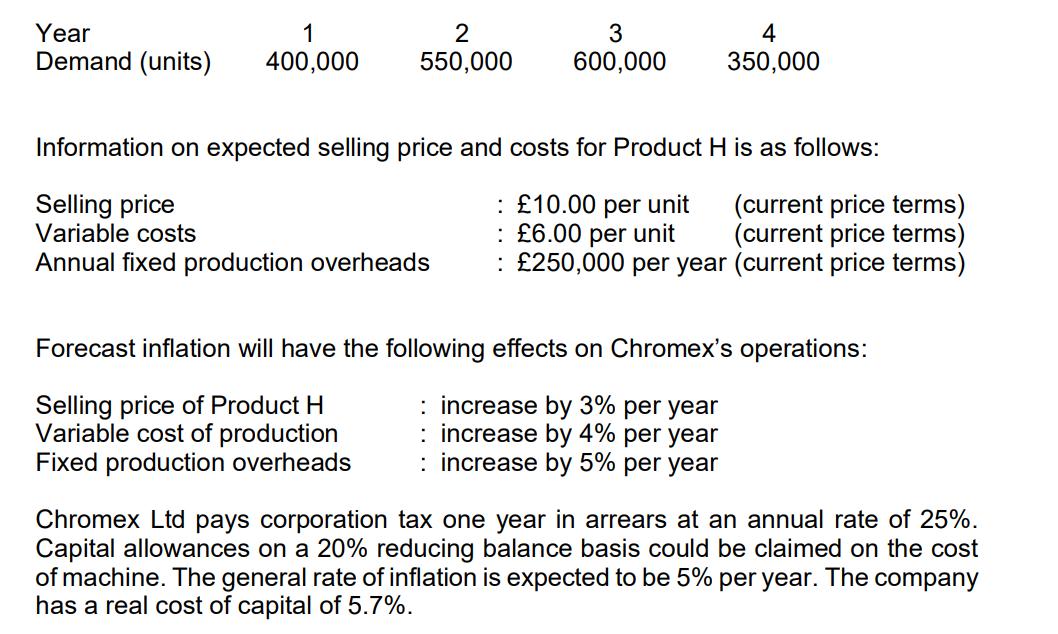

Chromex Ltd is a manufacturing company that wishes to evaluate an investment in new production machinery. The company plans to buy a new machine to meet expected demand for a new product, Product H. This machine will cost £2,000,000 with an expected life of four years. The scrap value of machinery at the end of the four-year life is £50,000. Chromex Ltd expects demand for Product H to be as follows:

a) Calculate the net present value of buying the new machine and advise on its financial acceptability.

b) Explain how probability analysis and sensitivity analysis can help management to assess the riskiness of an investment project. (Word limit: maximum 300 words)

Year 1 Demand (units) 400,000 2 550,000 3 600,000 Selling price Variable costs Annual fixed production overheads 4 350,000 Information on expected selling price and costs for Product H is as follows: : 10.00 per unit : 6.00 per unit (current price terms) (current price terms) 250,000 per year (current price terms) Forecast inflation will have the following effects on Chromex's operations: Selling price of Product H Variable cost of production Fixed production overheads : increase by 3% per year : increase by 4% per year : increase by 5% per year Chromex Ltd pays corporation tax one year in arrears at an annual rate of 25%. Capital allowances on a 20% reducing balance basis could be claimed on the cost of machine. The general rate of inflation is expected to be 5% per year. The company has a real cost of capital of 5.7%.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

221 222 223 224 225 226 227 228 229 58838858822REN Paste Y240 File 244 270 273 240 B 241 CAB DAC EC2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started