Chrysler is considering a cost reduction program. The suppliers must reduce the cost of the components that they furnish to Chrysler by

55%

each year. (The total amount of savings would increase each year.) The initial costs:

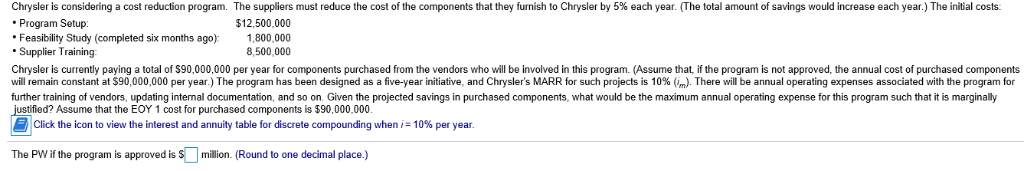

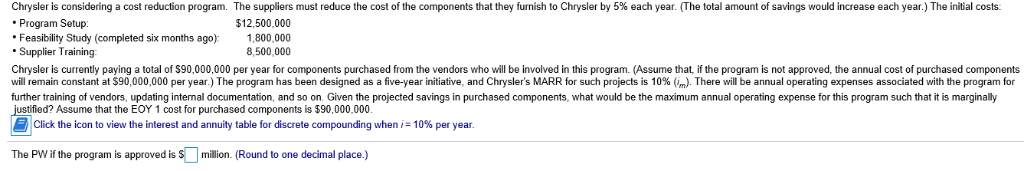

| bullet Program Setup: | $12 comma 500 comma 00012,500,000 |

| bullet Feasibility Study (completed six months ago): | 1 comma 800 comma 0001,800,000 |

| bullet Supplier Training: | 8 comma 500 comma 0008,500,000 |

Chrysler is currently paying a total of

$90 comma 000 comma 00090,000,000

per year for components purchased from the vendors who will be involved in this program. (Assume that, if the program is not approved, the annual cost of purchased components will remain constant at

$90 comma 000 comma 00090,000,000

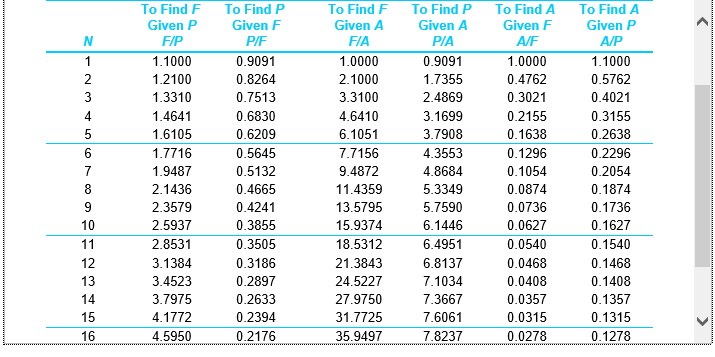

per year.) The program has been designed as a five-year initiative, and Chrysler's MARR for such projects is

1010%

(im).

There will be annual operating expenses associated with the program for further training of vendors, updating internal documentation, and so on. Given the projected savings in purchased components, what would be the maximum annual operating expense for this program such that it is marginally justified? Assume that the EOY 1 cost for purchased components is

$90 comma 000 comma 00090,000,000.

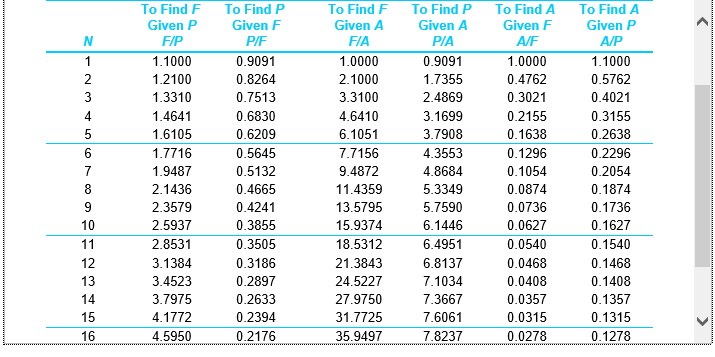

Chrysler is considering a cost reduction program. The suppliers must reduce the cost of the components that they furnish to Chrysler by 5% each year. The total amount of savings would increase each year. The initial costs. $12,500,000 1,800,000 8,500,000 Program Setup: Feasibility Study (completed six months ago Chrysler is currently paying a total of S90,000,000 per year for components purchased from the vendors who will be involved in this program. (Assume that, if the program is not approved, the annual cost of purchased components will remain constant a $90 000 000 per year The program has been designed as a five-year initiative and Chryslers MARR for such pro ects is 10% There will be annual operating expenses associated with he rogram or further training of vendors, updating internal documentation, and so on. Given the projected savings in purchased components, what would be the maximum annual operating expense for this program such that it is marginaly ustified? Assume that the EOY 1 cost for purchased components is $90,000,000 Click the icon to view the interest and annuity table for discrete compounding when i: 10% per year The PW if the program is approved is Smillion. (Round to one decimal place.) 02158|64467|0 8875-8 06253-9573 07016 15432 10000-00000-0 0000-0 |46051-7 54433-2 087 oG | 02158|64467|0 8875-8 06253-9573 07016-2087 04321|11000|0 0 0 0 0 0 10000-00000-0 0000-0 |46051-7 5 4 4 3 3-2 oG - 15998|34906-17471-7 95690|58 03869-56 97417-38371-4 8 1 3 6-8 94 53366-3 54 91060-2 i 0 1 2 3 34 4 5 5 6667777 954|23705|7 00001-62 nnA|0 0 0 1 557597-1. 3 Fi i F 0 1 3 6 10-74 oG -1 2 3 4 679 11 13 5 8 1 4 7 15 59-5 2 14309-52515-5 6 7 3 4-6 3645-0 8939-7 5 1863-1 33222-2 00000-00000-0 0000-0 96130 5544 oG - 00015|67697|14352-0 0-18373|38 001 459-53 135|8 1471-5 FiF|1 2 3 4 6 N123456789 10 11 2 3 4 5 6 Chrysler is considering a cost reduction program. The suppliers must reduce the cost of the components that they furnish to Chrysler by 5% each year. The total amount of savings would increase each year. The initial costs. $12,500,000 1,800,000 8,500,000 Program Setup: Feasibility Study (completed six months ago Chrysler is currently paying a total of S90,000,000 per year for components purchased from the vendors who will be involved in this program. (Assume that, if the program is not approved, the annual cost of purchased components will remain constant a $90 000 000 per year The program has been designed as a five-year initiative and Chryslers MARR for such pro ects is 10% There will be annual operating expenses associated with he rogram or further training of vendors, updating internal documentation, and so on. Given the projected savings in purchased components, what would be the maximum annual operating expense for this program such that it is marginaly ustified? Assume that the EOY 1 cost for purchased components is $90,000,000 Click the icon to view the interest and annuity table for discrete compounding when i: 10% per year The PW if the program is approved is Smillion. (Round to one decimal place.) 02158|64467|0 8875-8 06253-9573 07016 15432 10000-00000-0 0000-0 |46051-7 54433-2 087 oG | 02158|64467|0 8875-8 06253-9573 07016-2087 04321|11000|0 0 0 0 0 0 10000-00000-0 0000-0 |46051-7 5 4 4 3 3-2 oG - 15998|34906-17471-7 95690|58 03869-56 97417-38371-4 8 1 3 6-8 94 53366-3 54 91060-2 i 0 1 2 3 34 4 5 5 6667777 954|23705|7 00001-62 nnA|0 0 0 1 557597-1. 3 Fi i F 0 1 3 6 10-74 oG -1 2 3 4 679 11 13 5 8 1 4 7 15 59-5 2 14309-52515-5 6 7 3 4-6 3645-0 8939-7 5 1863-1 33222-2 00000-00000-0 0000-0 96130 5544 oG - 00015|67697|14352-0 0-18373|38 001 459-53 135|8 1471-5 FiF|1 2 3 4 6 N123456789 10 11 2 3 4 5 6