Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chrysler is considering a cost reduction program. The suppliers must reduce the cost of the components that they furnish to Chrysler by 4% each

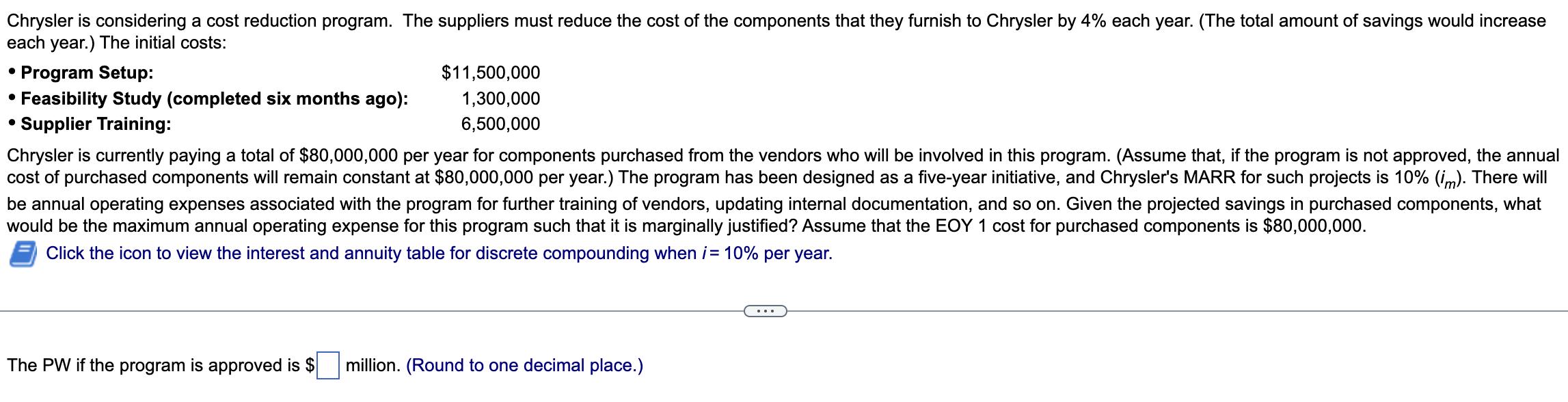

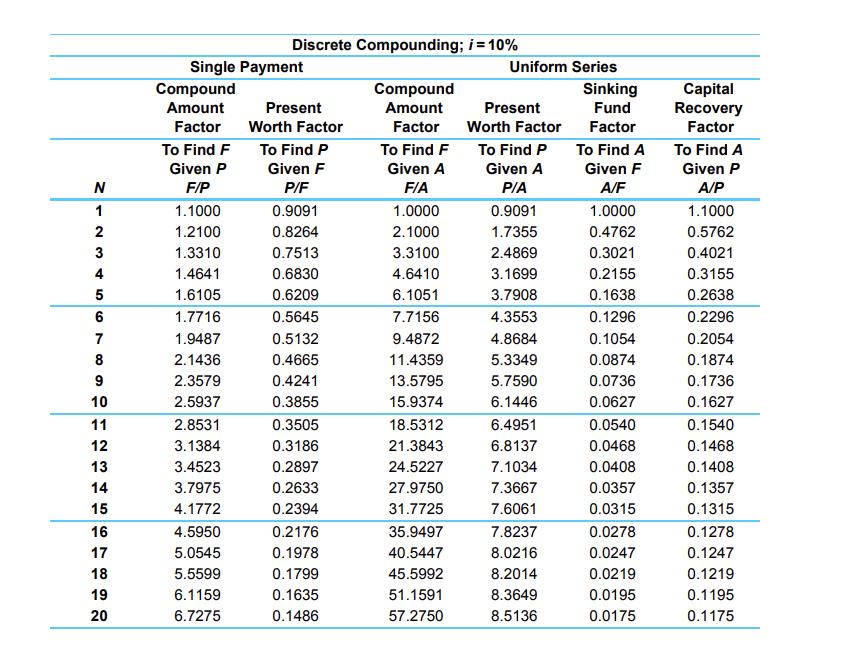

Chrysler is considering a cost reduction program. The suppliers must reduce the cost of the components that they furnish to Chrysler by 4% each year. (The total amount of savings would increase each year.) The initial costs: Program Setup: Feasibility Study (completed six months ago): Supplier Training: $11,500,000 1,300,000 6,500,000 Chrysler is currently paying a total of $80,000,000 per year for components purchased from the vendors who will be involved in this program. (Assume that, if the program is not approved, the annual cost of purchased components will remain constant at $80,000,000 per year.) The program has been designed as a five-year initiative, and Chrysler's MARR for such projects is 10% (im). There will be annual operating expenses associated with the program for further training of vendors, updating internal documentation, and so on. Given the projected savings in purchased components, what would be the maximum annual operating expense for this program such that it is marginally justified? Assume that the EOY 1 cost for purchased components is $80,000,000. Click the icon to view the interest and annuity table for discrete compounding when i = 10% per year. The PW if the program is approved is $ million. (Round to one decimal place.) N123 N 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Single Payment Compound Amount Present Factor Worth Factor To Find P Given F P/F To Find F Given P F/P 1.1000 1.2100 1.3310 1.4641 1.6105 1.7716 1.9487 2.1436 2.3579 2.5937 2.8531 3.1384 3.4523 Discrete Compounding; i = 10% Compound Amount Factor To Find F Given A F/A 1.0000 2.1000 3.3100 4.6410 6.1051 3.7975 4.1772 4.5950 5.0545 5.5599 6.1159 6.7275 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 0.3505 0.3186 0.2897 0.2633 0.2394 0.2176 0.1978 0.1799 0.1635 0.1486 7.7156 9.4872 11.4359 13.5795 15.9374 18.5312 21.3843 24.5227 27.9750 31.7725 35.9497 40.5447 45.5992 51.1591 57.2750 Uniform Series Present Worth Factor To Find P Given A P/A 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 6.4951 6.8137 7.1034 7.3667 7.6061 7.8237 8.0216 8.2014 8.3649 8.5136 Sinking Fund Factor To Find A Given F A/F 1.0000 0.4762 0.3021 0.2155 0.1638 0.1296 0.1054 0.0874 0.0736 0.0627 0.0540 0.0468 0.0408 0.0357 0.0315 0.0278 0.0247 0.0219 0.0195 0.0175 Capital Recovery Factor To Find A Given P A/P 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0.1219 0.1195 0.1175

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started