Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Five separate projects have calculated rates of return of 8, 11, 12.4, 14, and 19% per year. An engineer wants to know which projects

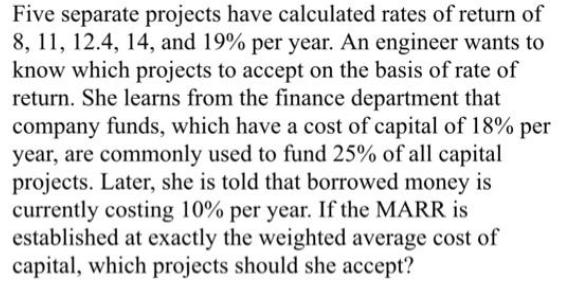

Five separate projects have calculated rates of return of 8, 11, 12.4, 14, and 19% per year. An engineer wants to know which projects to accept on the basis of rate of return. She learns from the finance department that company funds, which have a cost of capital of 18% per year, are commonly used to fund 25% of all capital projects. Later, she is told that borrowed money is currently costing 10% per year. If the MARR is established at exactly the weighted average cost of capital, which projects should she accept? Five separate projects have calculated rates of return of 8, 11, 12.4, 14, and 19% per year. An engineer wants to know which projects to accept on the basis of rate of return. She learns from the finance department that company funds, which have a cost of capital of 18% per year, are commonly used to fund 25% of all capital projects. Later, she is told that borrowed money is currently costing 10% per year. If the MARR is established at exactly the weighted average cost of capital, which projects should she accept?

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

MARR is Minimum Attractive Rate of return As per the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started