Question

Chubbyville purchases a delivery van for $22,800. Chubbyville estimates that at the end of its four-year service life, the van will be worth $2,200. During

Chubbyville purchases a delivery van for $22,800. Chubbyville estimates that at the end of its four-year service life, the van will be worth $2,200. During the four-year period, the company expects to drive the van 106,000 miles.

| 1. | Straight-line. (Round your depreciation rate to two decimal places, round other intermediate calculations and final answer to the nearest dollar amount. Omit the "$" sign in your response.) |

| Depreciation expense | $ |

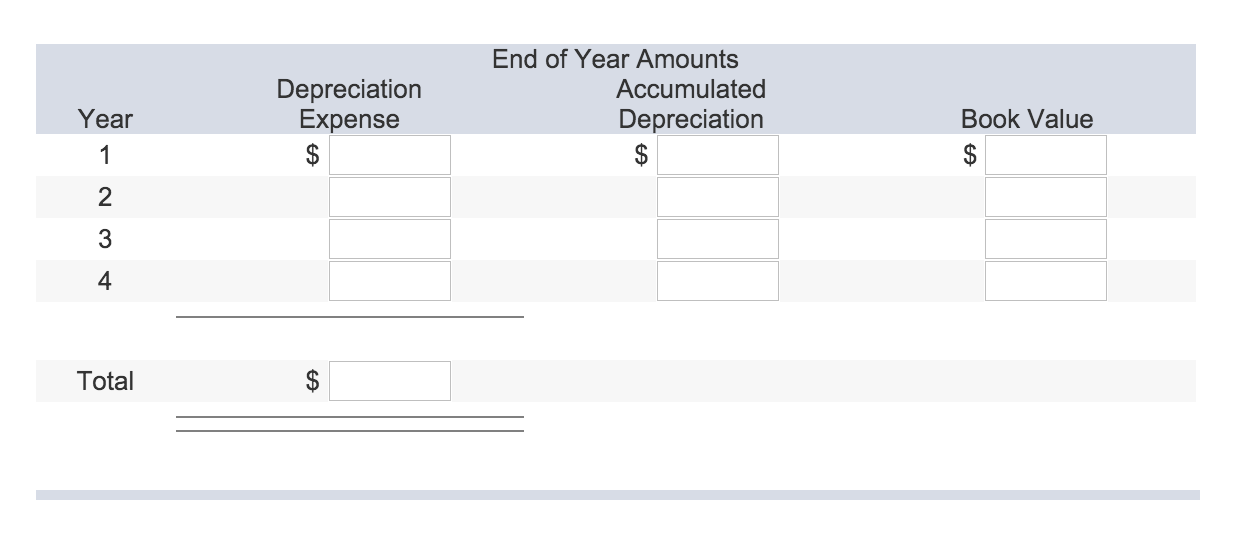

| 2. | Double-declining-balance. (Round your depreciation rate to two decimal places, round other intermediate calculations and final answers to the nearest dollar amount. Omit the "$" sign in your response.)

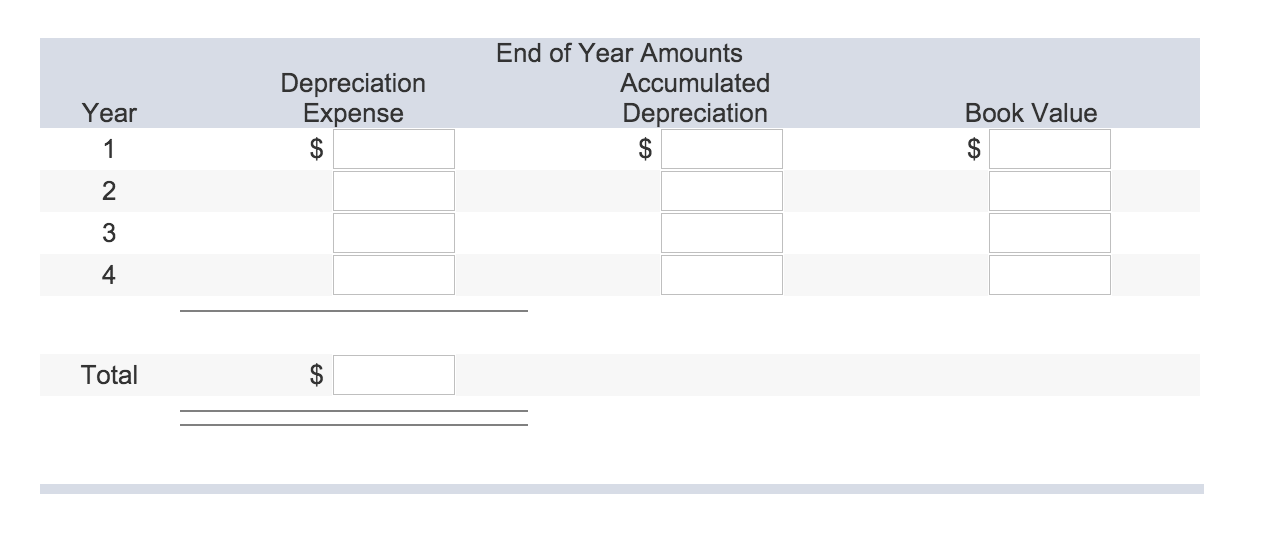

3. Activity-based. Actual miles driven each year were 23,000 miles in Year 1; 30,000 miles in Year 2; 19,000 miles in Year 3; and 27,000 miles in Year 4. Note that actual total miles of 99,000 fall short of expectations by 7,000 miles. Calculate annual depreciation for the four-year life of the van using each of the following methods.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started