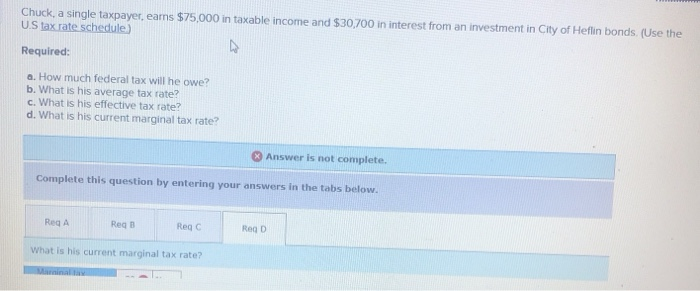

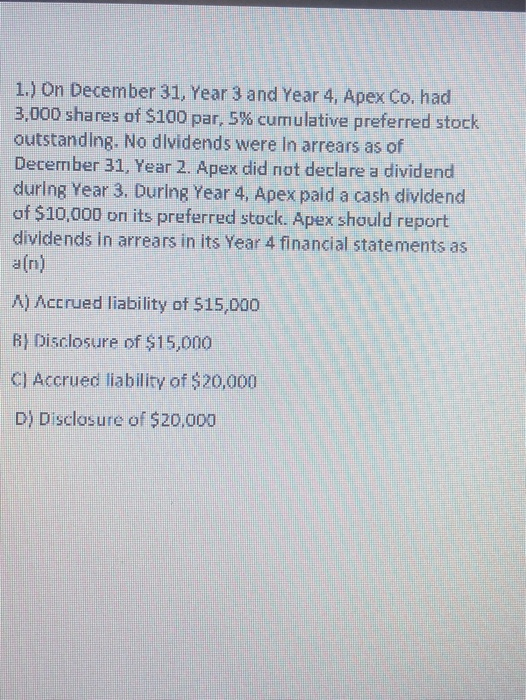

Chuck, a single taxpayer, earns $75,000 in taxable income and $30,700 in interest from an investment in City of Heflin bonds (Use the US tax rate schedule) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. RGA Red B Regc RD What is his current marginal tax rate? Hd-ons Help Last edit was made seconds ago by JUAN NARVAEZ Arial 11 BI U A co 15 E 3 51 6 Case B Case Study B Journal Entries Reveal a Puzzling Pattern For several years, I've been a senior audit manager on a subsidiary of a foreign entity. We conduct the annual audit, with no review of quarterly financial information. One year, a few months before we started fieldwork, the client hired a new controller and made some other personnel changes to the finance team. When we began our work, we found more small errors than usual, specifically in revenue and accounts receivable. We attributed the errors to the change in personnel and were not overly concerned, but we modified our procedures for testing revenue and looked for journal entries made to revenue with offsets to unusual accounts. We soon noticed a trend: entries to revenue often had an offset to atypical accounts. The pattern was puzzling because the entries both increased and decreased revenue during the course of the year, so it was difficult to understand any potential reasoning. As the reporting deadline approached, the partner and I sat down with the controller to ask for an explanation In response to our questions, the controller produced a spreadsheet and showed us that all the topside entries netted out to a minimal effect on the final full-year results. He indicated that the entries were made with the agreement of the CEO. Since we were performing an annual audit the financial statements on which these entries had little effect, the controller evidently felt our questions were satisfied. "But what was the purpose of the entries?" our partner asked. "We need to understand why these topside entries have been made," he persisted. There was a long, uncomfortable pause. hn 1.) On December 31, Year 3 and Year 4, Apex Co. had 3,000 shares of $100 par, 5% cumulative preferred stock outstanding. No dividends were in arrears as of December 31, Year 2. Apex did not declare a dividend during Year 3. During Year 4, Apex paid a cash dividend of $10,000 on its preferred stock. Apex should report dividends in arrears in its Year 4 financial statements as A) Accrued liability of $15,000 B) Disclosure of $15,000 C) Accrued liability of $20,000 D) Disclosure of $20,000