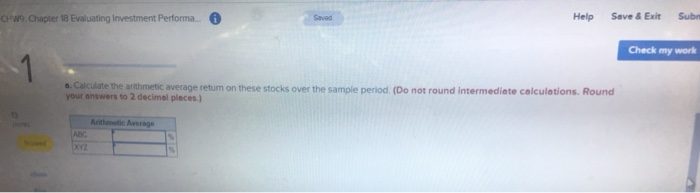

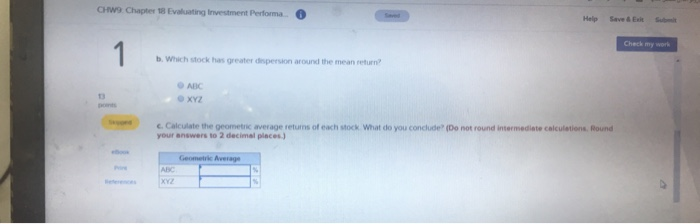

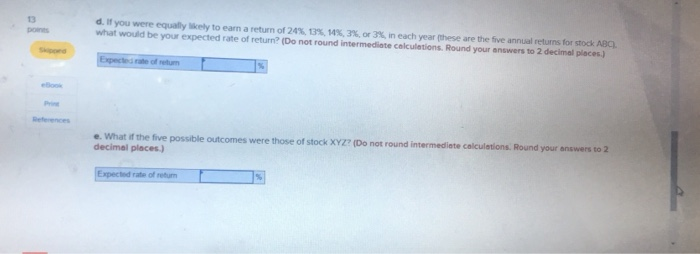

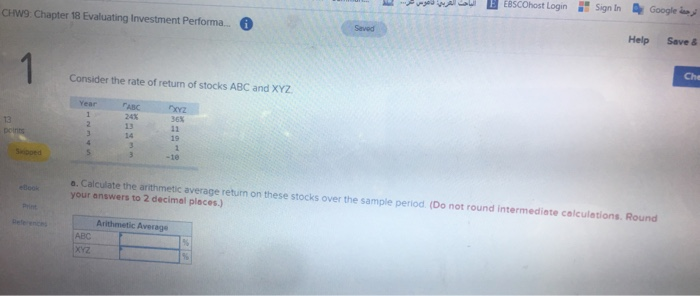

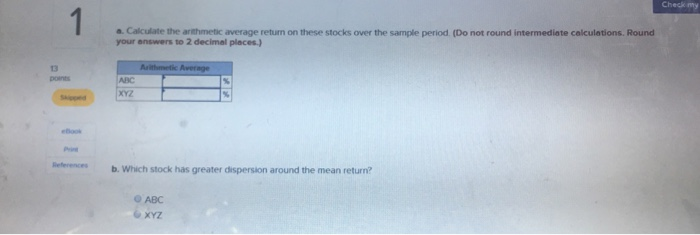

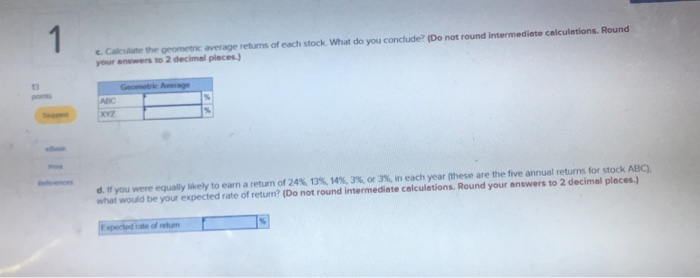

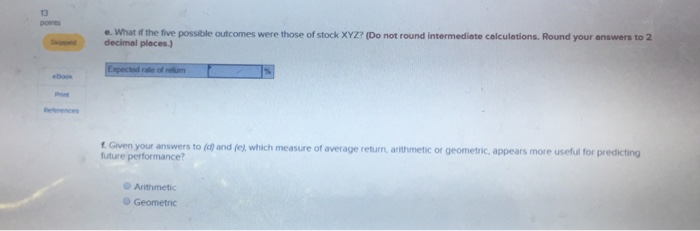

CHW9: Chapter 18 Evaluating Investment Performa. A Help Save & Exit Sub Check my work a. Calculate the arithmetic average return on these stocks over the sample period. (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Mide verage XYZ CHW9 Chapter 18 Evaluating Investment Performa Help Save & Ext Sub Check my work b. Which stock has greater person around the mean return ABC Xr2 - c. Calculate the geometric average returns of each stock What do you conclude(Do not round intermediate calculation Round your answers to 2 decimal places) Geometric Average ABC d. If you were equally Wely to earn a return of 24% 13% 14% 3%, or 3% in each year these are the five annual returns for stock AB what would be your expected rate of return? Do not round intermediate calculations. Round your answers to 2 decimal places.) Expected rate of retum e. What if the five possible outcomes were those of stock XYZ? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expected rate of return f. Given your answers to d) and el which measure of average return, arithmetic or geometric, appears more useful for predicting future performance? Arithmetic Geometric Goo B EBSCOhost Login Sign I n CHW9 Chapter 18 Evaluating Investment Performa. A Help Save & Consider the rate of return of stocks ABC and XYZ Che 13 6. Calculate the arithmetic average return on these stocks over the sample period. (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Arithmetic Average ABC XYZ Calculate the arithmetic average return on these stocks over the sample period. (Do not found intermediate calculations. Round your answers to 2 decimal places) (Anc XYZ b. Which stock has greater dispersion around the mean return? ABC 6XYZ Calculate the geometric average returns of each stock. What do you conclude? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Geometri Avage d. If you were equally likely to earn a return of 24% 13% 14% 3%, or 3%, in each year these are the five annual returns for stock ABC). what would be your expected rate of return? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Expected rate of retum e. What if the five possible outcomes were those of stock XYZ? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Given your answers to handle which measure of average return arithmetic or geometric appears more useful for predicting future performance? Arithmetic Geometric