Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CI05 1 - 3 will upvote. thank you Which of the following statements is incorrect? The percent of sales tool of Excel is in the

CI05 1 - 3 will upvote. thank you

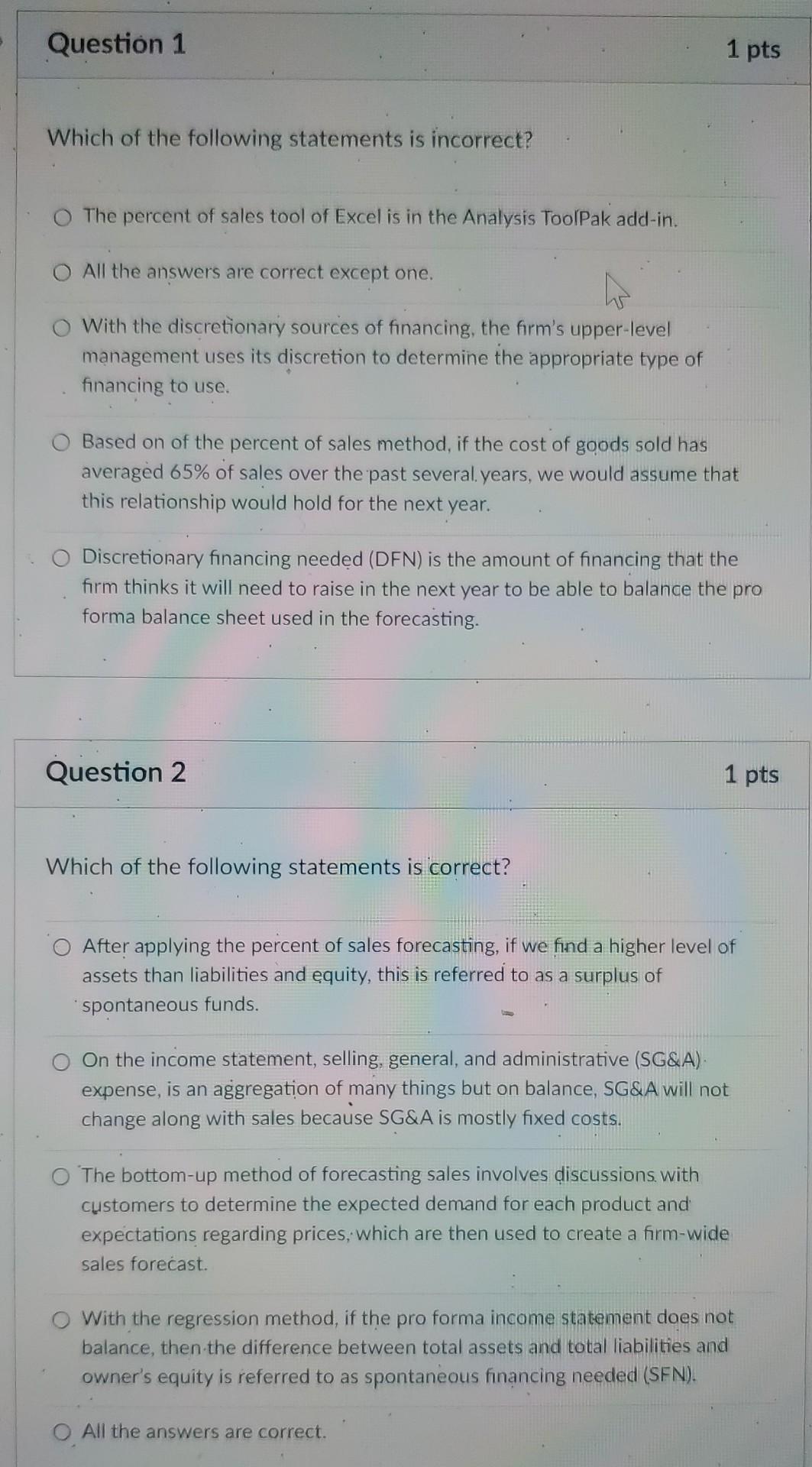

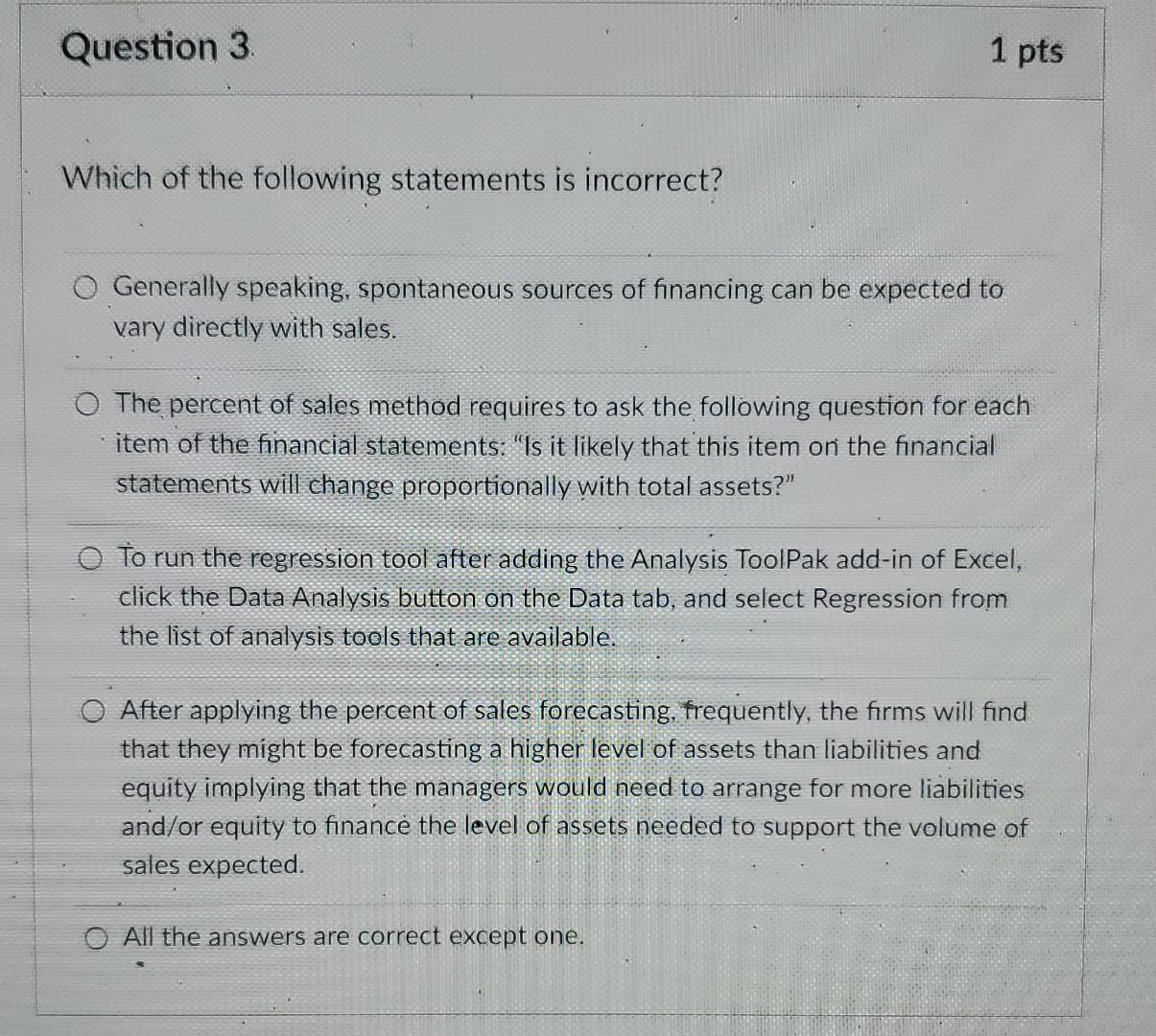

Which of the following statements is incorrect? The percent of sales tool of Excel is in the Analysis ToolPak add-in. All the answers are correct except one. With the discretionary sources of financing, the firm's upper-level management uses its discretion to determine the appropriate type of financing to use. Based on of the percent of sales method, if the cost of goods sold has averaged 65% of sales over the past several. years, we would assume that this relationship would hold for the next year. Discretionary financing needed (DFN) is the amount of financing that the firm thinks it will need to raise in the next year to be able to balance the pro forma balance sheet used in the forecasting. Question 2 1 pts Which of the following statements is correct? After applying the percent of sales forecasting, if we find a higher level of assets than liabilities and equity, this is referred to as a surplus of spontaneous funds. On the income statement, selling, general, and administrative (SG\&A). expense, is an aggregation of many things but on balance, SG\&A will not change along with sales because SG\&A is mostly fixed costs. The bottom-up method of forecasting sales involves discussions. with customers to determine the expected demand for each product and expectations regarding prices, which are then used to create a firm-wide sales forecast. With the regression method, if the pro forma income statement does not balance, then the difference between total assets and total liabilities and owner's equity is referred to as spontaneous financing needed (SFN). All the answers are correct. Which of the following statements is incorrect? Generally speaking, spontaneous sources of financing can be expected to vary directly with sales. The percent of sales method requires to ask the following question for each item of the financial statements: "Is it likely that this item on the financial statements will change proportionally with total assets?" To run the regression tool after adding the Analysis ToolPak add-in of Excel, click the Data Analysis button on the Data tab, and select Regression from the list of analysis tools that are available. After applying the percent of sales forecasting, frequently, the firms will find that they might be forecasting a higher level of assets than liabilities and equity implying that the managers would need to arrange for more liabilities and/or equity to finance the level of assets needed to support the volume of sales expected. All the answers are correct except oneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started