Answered step by step

Verified Expert Solution

Question

1 Approved Answer

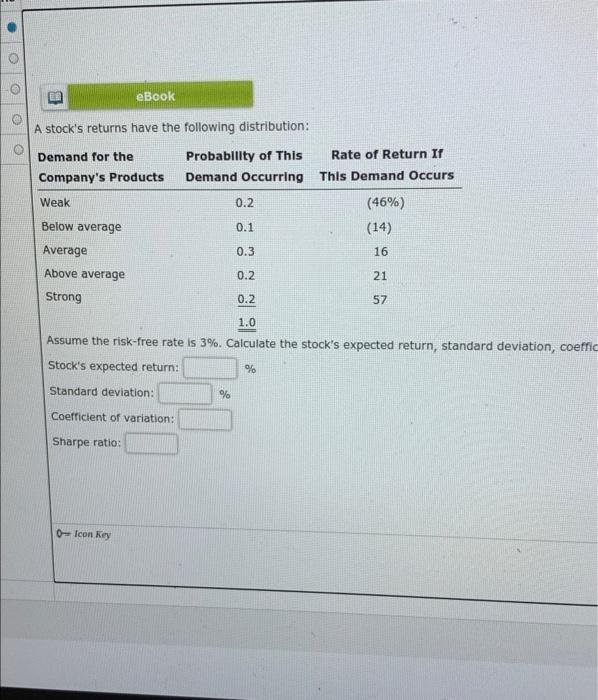

please be clear and label the questions by number 1. 2. 3. 4 4. eBook e A stock's returns have the following distribution: Demand for

please be clear and label the questions by number

4

4

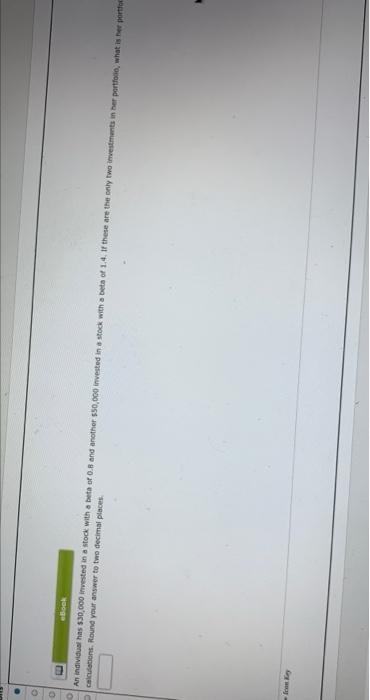

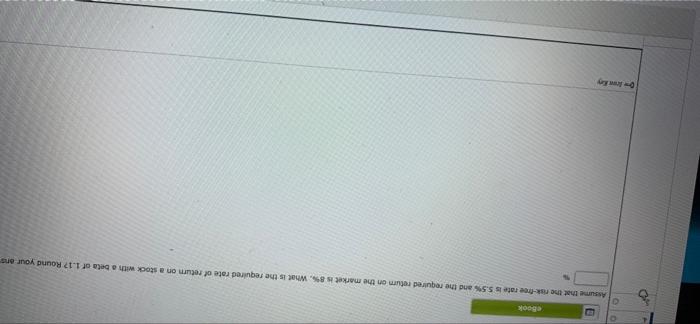

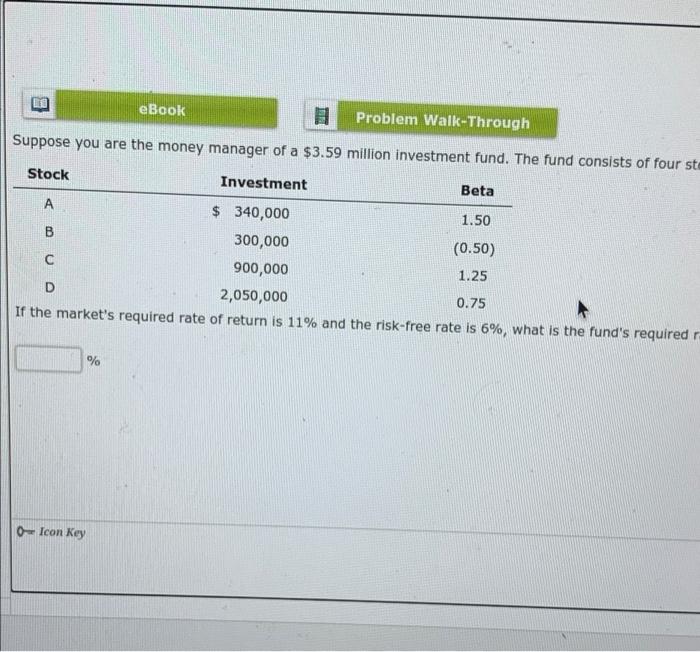

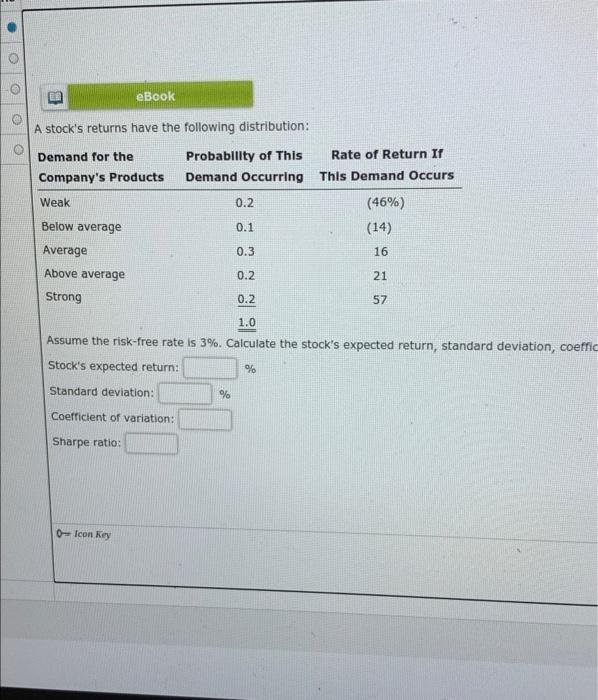

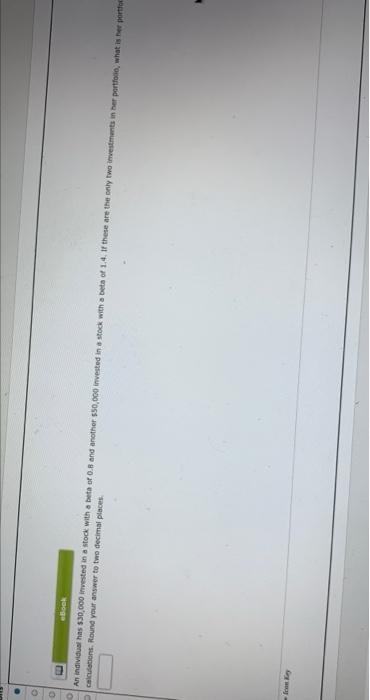

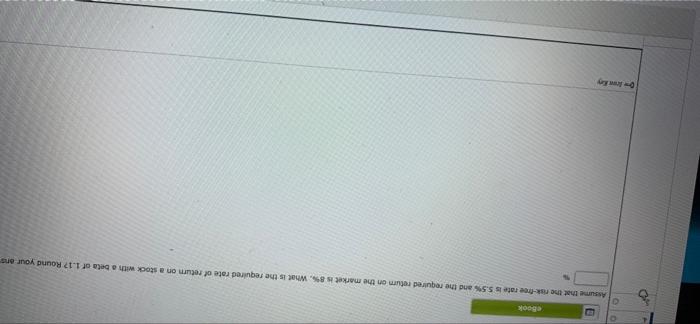

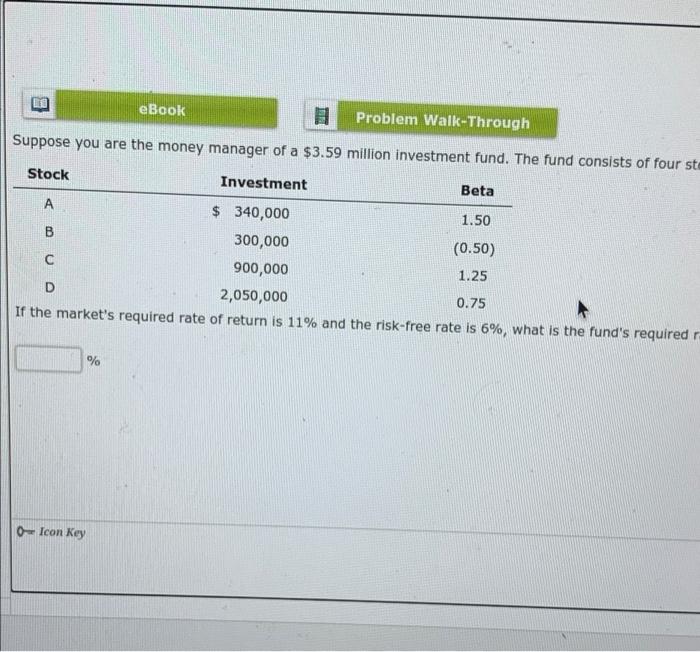

eBook e A stock's returns have the following distribution: Demand for the Probability of this Rate of Return If Company's Products Demand Occurring This Demand Occurs Weak 0.2 (46%) Below average 0.1 (14) Average 0.3 16 Above average 0.2 21 Strong 0.2 57 1.0 Assume the risk-free rate is 3%. Calculate the stock's expected return, standard deviation, coeffic Stock's expected returns % Standard deviation: % Coefficient of variation: Sharpe ratio: 0-Icon Key OO E eBook An individual has $30,000 invested in a stock with a hea of 0.5 and another 550,000 invested in stock with a beta of 1.4. If these are the only two investments in her porto, what is the porte calculations. Round your answer to two decimal places eBook Assume that the free rates 5.5% and the required return on the market is 8%. What is the required rate of return on a stock with a bea of 1.17 Round your ans eBook Problem Walk-Through Suppose you are the money manager of a $3.59 million investment fund. The fund consists of four ste Stock Investment Beta $ 340,000 1.50 B 300,000 (0.50) 900,000 1.25 D 2,050,000 0.75 If the market's required rate of return is 11% and the risk-free rate is 6%, what is the fund's required % 0Icon Key 1.

2.

3.

4

44.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started