Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P acquired 90% of the voting stock of S on 1/1/x1 for $430,000 when it was selling for $21/share. S balance sheet on 1/1/x1:

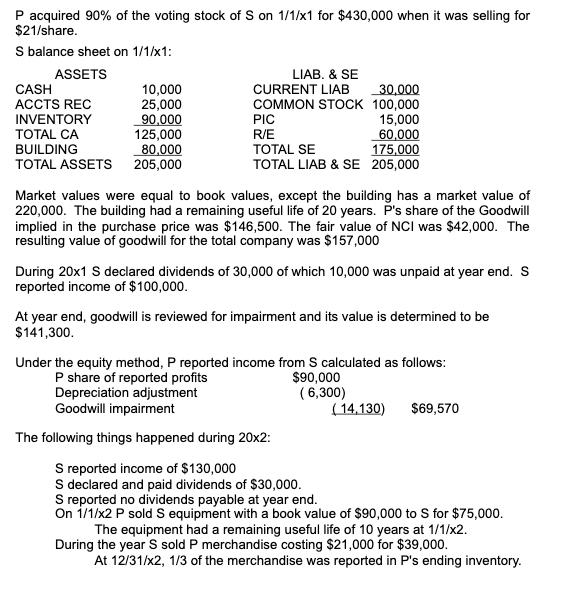

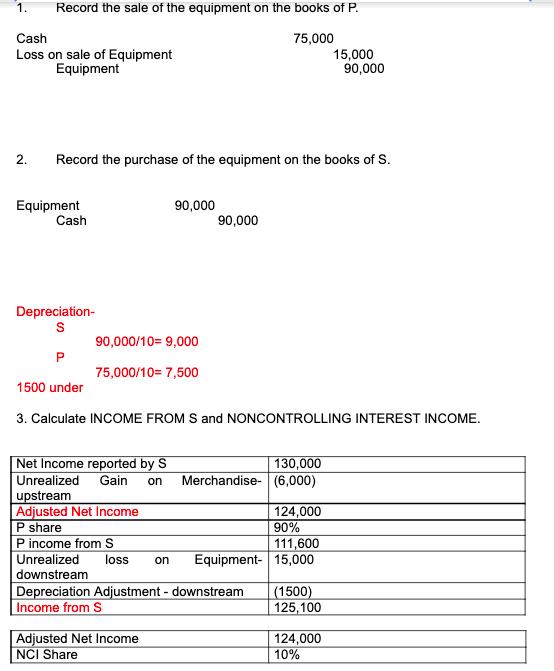

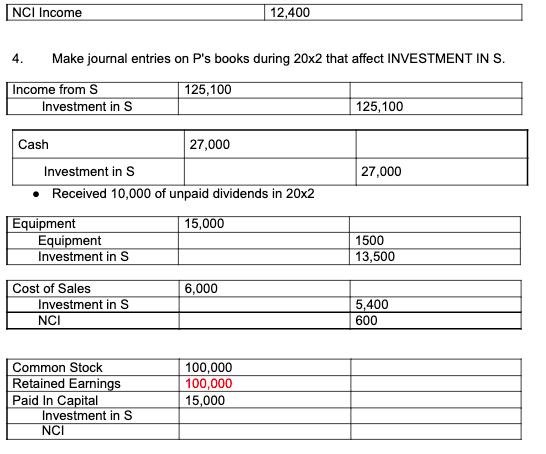

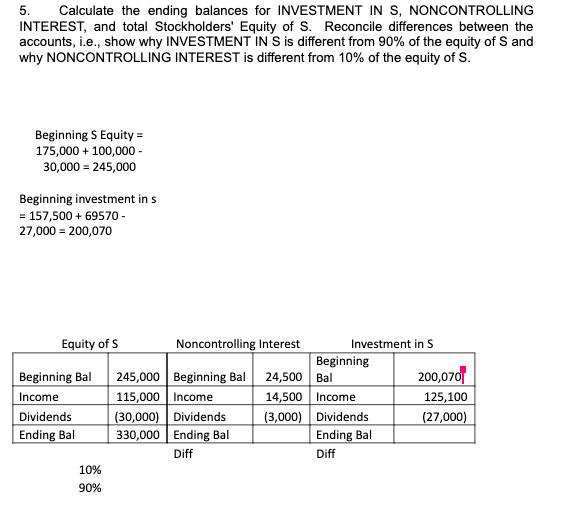

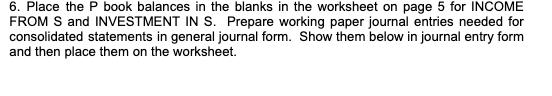

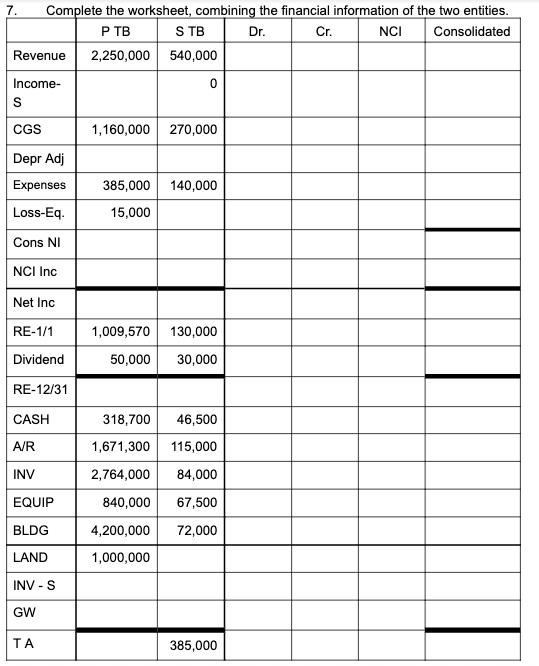

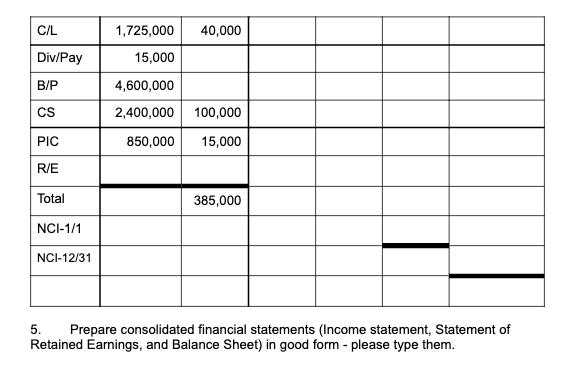

P acquired 90% of the voting stock of S on 1/1/x1 for $430,000 when it was selling for $21/share. S balance sheet on 1/1/x1: ASSETS CASH ACCTS REC INVENTORY TOTAL CA BUILDING TOTAL ASSETS 10,000 25,000 90,000 125,000 80,000 205,000 LIAB. & SE CURRENT LIAB COMMON STOCK PIC R/E TOTAL SE TOTAL LIAB & SE 30,000 100,000 15,000 60,000 175,000 205,000 Market values were equal to book values, except the building has a market value of 220,000. The building had a remaining useful life of 20 years. P's share of the Goodwill implied in the purchase price was $146,500. The fair value of NCI was $42,000. The resulting value of goodwill for the total company was $157,000 During 20x1 S declared dividends of 30,000 of which 10,000 was unpaid at year end. S reported income of $100,000. At year end, goodwill is reviewed for impairment and its value is determined to be $141,300. Under the equity method, P reported income from S calculated as follows: $90,000 P share of reported profits Depreciation adjustment Goodwill impairment The following things happened during 20x2: S reported income of $130,000 S declared and paid dividends of $30,000. S reported no dividends payable at year end. On 1/1/x2 P sold S equipment with a book value of $90,000 to S for $75,000. The equipment had a remaining useful life of 10 years at 1/1/x2. During the year S sold P merchandise costing $21,000 for $39,000. At 12/31/x2, 1/3 of the merchandise was reported in P's ending inventory. (6,300) (14,130) $69,570 1. Record the sale of the equipment on the books of P. 75,000 Cash Loss on sale of Equipment Equipment 2. Equipment Record the purchase of the equipment on the books of S. Cash 90,000/10= 9,000 75,000/10= 7,500 Net Income reported by S Unrealized Gain on 90,000 upstream Adjusted Net Income P share P income from S Depreciation- S P 1500 under 3. Calculate INCOME FROM S and NONCONTROLLING INTEREST INCOME. 90,000 Adjusted Net Income NCI Share Merchandise- 130,000 (6,000) 124,000 90% 111,600 loss on Equipment- 15,000 Unrealized downstream Depreciation Adjustment - downstream (1500) Income from S 125,100 15,000 90,000 124,000 10% NCI Income 4. Make journal entries on P's books during 20x2 that affect INVESTMENT IN S. Income from S 125,100 Investment in S Cash Equipment Investment in S Received 10,000 of unpaid dividends in 20x2 Equipment Investment in S Cost of Sales Investment in S NCI Common Stock Retained Earnings Paid In Capital 27,000 Investment in S NCI 15,000 12,400 6,000 100,000 100,000 15,000 125,100 27,000 1500 13,500 5,400 600 5. Calculate the ending balances for INVESTMENT IN S, NONCONTROLLING INTEREST, and total Stockholders' Equity of S. Reconcile differences between the accounts, i.e., show why INVESTMENT IN S is different from 90% of the equity of S and why NONCONTROLLING INTEREST is different from 10% of the equity of S. Beginning S Equity = 175,000 + 100,000 - 30,000 = 245,000 Beginning investment in s = 157,500 + 69570- 27,000 = 200,070 Equity of S Noncontrolling Interest Beginning Beginning Bal 245,000 Beginning Bal 24,500 Bal Income 115,000 Income 14,500 Income Dividends (3,000) Dividends (30,000) Dividends 330,000 Ending Bal Ending Bal Ending Bal Diff Diff Investment in S 10% 90% 200,070 125,100 (27,000) 6. Place the P book balances in the blanks in the worksheet on page 5 for INCOME FROM S and INVESTMENT IN S. Prepare working paper journal entries needed for consolidated statements in general journal form. Show them below in journal entry form and then place them on the worksheet. 7. Complete the worksheet, combining the financial information of the two entities. NCI PTB Dr. Cr. Consolidated 2,250,000 Revenue Income- S CGS Depr Adj Expenses Loss-Eq. Cons NI NCI Inc Net Inc RE-1/1 Dividend RE-12/31 CASH A/R INV EQUIP BLDG LAND INV - S GW STB 540,000 0 1,160,000 270,000 385,000 140,000 15,000 1,009,570 130,000 50,000 30,000 318,700 46,500 1,671,300 115,000 2,764,000 84,000 840,000 67,500 4,200,000 72,000 1,000,000 385,000 C/L Div/Pay B/P CS PIC R/E Total NCI-1/1 NCI-12/31 1,725,000 40,000 15,000 4,600,000 2,400,000 100,000 850,000 15,000 385,000 5. Prepare consolidated financial statements (Income statement, Statement of Retained Earnings, and Balance Sheet) in good form - please type them. P acquired 90% of the voting stock of S on 1/1/x1 for $430,000 when it was selling for $21/share. S balance sheet on 1/1/x1: ASSETS CASH ACCTS REC INVENTORY TOTAL CA BUILDING TOTAL ASSETS 10,000 25,000 90,000 125,000 80,000 205,000 LIAB. & SE CURRENT LIAB COMMON STOCK PIC R/E TOTAL SE TOTAL LIAB & SE 30,000 100,000 15,000 60,000 175,000 205,000 Market values were equal to book values, except the building has a market value of 220,000. The building had a remaining useful life of 20 years. P's share of the Goodwill implied in the purchase price was $146,500. The fair value of NCI was $42,000. The resulting value of goodwill for the total company was $157,000 During 20x1 S declared dividends of 30,000 of which 10,000 was unpaid at year end. S reported income of $100,000. At year end, goodwill is reviewed for impairment and its value is determined to be $141,300. Under the equity method, P reported income from S calculated as follows: $90,000 P share of reported profits Depreciation adjustment Goodwill impairment The following things happened during 20x2: S reported income of $130,000 S declared and paid dividends of $30,000. S reported no dividends payable at year end. On 1/1/x2 P sold S equipment with a book value of $90,000 to S for $75,000. The equipment had a remaining useful life of 10 years at 1/1/x2. During the year S sold P merchandise costing $21,000 for $39,000. At 12/31/x2, 1/3 of the merchandise was reported in P's ending inventory. (6,300) (14,130) $69,570 1. Record the sale of the equipment on the books of P. 75,000 Cash Loss on sale of Equipment Equipment 2. Equipment Record the purchase of the equipment on the books of S. Cash 90,000/10= 9,000 75,000/10= 7,500 Net Income reported by S Unrealized Gain on 90,000 upstream Adjusted Net Income P share P income from S Depreciation- S P 1500 under 3. Calculate INCOME FROM S and NONCONTROLLING INTEREST INCOME. 90,000 Adjusted Net Income NCI Share Merchandise- 130,000 (6,000) 124,000 90% 111,600 loss on Equipment- 15,000 Unrealized downstream Depreciation Adjustment - downstream (1500) Income from S 125,100 15,000 90,000 124,000 10% NCI Income 4. Make journal entries on P's books during 20x2 that affect INVESTMENT IN S. Income from S 125,100 Investment in S Cash Equipment Investment in S Received 10,000 of unpaid dividends in 20x2 Equipment Investment in S Cost of Sales Investment in S NCI Common Stock Retained Earnings Paid In Capital 27,000 Investment in S NCI 15,000 12,400 6,000 100,000 100,000 15,000 125,100 27,000 1500 13,500 5,400 600 5. Calculate the ending balances for INVESTMENT IN S, NONCONTROLLING INTEREST, and total Stockholders' Equity of S. Reconcile differences between the accounts, i.e., show why INVESTMENT IN S is different from 90% of the equity of S and why NONCONTROLLING INTEREST is different from 10% of the equity of S. Beginning S Equity = 175,000 + 100,000 - 30,000 = 245,000 Beginning investment in s = 157,500 + 69570- 27,000 = 200,070 Equity of S Noncontrolling Interest Beginning Beginning Bal 245,000 Beginning Bal 24,500 Bal Income 115,000 Income 14,500 Income Dividends (3,000) Dividends (30,000) Dividends 330,000 Ending Bal Ending Bal Ending Bal Diff Diff Investment in S 10% 90% 200,070 125,100 (27,000) 6. Place the P book balances in the blanks in the worksheet on page 5 for INCOME FROM S and INVESTMENT IN S. Prepare working paper journal entries needed for consolidated statements in general journal form. Show them below in journal entry form and then place them on the worksheet. 7. Complete the worksheet, combining the financial information of the two entities. NCI PTB Dr. Cr. Consolidated 2,250,000 Revenue Income- S CGS Depr Adj Expenses Loss-Eq. Cons NI NCI Inc Net Inc RE-1/1 Dividend RE-12/31 CASH A/R INV EQUIP BLDG LAND INV - S GW STB 540,000 0 1,160,000 270,000 385,000 140,000 15,000 1,009,570 130,000 50,000 30,000 318,700 46,500 1,671,300 115,000 2,764,000 84,000 840,000 67,500 4,200,000 72,000 1,000,000 385,000 C/L Div/Pay B/P CS PIC R/E Total NCI-1/1 NCI-12/31 1,725,000 40,000 15,000 4,600,000 2,400,000 100,000 850,000 15,000 385,000 5. Prepare consolidated financial statements (Income statement, Statement of Retained Earnings, and Balance Sheet) in good form - please type them. P acquired 90% of the voting stock of S on 1/1/x1 for $430,000 when it was selling for $21/share. S balance sheet on 1/1/x1: ASSETS CASH ACCTS REC INVENTORY TOTAL CA BUILDING TOTAL ASSETS 10,000 25,000 90,000 125,000 80,000 205,000 LIAB. & SE CURRENT LIAB COMMON STOCK PIC R/E TOTAL SE TOTAL LIAB & SE 30,000 100,000 15,000 60,000 175,000 205,000 Market values were equal to book values, except the building has a market value of 220,000. The building had a remaining useful life of 20 years. P's share of the Goodwill implied in the purchase price was $146,500. The fair value of NCI was $42,000. The resulting value of goodwill for the total company was $157,000 During 20x1 S declared dividends of 30,000 of which 10,000 was unpaid at year end. S reported income of $100,000. At year end, goodwill is reviewed for impairment and its value is determined to be $141,300. Under the equity method, P reported income from S calculated as follows: $90,000 P share of reported profits Depreciation adjustment Goodwill impairment The following things happened during 20x2: S reported income of $130,000 S declared and paid dividends of $30,000. S reported no dividends payable at year end. On 1/1/x2 P sold S equipment with a book value of $90,000 to S for $75,000. The equipment had a remaining useful life of 10 years at 1/1/x2. During the year S sold P merchandise costing $21,000 for $39,000. At 12/31/x2, 1/3 of the merchandise was reported in P's ending inventory. (6,300) (14,130) $69,570 1. Record the sale of the equipment on the books of P. 75,000 Cash Loss on sale of Equipment Equipment 2. Equipment Record the purchase of the equipment on the books of S. Cash 90,000/10= 9,000 75,000/10= 7,500 Net Income reported by S Unrealized Gain on 90,000 upstream Adjusted Net Income P share P income from S Depreciation- S P 1500 under 3. Calculate INCOME FROM S and NONCONTROLLING INTEREST INCOME. 90,000 Adjusted Net Income NCI Share Merchandise- 130,000 (6,000) 124,000 90% 111,600 loss on Equipment- 15,000 Unrealized downstream Depreciation Adjustment - downstream (1500) Income from S 125,100 15,000 90,000 124,000 10% NCI Income 4. Make journal entries on P's books during 20x2 that affect INVESTMENT IN S. Income from S 125,100 Investment in S Cash Equipment Investment in S Received 10,000 of unpaid dividends in 20x2 Equipment Investment in S Cost of Sales Investment in S NCI Common Stock Retained Earnings Paid In Capital 27,000 Investment in S NCI 15,000 12,400 6,000 100,000 100,000 15,000 125,100 27,000 1500 13,500 5,400 600 5. Calculate the ending balances for INVESTMENT IN S, NONCONTROLLING INTEREST, and total Stockholders' Equity of S. Reconcile differences between the accounts, i.e., show why INVESTMENT IN S is different from 90% of the equity of S and why NONCONTROLLING INTEREST is different from 10% of the equity of S. Beginning S Equity = 175,000 + 100,000 - 30,000 = 245,000 Beginning investment in s = 157,500 + 69570- 27,000 = 200,070 Equity of S Noncontrolling Interest Beginning Beginning Bal 245,000 Beginning Bal 24,500 Bal Income 115,000 Income 14,500 Income Dividends (3,000) Dividends (30,000) Dividends 330,000 Ending Bal Ending Bal Ending Bal Diff Diff Investment in S 10% 90% 200,070 125,100 (27,000) 6. Place the P book balances in the blanks in the worksheet on page 5 for INCOME FROM S and INVESTMENT IN S. Prepare working paper journal entries needed for consolidated statements in general journal form. Show them below in journal entry form and then place them on the worksheet. 7. Complete the worksheet, combining the financial information of the two entities. NCI PTB Dr. Cr. Consolidated 2,250,000 Revenue Income- S CGS Depr Adj Expenses Loss-Eq. Cons NI NCI Inc Net Inc RE-1/1 Dividend RE-12/31 CASH A/R INV EQUIP BLDG LAND INV - S GW STB 540,000 0 1,160,000 270,000 385,000 140,000 15,000 1,009,570 130,000 50,000 30,000 318,700 46,500 1,671,300 115,000 2,764,000 84,000 840,000 67,500 4,200,000 72,000 1,000,000 385,000 C/L Div/Pay B/P CS PIC R/E Total NCI-1/1 NCI-12/31 1,725,000 40,000 15,000 4,600,000 2,400,000 100,000 850,000 15,000 385,000 5. Prepare consolidated financial statements (Income statement, Statement of Retained Earnings, and Balance Sheet) in good form - please type them. P acquired 90% of the voting stock of S on 1/1/x1 for $430,000 when it was selling for $21/share. S balance sheet on 1/1/x1: ASSETS CASH ACCTS REC INVENTORY TOTAL CA BUILDING TOTAL ASSETS 10,000 25,000 90,000 125,000 80,000 205,000 LIAB. & SE CURRENT LIAB COMMON STOCK PIC R/E TOTAL SE TOTAL LIAB & SE 30,000 100,000 15,000 60,000 175,000 205,000 Market values were equal to book values, except the building has a market value of 220,000. The building had a remaining useful life of 20 years. P's share of the Goodwill implied in the purchase price was $146,500. The fair value of NCI was $42,000. The resulting value of goodwill for the total company was $157,000 During 20x1 S declared dividends of 30,000 of which 10,000 was unpaid at year end. S reported income of $100,000. At year end, goodwill is reviewed for impairment and its value is determined to be $141,300. Under the equity method, P reported income from S calculated as follows: $90,000 P share of reported profits Depreciation adjustment Goodwill impairment The following things happened during 20x2: S reported income of $130,000 S declared and paid dividends of $30,000. S reported no dividends payable at year end. On 1/1/x2 P sold S equipment with a book value of $90,000 to S for $75,000. The equipment had a remaining useful life of 10 years at 1/1/x2. During the year S sold P merchandise costing $21,000 for $39,000. At 12/31/x2, 1/3 of the merchandise was reported in P's ending inventory. (6,300) (14,130) $69,570 1. Record the sale of the equipment on the books of P. 75,000 Cash Loss on sale of Equipment Equipment 2. Equipment Record the purchase of the equipment on the books of S. Cash 90,000/10= 9,000 75,000/10= 7,500 Net Income reported by S Unrealized Gain on 90,000 upstream Adjusted Net Income P share P income from S Depreciation- S P 1500 under 3. Calculate INCOME FROM S and NONCONTROLLING INTEREST INCOME. 90,000 Adjusted Net Income NCI Share Merchandise- 130,000 (6,000) 124,000 90% 111,600 loss on Equipment- 15,000 Unrealized downstream Depreciation Adjustment - downstream (1500) Income from S 125,100 15,000 90,000 124,000 10% NCI Income 4. Make journal entries on P's books during 20x2 that affect INVESTMENT IN S. Income from S 125,100 Investment in S Cash Equipment Investment in S Received 10,000 of unpaid dividends in 20x2 Equipment Investment in S Cost of Sales Investment in S NCI Common Stock Retained Earnings Paid In Capital 27,000 Investment in S NCI 15,000 12,400 6,000 100,000 100,000 15,000 125,100 27,000 1500 13,500 5,400 600 5. Calculate the ending balances for INVESTMENT IN S, NONCONTROLLING INTEREST, and total Stockholders' Equity of S. Reconcile differences between the accounts, i.e., show why INVESTMENT IN S is different from 90% of the equity of S and why NONCONTROLLING INTEREST is different from 10% of the equity of S. Beginning S Equity = 175,000 + 100,000 - 30,000 = 245,000 Beginning investment in s = 157,500 + 69570- 27,000 = 200,070 Equity of S Noncontrolling Interest Beginning Beginning Bal 245,000 Beginning Bal 24,500 Bal Income 115,000 Income 14,500 Income Dividends (3,000) Dividends (30,000) Dividends 330,000 Ending Bal Ending Bal Ending Bal Diff Diff Investment in S 10% 90% 200,070 125,100 (27,000) 6. Place the P book balances in the blanks in the worksheet on page 5 for INCOME FROM S and INVESTMENT IN S. Prepare working paper journal entries needed for consolidated statements in general journal form. Show them below in journal entry form and then place them on the worksheet. 7. Complete the worksheet, combining the financial information of the two entities. NCI PTB Dr. Cr. Consolidated 2,250,000 Revenue Income- S CGS Depr Adj Expenses Loss-Eq. Cons NI NCI Inc Net Inc RE-1/1 Dividend RE-12/31 CASH A/R INV EQUIP BLDG LAND INV - S GW STB 540,000 0 1,160,000 270,000 385,000 140,000 15,000 1,009,570 130,000 50,000 30,000 318,700 46,500 1,671,300 115,000 2,764,000 84,000 840,000 67,500 4,200,000 72,000 1,000,000 385,000 C/L Div/Pay B/P CS PIC R/E Total NCI-1/1 NCI-12/31 1,725,000 40,000 15,000 4,600,000 2,400,000 100,000 850,000 15,000 385,000 5. Prepare consolidated financial statements (Income statement, Statement of Retained Earnings, and Balance Sheet) in good form - please type them.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

IN COM E STAT EMENT For the Year Ended December 31 2020 Re ven ues C L Division ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started