CIMA Adopted

CIMA Adopted

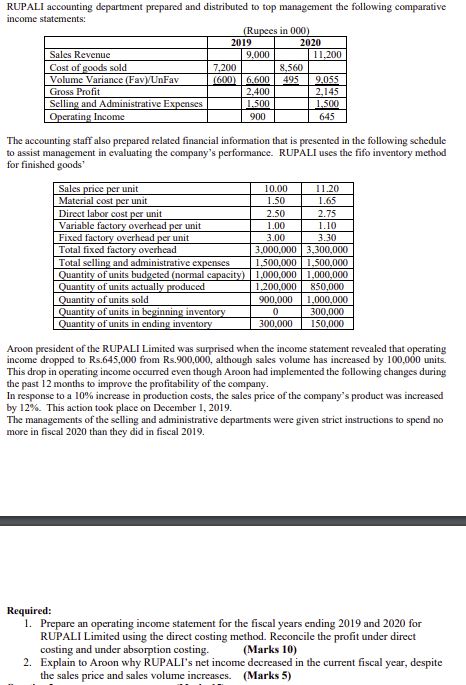

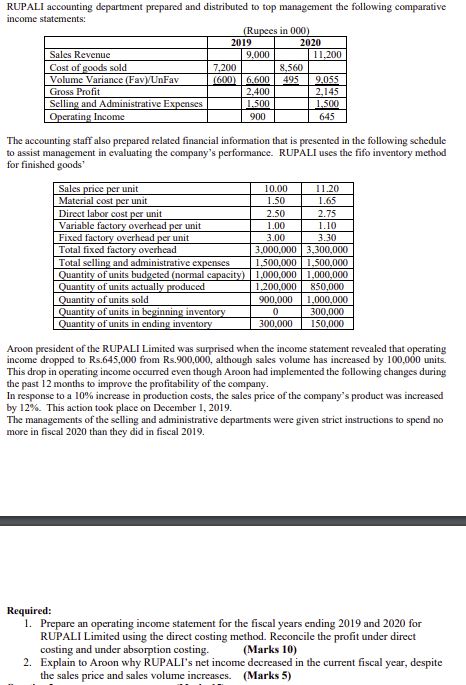

RUPALI accounting department prepared and distributed to top management the following comparative income statements: (Rupees in 000) 2019 2020 Sales Revenue 9,000 11.200 Cost of goods sold 7,200 8,560 Volume Variance (Fav) UnFav (600) 6.600 495 9,055 Gross Profit 2.400 2,145 Selling and Administrative Expenses 1.500 1.500 Operating Income 645 900 The accounting staff also prepared related financial information that is presented in the following schedule to assist management in evaluating the company's performance. RUPALI uses the fifo inventory method for finished goods Sales price per unit 10.00 11.20 Material cost per unit 1.50 1.65 Direct labor cost per unit 2.50 2.75 Variable factory overhead per unit 1.00 1.10 Fixed factory overhead per unit 3.00 3.30 Total fixed factory overhead 3,000,000 3,300,000 Total selling and administrative expenses 1,500,000 1,500,000 Quantity of units budgeted (normal capacity) 1,000,000 1,000,000 Quantity of units actually produced 1.200.000 850,000 Quantity of units sold 900.000 1,000,000 Quantity of units in beginning inventory 0 300,000 Quantity of units in ending inventory 300.000 150,000 Aroon president of the RUPALI Limited was surprised when the income statement revealed that operating income dropped to Rs.645,000 from Rs.900,000, although sales volume has increased by 100,000 units. This drop in operating income occurred even though Aroon had implemented the following changes during the past 12 months to improve the profitability of the company. In response to a 10% increase in production costs, the sales price of the company's product was increased by 12%. This action took place on December 1, 2019. The managements of the selling and administrative departments were given strict instructions to spend no more in fiscal 2020 than they did in fiscal 2019. Required: 1. Prepare an operating income statement for the fiscal years ending 2019 and 2020 for RUPALI Limited using the direct costing method. Reconcile the profit under direct costing and under absorption costing. (Marks 10) 2. Explain to Aroon why RUPALI's net income decreased in the current fiscal year, despite the sales price and sales volume increases. (Marks 5)

CIMA Adopted

CIMA Adopted