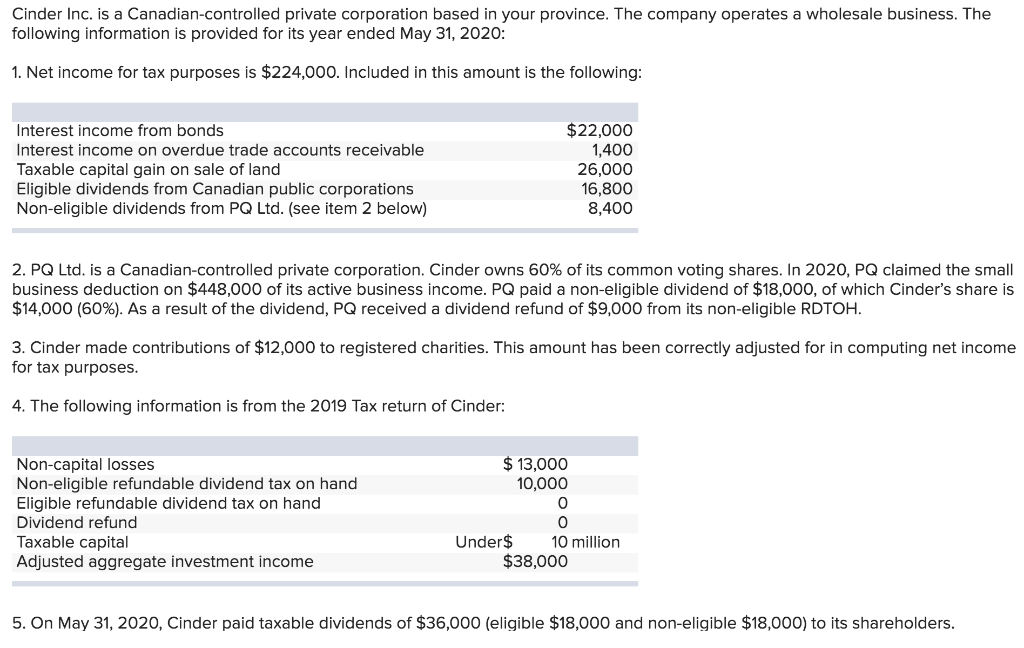

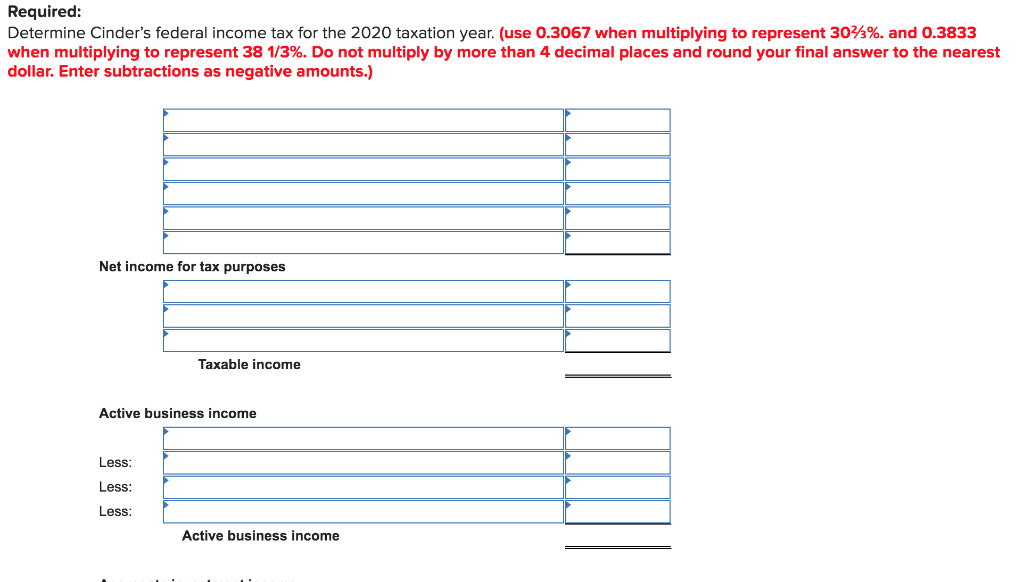

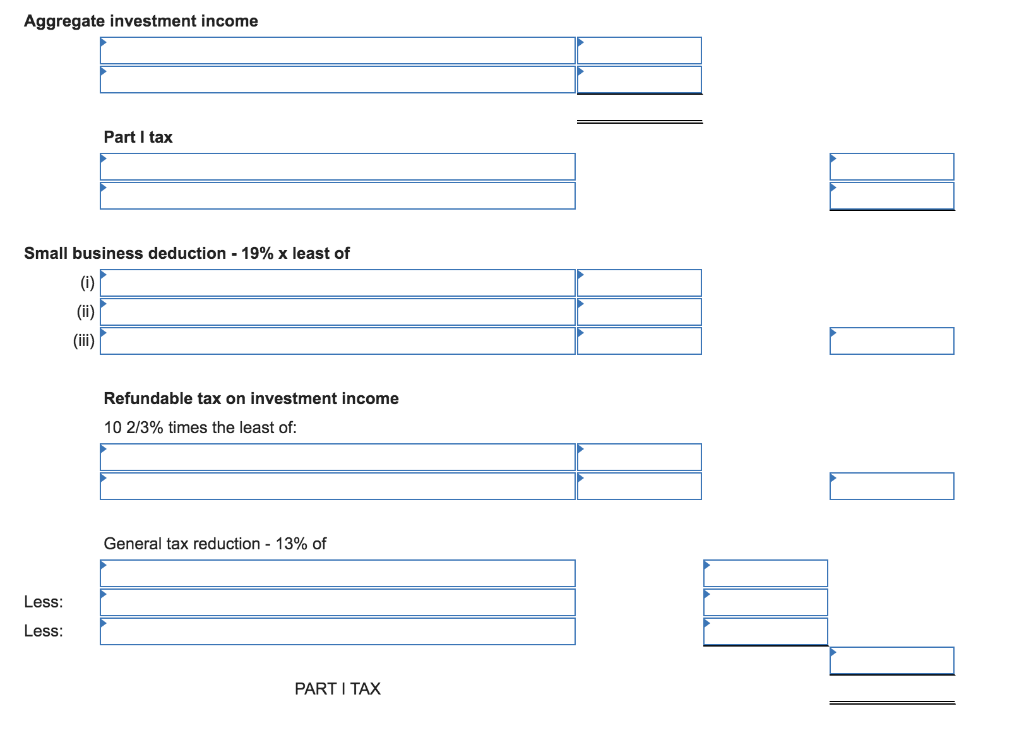

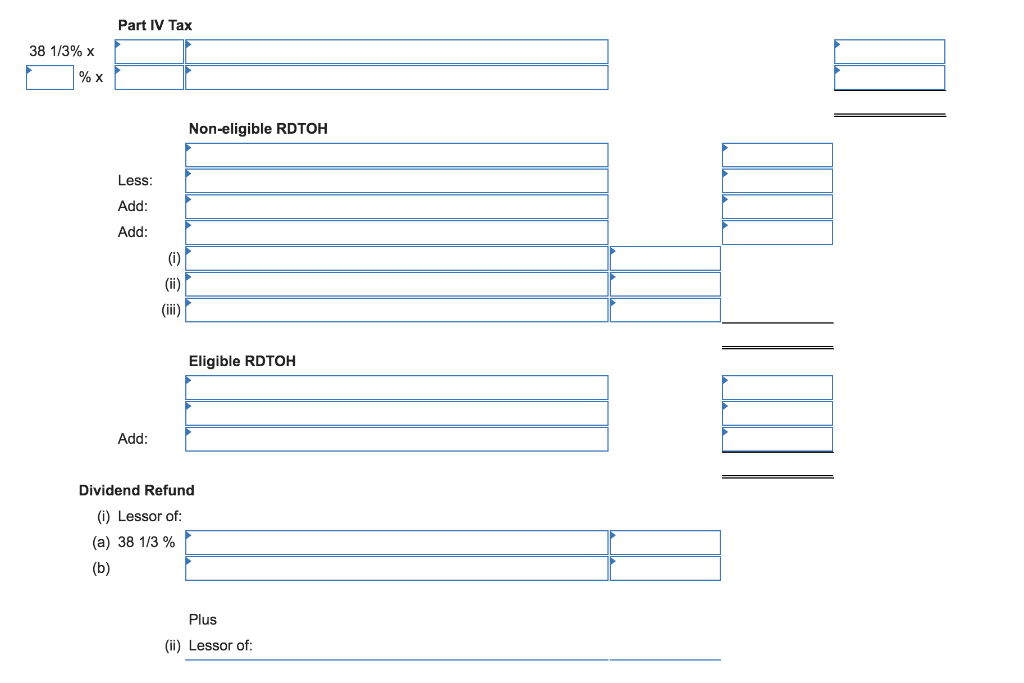

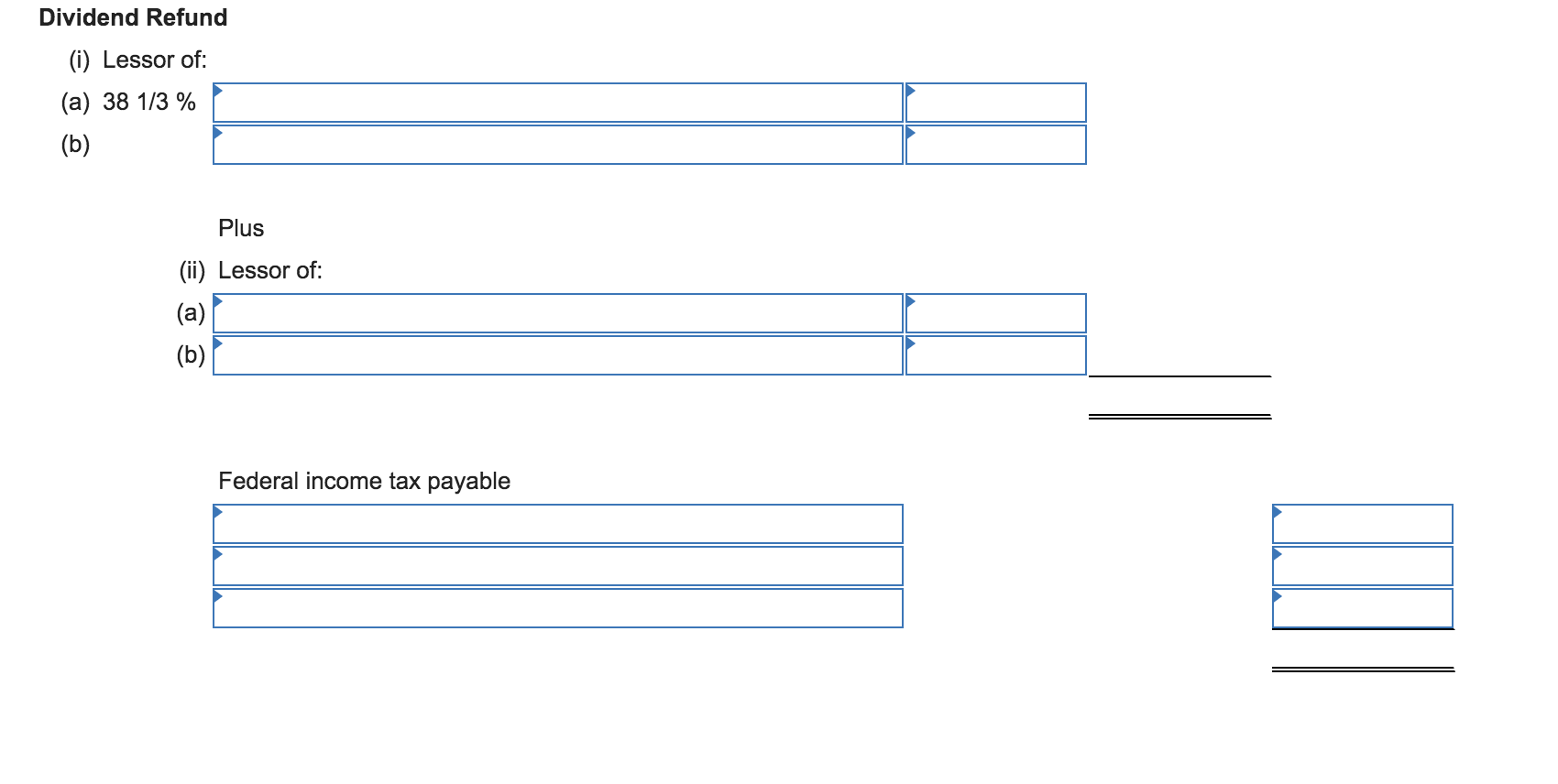

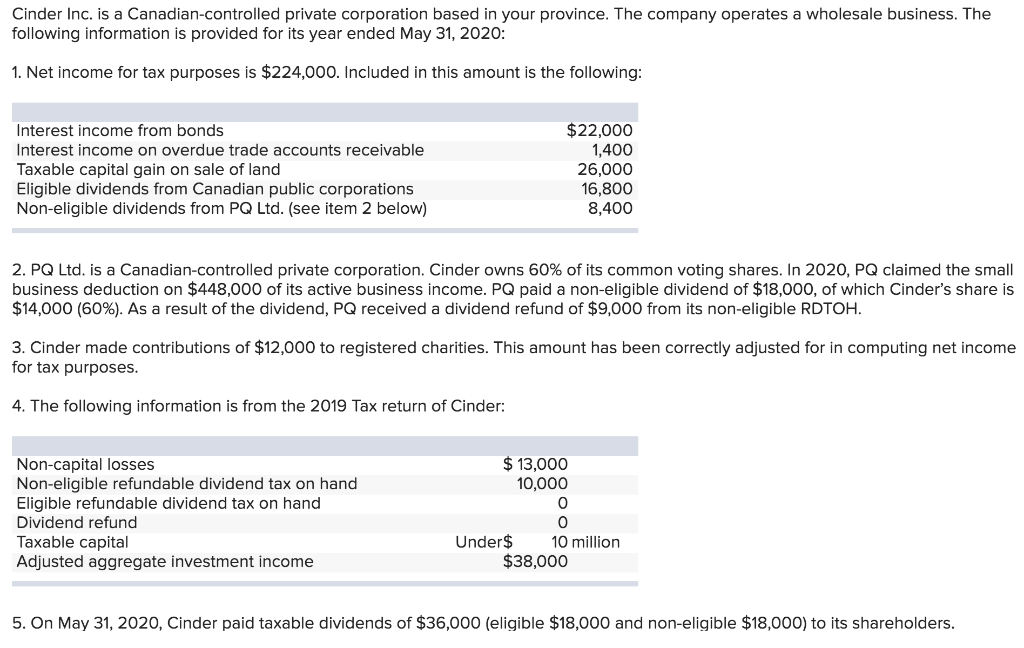

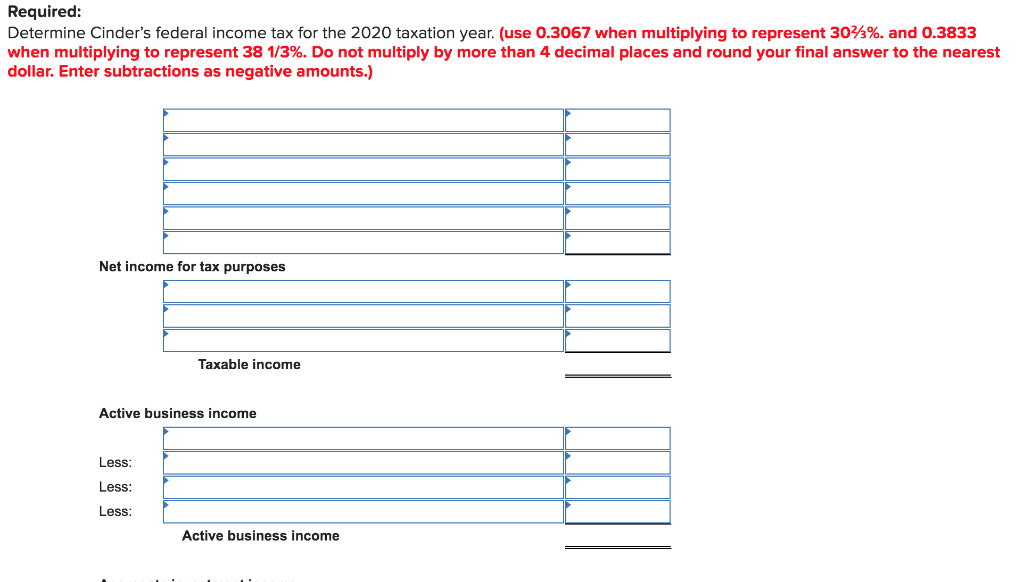

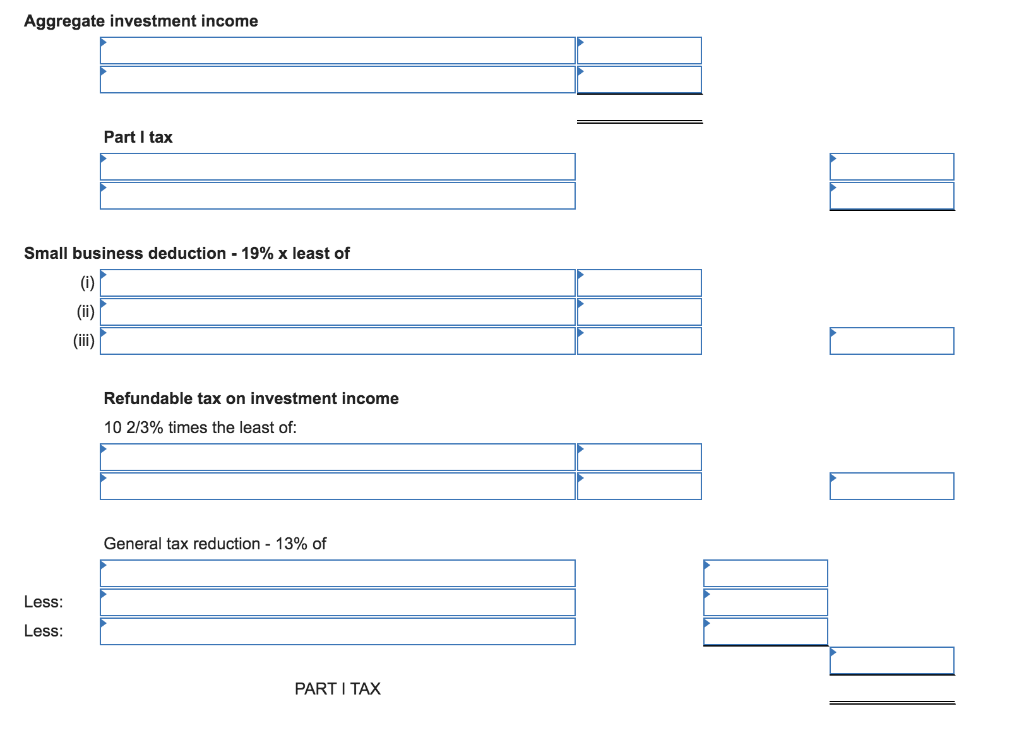

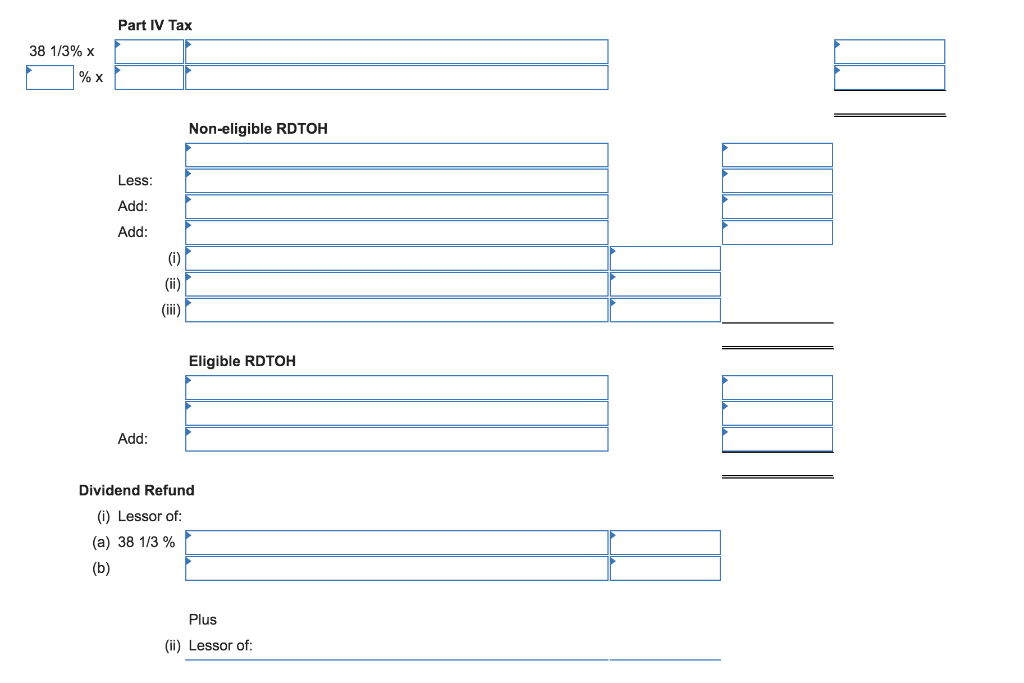

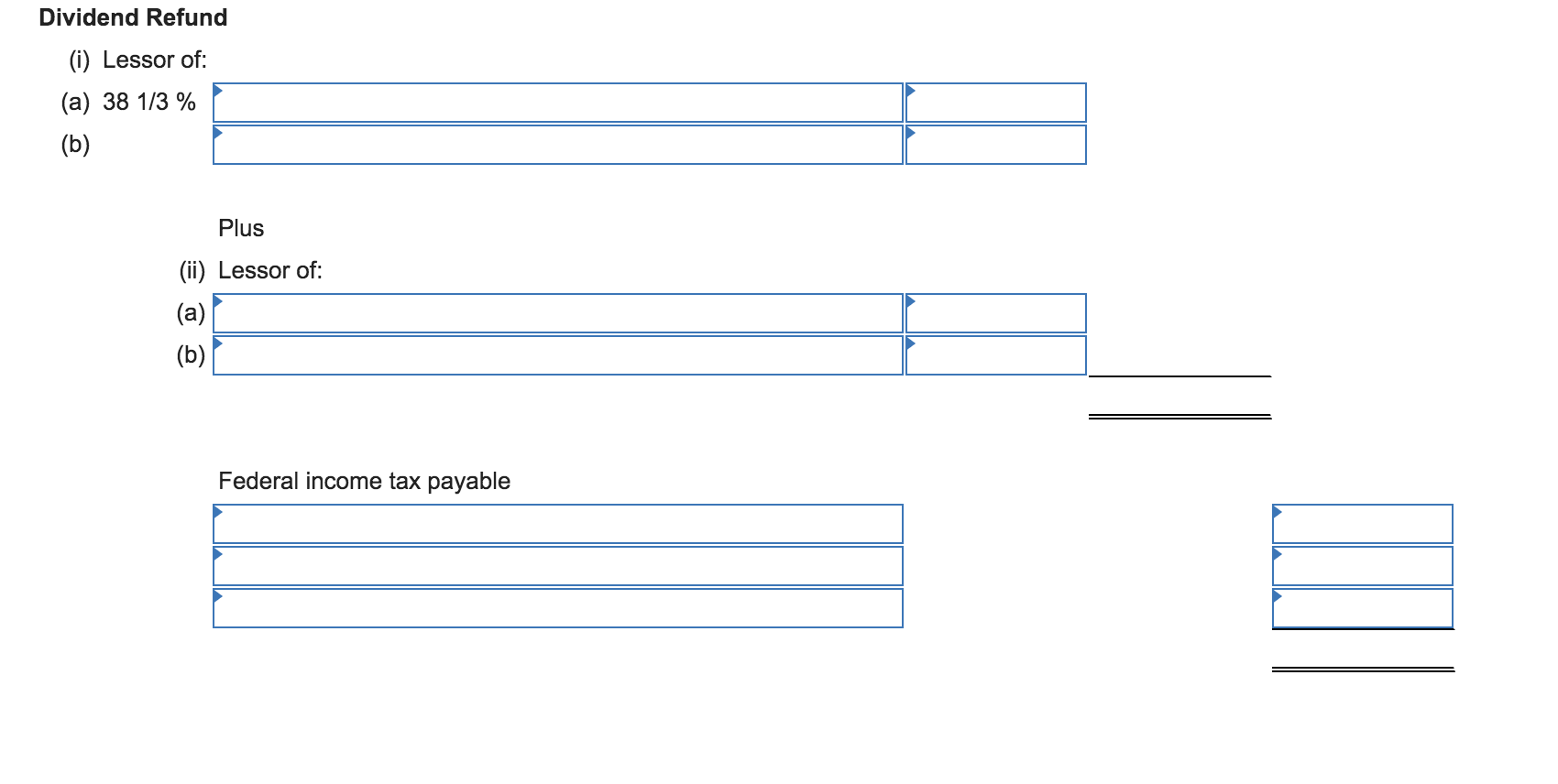

Cinder Inc. is a Canadian-controlled private corporation based in your province. The company operates a wholesale business. The following information is provided for its year ended May 31, 2020: 1. Net income for tax purposes is $224,000. Included in this amount is the following: Interest income from bonds Interest income on overdue trade accounts receivable Taxable capital gain on sale of land Eligible dividends from Canadian public corporations Non-eligible dividends from PQ Ltd. (see item 2 below) $22,000 1,400 26,000 16,800 8,400 2. PQ Ltd. is a Canadian-controlled private corporation. Cinder owns 60% of its common voting shares. In 2020, PQ claimed the small business deduction on $448,000 of its active business income. PQ paid a non-eligible dividend of $18,000, of which Cinder's share is $14,000 (60%). As a result of the dividend, PQ received a dividend refund of $9,000 from its non-eligible RDTOH. 3. Cinder made contributions of $12,000 to registered charities. This amount has been correctly adjusted for in computing net income for tax purposes. 4. The following information is from the 2019 Tax return of Cinder: Non-capital losses Non-eligible refundable dividend tax on hand Eligible refundable dividend tax on hand Dividend refund Taxable capital Adjusted aggregate investment income $ 13,000 10,000 0 0 Under $ 10 million $38,000 5. On May 31, 2020, Cinder paid taxable dividends of $36,000 (eligible $18,000 and non-eligible $18,000) to its shareholders. Required: Determine Cinder's federal income tax for the 2020 taxation year. (use 0.3067 when multiplying to represent 3043%. and 0.3833 when multiplying to represent 38 1/3%. Do not multiply by more than 4 decimal places and round your final answer to the nearest dollar. Enter subtractions as negative amounts.) Net income for tax purposes Taxable income Active business income Less Less: Less: Active business income Aggregate investment income Part I tax Small business deduction - 19% x least of 0 (ii) (iii) Refundable tax on investment income 10 2/3% times the least of: General tax reduction - 13% of Less: Less: PART I TAX Part IV Tax 38 1/3% x % x Non-eligible RDTOH Less: Add: Add: () (ii) Eligible RDTOH Add: Dividend Refund (i) Lessor of: (a) 38 1/3 % (b) Plus (ii) Lessor of: Dividend Refund (i) Lessor of: (a) 38 1/3 % (b) Plus (ii) Lessor of: (a) (b) Federal income tax payable M10 Cinder Inc. is a Canadian-controlled private corporation based in your province. The company operates a wholesale business. The following information is provided for its year ended May 31, 2020: 1. Net income for tax purposes is $224,000. Included in this amount is the following: Interest income from bonds Interest income on overdue trade accounts receivable Taxable capital gain on sale of land Eligible dividends from Canadian public corporations Non-eligible dividends from PQ Ltd. (see item 2 below) $22,000 1,400 26,000 16,800 8,400 2. PQ Ltd. is a Canadian-controlled private corporation. Cinder owns 60% of its common voting shares. In 2020, PQ claimed the small business deduction on $448,000 of its active business income. PQ paid a non-eligible dividend of $18,000, of which Cinder's share is $14,000 (60%). As a result of the dividend, PQ received a dividend refund of $9,000 from its non-eligible RDTOH. 3. Cinder made contributions of $12,000 to registered charities. This amount has been correctly adjusted for in computing net income for tax purposes. 4. The following information is from the 2019 Tax return of Cinder: Non-capital losses Non-eligible refundable dividend tax on hand Eligible refundable dividend tax on hand Dividend refund Taxable capital Adjusted aggregate investment income $ 13,000 10,000 0 0 Under $ 10 million $38,000 5. On May 31, 2020, Cinder paid taxable dividends of $36,000 (eligible $18,000 and non-eligible $18,000) to its shareholders. Required: Determine Cinder's federal income tax for the 2020 taxation year. (use 0.3067 when multiplying to represent 3043%. and 0.3833 when multiplying to represent 38 1/3%. Do not multiply by more than 4 decimal places and round your final answer to the nearest dollar. Enter subtractions as negative amounts.) Net income for tax purposes Taxable income Active business income Less Less: Less: Active business income Aggregate investment income Part I tax Small business deduction - 19% x least of 0 (ii) (iii) Refundable tax on investment income 10 2/3% times the least of: General tax reduction - 13% of Less: Less: PART I TAX Part IV Tax 38 1/3% x % x Non-eligible RDTOH Less: Add: Add: () (ii) Eligible RDTOH Add: Dividend Refund (i) Lessor of: (a) 38 1/3 % (b) Plus (ii) Lessor of: Dividend Refund (i) Lessor of: (a) 38 1/3 % (b) Plus (ii) Lessor of: (a) (b) Federal income tax payable M10