Answered step by step

Verified Expert Solution

Question

1 Approved Answer

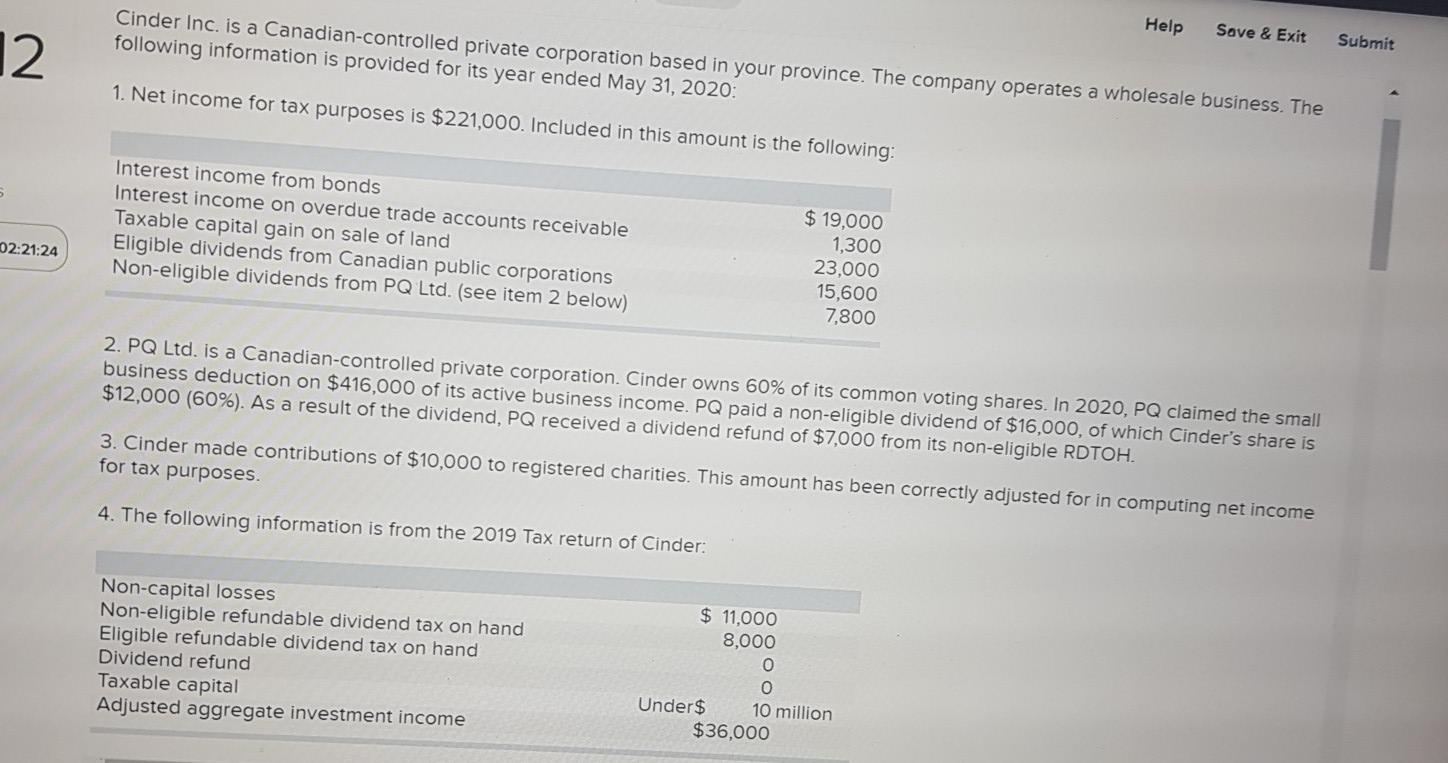

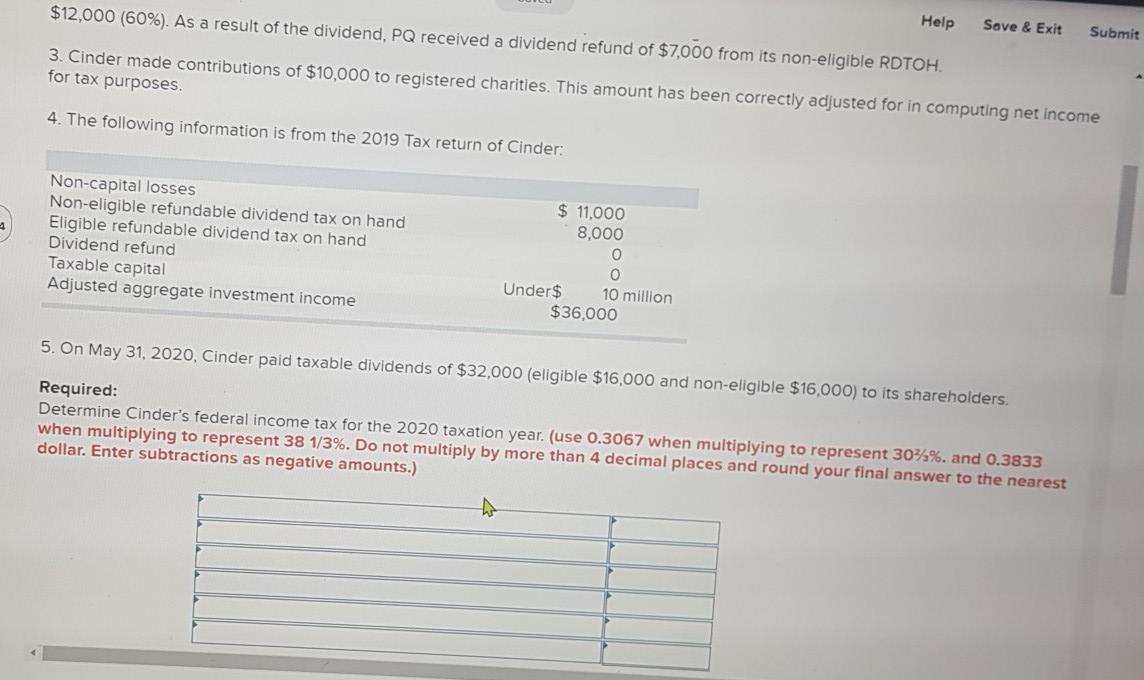

Cinder Inc. is a Canadian-controlled private corporation based in your province. The company operates a wholesale business. The following information is provided for its year

Cinder Inc. is a Canadian-controlled private corporation based in your province. The company operates a wholesale business. The following information is provided for its year ended May 31, 2020: Help Save & Exit Submit 12 1. Net income for tax purposes is $221,000. Included in this amount is the following: Interest income from bonds Interest income on overdue trade accounts receivable Taxable capital gain on sale of land Eligible dividends from Canadian public corporations Non-eligible dividends from PQ Ltd. (see item 2 below) 02:21:24 $ 19,000 1,300 23,000 15,600 7,800 2. PQ Ltd. is a Canadian-controlled private corporation. Cinder owns 60% of its common voting shares. In 2020, PQ claimed the small business deduction on $416,000 of its active business income. PQ paid a non-eligible dividend of $16,000, of which Cinder's share is $12,000 (60%). As a result of the dividend, PQ received a dividend refund of $7,000 from its non-eligible RDTOH. 3. Cinder made contributions of $10,000 to registered charities. This amount has been correctly adjusted for in computing net income for tax purposes. 4. The following information is from the 2019 Tax return of Cinder: Non-capital losses Non-eligible refundable dividend tax on hand Eligible refundable dividend tax on hand Dividend refund Taxable capital Adjusted aggregate investment income $ 11,000 8,000 O 0 Under $ 10 million $36,000 $12,000 (60%). As a result of the dividend, PQ received a dividend refund of $7,000 from its non-eligible RDTOH. Help Save & Exit Submit 3. Cinder made contributions of $10,000 to registered charities. This amount has been correctly adjusted for in computing net income for tax purposes. 4. The following information is from the 2019 Tax return of Cinder: Non-capital losses Non-eligible refundable dividend tax on hand Eligible refundable dividend tax on hand Dividend refund Taxable capital Adjusted aggregate investment income $ 11,000 8,000 0 Under$ 10 million $36,000 5. On May 31, 2020, Cinder paid taxable dividends of $32,000 (eligible $16,000 and non-eligible $16,000) to its shareholders. Required: Determine Cinder's federal income tax for the 2020 taxation year. (use 0.3067 when multiplying to represent 30%-%. and 0.3833 when multiplying to represent 38 1/3%. Do not multiply by more than 4 decimal places and round your final answer to the nearest dollar. Enter subtractions as negative amounts.) Cinder Inc. is a Canadian-controlled private corporation based in your province. The company operates a wholesale business. The following information is provided for its year ended May 31, 2020: Help Save & Exit Submit 12 1. Net income for tax purposes is $221,000. Included in this amount is the following: Interest income from bonds Interest income on overdue trade accounts receivable Taxable capital gain on sale of land Eligible dividends from Canadian public corporations Non-eligible dividends from PQ Ltd. (see item 2 below) 02:21:24 $ 19,000 1,300 23,000 15,600 7,800 2. PQ Ltd. is a Canadian-controlled private corporation. Cinder owns 60% of its common voting shares. In 2020, PQ claimed the small business deduction on $416,000 of its active business income. PQ paid a non-eligible dividend of $16,000, of which Cinder's share is $12,000 (60%). As a result of the dividend, PQ received a dividend refund of $7,000 from its non-eligible RDTOH. 3. Cinder made contributions of $10,000 to registered charities. This amount has been correctly adjusted for in computing net income for tax purposes. 4. The following information is from the 2019 Tax return of Cinder: Non-capital losses Non-eligible refundable dividend tax on hand Eligible refundable dividend tax on hand Dividend refund Taxable capital Adjusted aggregate investment income $ 11,000 8,000 O 0 Under $ 10 million $36,000 $12,000 (60%). As a result of the dividend, PQ received a dividend refund of $7,000 from its non-eligible RDTOH. Help Save & Exit Submit 3. Cinder made contributions of $10,000 to registered charities. This amount has been correctly adjusted for in computing net income for tax purposes. 4. The following information is from the 2019 Tax return of Cinder: Non-capital losses Non-eligible refundable dividend tax on hand Eligible refundable dividend tax on hand Dividend refund Taxable capital Adjusted aggregate investment income $ 11,000 8,000 0 Under$ 10 million $36,000 5. On May 31, 2020, Cinder paid taxable dividends of $32,000 (eligible $16,000 and non-eligible $16,000) to its shareholders. Required: Determine Cinder's federal income tax for the 2020 taxation year. (use 0.3067 when multiplying to represent 30%-%. and 0.3833 when multiplying to represent 38 1/3%. Do not multiply by more than 4 decimal places and round your final answer to the nearest dollar. Enter subtractions as negative amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started