Question

Cindy and Robert Castillo founded the Castillo Products Company in 2012. The company manufactures components for personal decision assistant products and for other handheld electronic

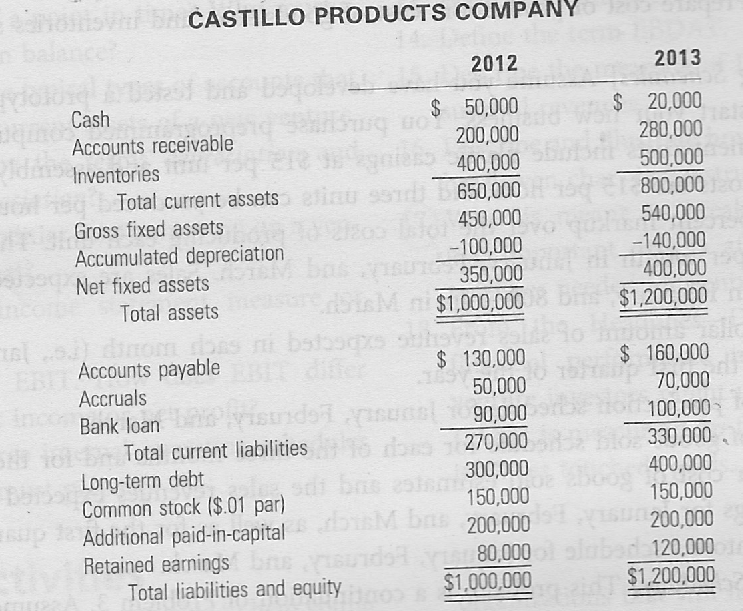

Cindy and Robert Castillo founded the Castillo Products Company in 2012. The company manufactures components for personal decision assistant products and for other handheld electronic products. Sales increased rapidly in 2013, and the firm reported a net income after taxes of $75,000. Depreciation expenses were $40,000 in 2013. In the image below, are the Castillo Products Company's balance sheets for 2012 and 2013. A. Calculate Castillo's cash flow from operating activities for 2013. B. Calculate Castillo's cash flow from investing activities for 2013.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started