Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cindy uses the services of a brokerage firm to buy and sell stocks. The firm charges 1.5% service charges on the total amount for each

Cindy uses the services of a brokerage firm to buy and sell stocks. The firm charges 1.5% service charges on the total amount for each transaction, buy or sell. When Cindy sells stocks, she would like to know if she gained or lost on a particular investment. Write a program that allows Cindy to input the number of shares sold, the purchase price of each share, and the selling price of each share. The program outputs the amount invested, the total service charges, amount gained or lost, and the amount received after selling the stock.

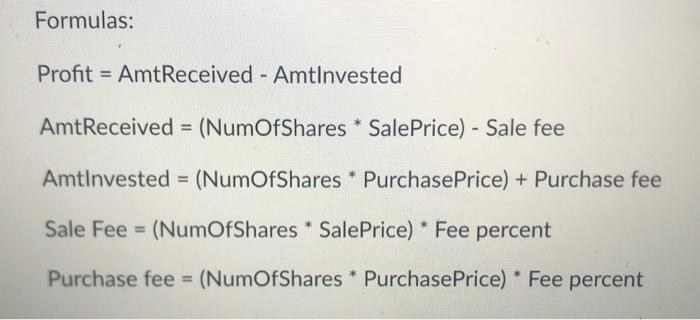

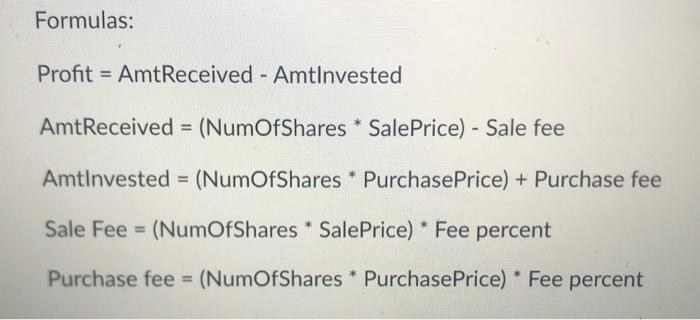

please use formulas provided as well.

need help/ example

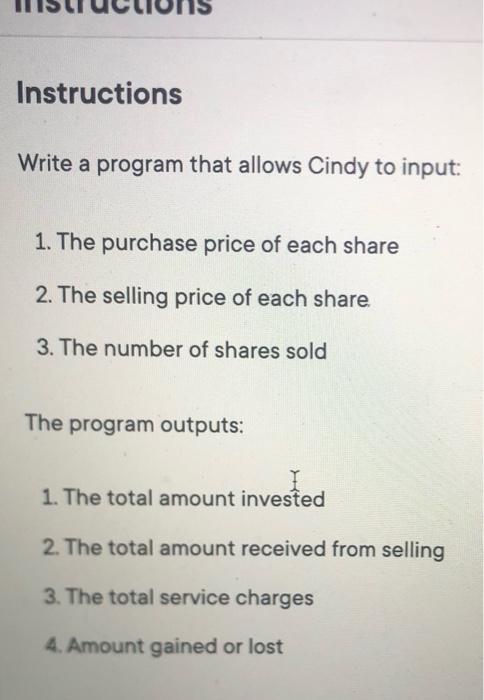

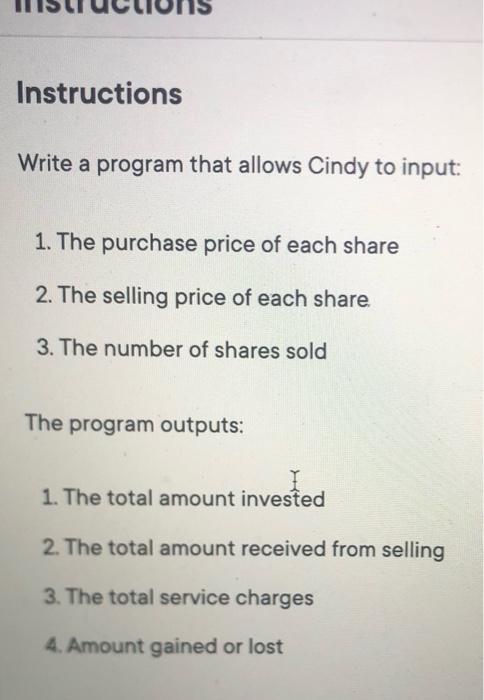

Formulas: Profit = AmtReceived - Amtlnvested AmtReceived = (NumOfShares * Sale Price) - Sale fee Amtlnvested = (NumOfShares * Purchase Price) + Purchase fee Sale Fee = (NumOfShares * SalePrice) * Fee percent Purchase fee = (NumOfShares * Purchase Price) * Fee percent Instructions Write a program that allows Cindy to input: 1. The purchase price of each share 2. The selling price of each share 3. The number of shares sold The program outputs: 1. The total amount invested 2. The total amount received from selling 3. The total service charges 4. Amount gained or lost Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started