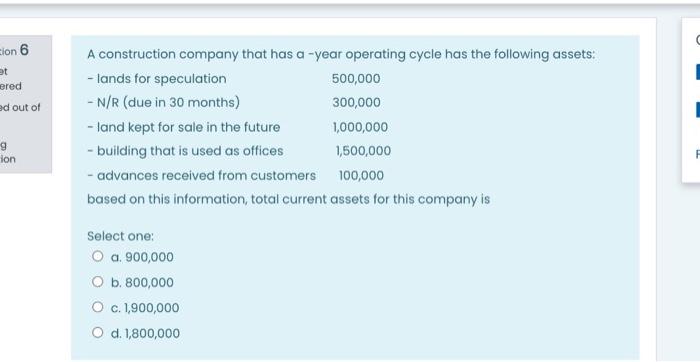

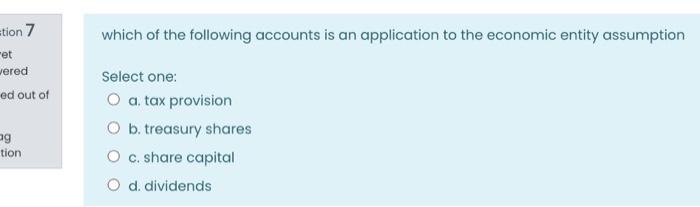

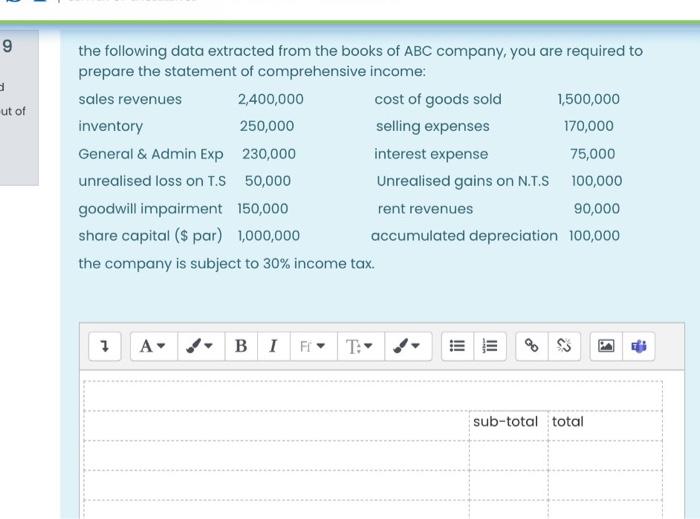

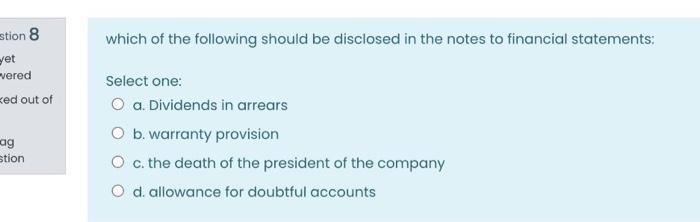

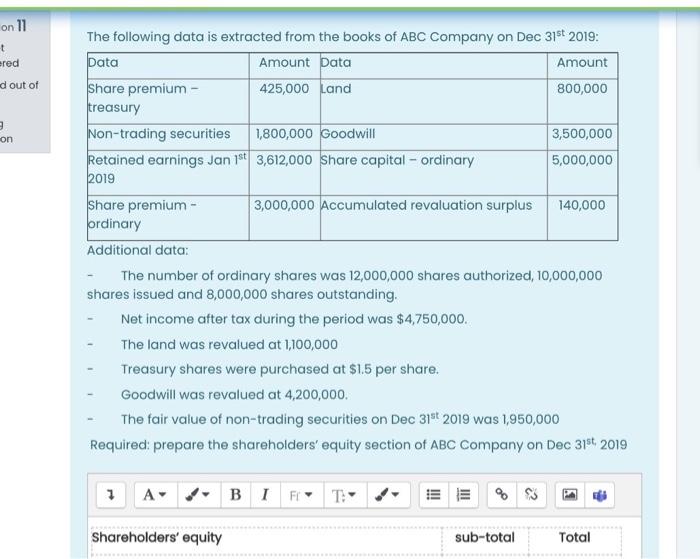

cion 6 et ered ed out of A construction company that has a -year operating cycle has the following assets: - lands for speculation 500,000 - N/R (due in 30 months) 300,000 - land kept for sale in the future 1,000,000 - building that is used as offices 1,500,000 - advances received from customers 100,000 based on this information, total current assets for this company is 9 ion Select one: O a. 900,000 O b. 800,000 O c. 1,900,000 O d. 1,800,000 tion 7 which of the following accounts is an application to the economic entity assumption ret wered ed out of ag tion Select one: O a tax provision O b.treasury shares O c. share capital O d. dividends 9 9 ut of the following data extracted from the books of ABC company, you are required to prepare the statement of comprehensive income: sales revenues 2,400,000 cost of goods sold 1,500,000 inventory 250,000 selling expenses 170,000 General & Admin Exp 230,000 interest expense 75,000 unrealised loss on TS 50,000 Unrealised gains on NTS 100,000 goodwill impairment 150,000 rent revenues 90,000 share capital (s par 1,000,000 accumulated depreciation 100,000 the company is subject to 30% income tax. 7 A B IFT III sub-total total stion 8 which of the following should be disclosed in the notes to financial statements: yet vered ked out of Select one: a. Dividends in arrears O b.warranty provision c. the death of the president of the company O d. allowance for doubtful accounts stion on 11 t ered d out of on The following data is extracted from the books of ABC Company on Dec 31st 2019: Data Amount Data Amount Share premium - 425,000 Land 800,000 treasury Non-trading securities 1,800,000 Goodwill 3,500,000 Retained earnings Jan 1st 3,612,000 share capital - ordinary 5,000,000 2019 Share premium - 3,000,000 Accumulated revaluation surplus 140,000 ordinary Additional data: The number of ordinary shares was 12,000,000 shares authorized, 10,000,000 shares issued and 8,000,000 shares outstanding, Net income after tax during the period was $4,750,000 The land was revalued at 1,100,000 Treasury shares were purchased at $1.5 per share. Goodwill was revalued at 4,200,000. The fair value of non-trading securities on Dec 31st 2019 was 1,950,000 Required: prepare the shareholders' equity section of ABC Company on Dec 31st, 2019 7 A B IF TO III Shareholders' equity sub-total Total