Answered step by step

Verified Expert Solution

Question

1 Approved Answer

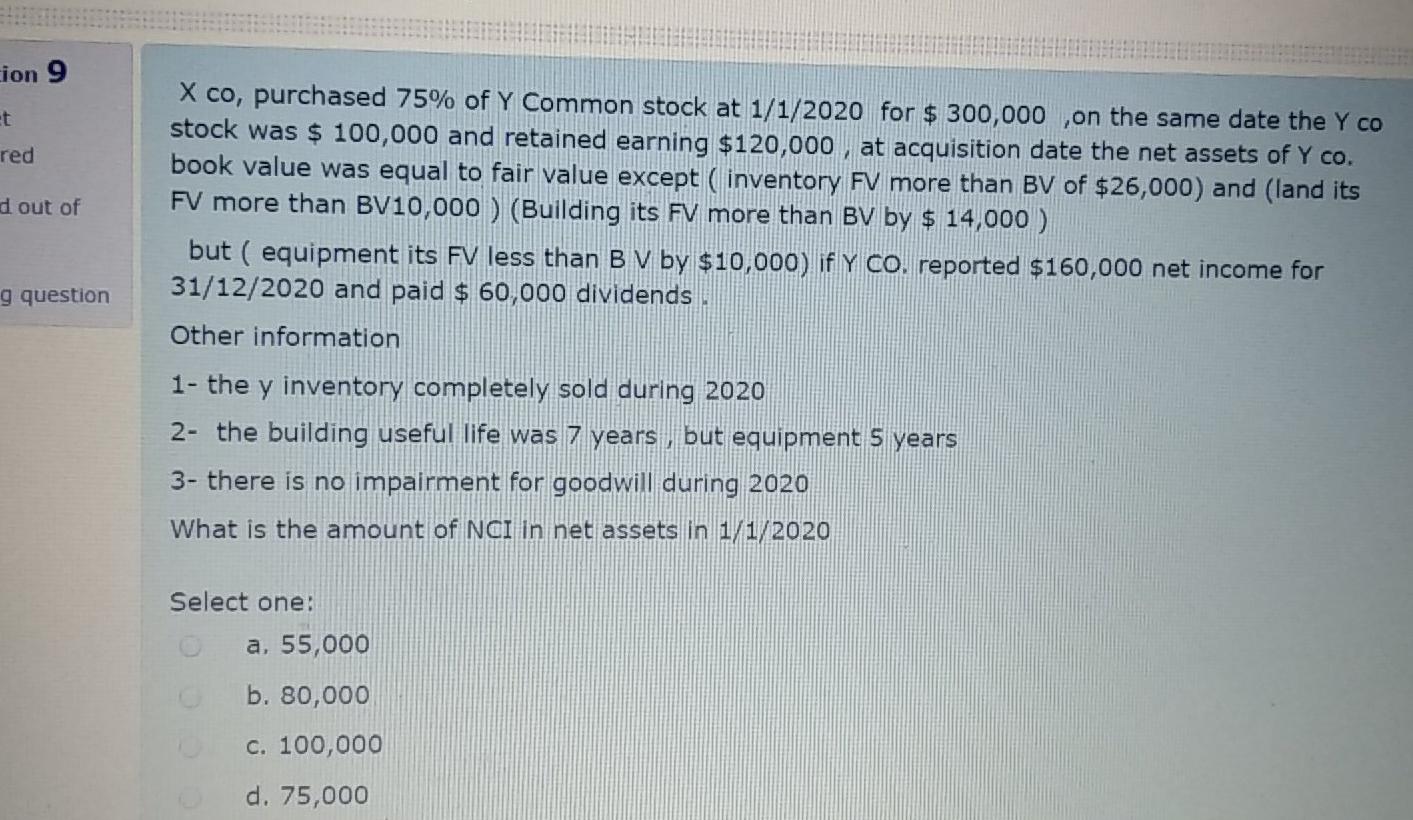

cion 9 et red Xco, purchased 75% of Y Common stock at 1/1/2020 for $ 300,000 ,on the same date the Y CO stock was

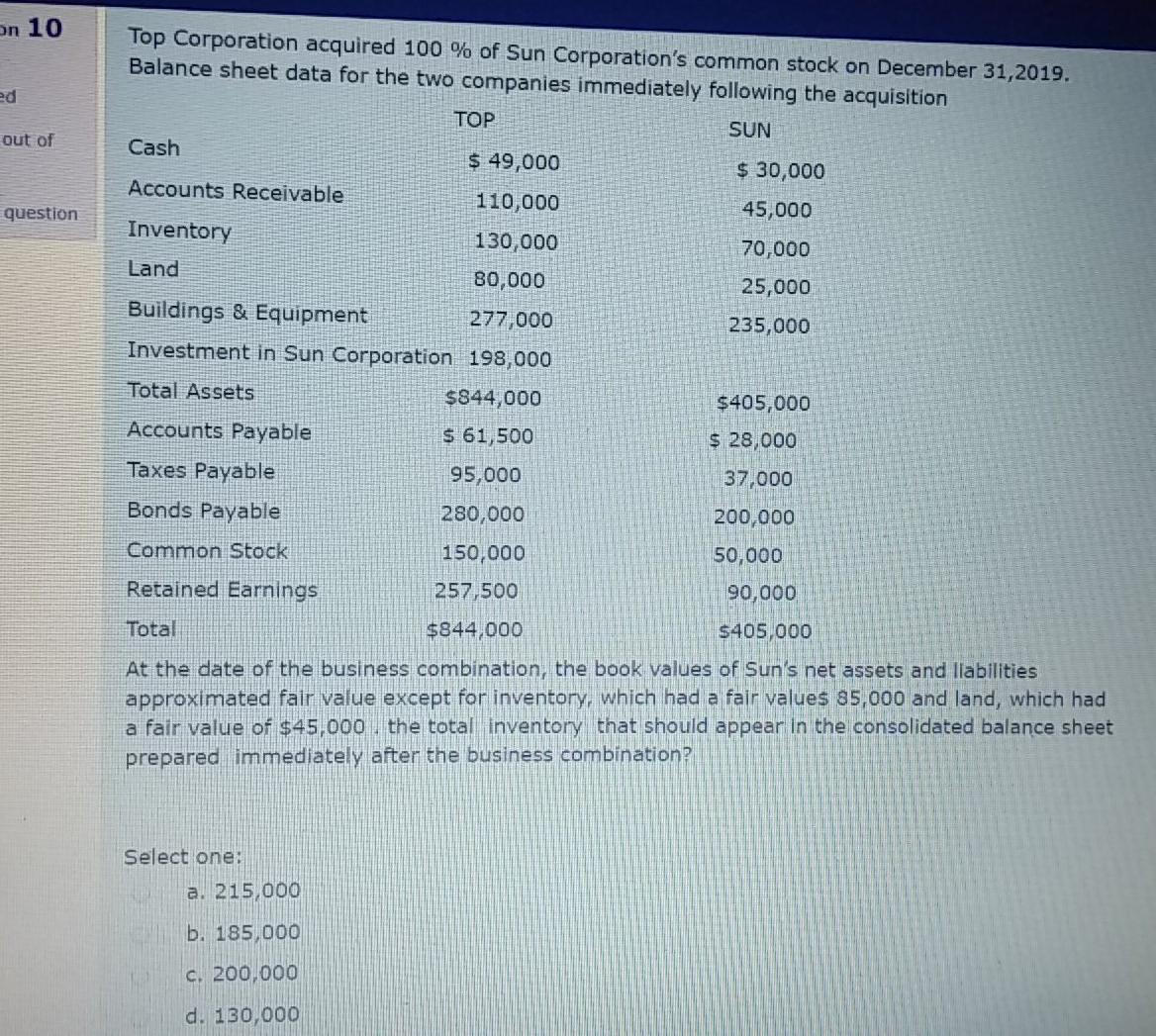

cion 9 et red Xco, purchased 75% of Y Common stock at 1/1/2020 for $ 300,000 ,on the same date the Y CO stock was $ 100,000 and retained earning $120,000, at acquisition date the net assets of Y co. book value was equal to fair value except ( inventory FV more than BV of $26,000) and (land its FV more than BV10,000 ) (Building its FV more than BV by $ 14,000 ) but ( equipment its FV less than B V by $10,000) if y Co. reported $160,000 net income for 31/12/2020 and paid $ 60,000 dividends d out of g question Other information 1- the y inventory completely sold during 2020 2- the building useful life was 7 years, but equipment 5 years 3- there is no impairment for goodwill during 2020 What is the amount of NCI In net assets in 1/1/2020 Select one: a. 55,000 b. 80,000 c. 100,000 d. 75,000 on 10 Top Corporation acquired 100 % of Sun Corporation's common stock on December 31, 2019. Balance sheet data for the two companies immediately following the acquisition ed TOP SUN out of Cash $ 49,000 $ 30,000 Accounts Receivable 110,000 question 45,000 Inventory 130,000 70,000 Land 80,000 25,000 Buildings & Equipment 277,000 235,000 Investment in Sun Corporation 198,000 Total Assets $844,000 $405,000 $ 28,000 Accounts Payable Taxes Payable $ 61,500 95,000 37,000 Bonds Payable 280,000 200,000 Common Stock 150,000 50,000 Retained Earnings 257,500 90,000 Total $844,000 $405,000 At the date of the business combination, the book values of Sun's net assets and liabilities approximated fair value except for inventory, which had a fair values 85,000 and land, which had a fair value of $45,000 , the total inventory that should appear in the consolidated balance sheet prepared immediately after the business combination? Select one: a. 215.000 b. 185,000 c. 200,000 d. 130,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started