Question

CIP XX Defered Tax XX Retained Earnings XX Complete journal entry! Change in Accounting for Construction Contracts Delta Company uses the completed-contract method of accounting

| CIP | XX | |

| Defered Tax | XX | |

| Retained Earnings | XX |

Complete journal entry!

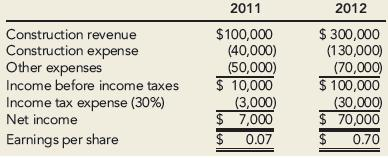

Change in Accounting for Construction Contracts Delta Company uses the completed-contract method of accounting for long-term construction contracts. Delta started business in 2011 and prepared the following income statements:

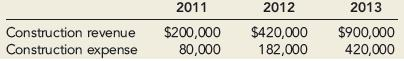

The company changes to the percentage-of-completion method at the beginning of 2013. It determines the construction revenue and expense amounts under the percentage-of-completion method to be as follows:

The other expenses remain unchanged for 2011 and 2012 and are $80,000 in 2013. Delta has not paid dividends on its 100,000 common shares outstanding. With the 2013 financial statements, the company issues comparative statements for the previous 2 years. Under the completed-contract method, construction revenue and construction expense would be $600,000 and $280,000, respectively, in 2013. Delta uses the percentage-of-completion method for income tax purposes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started