Answered step by step

Verified Expert Solution

Question

1 Approved Answer

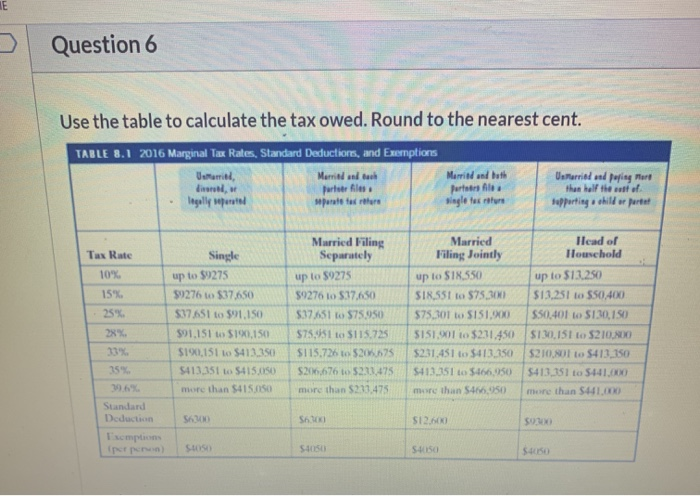

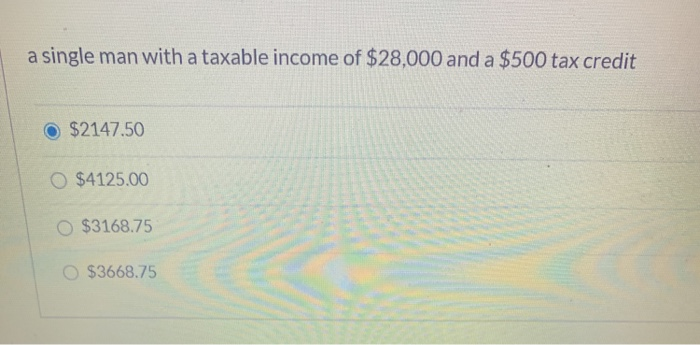

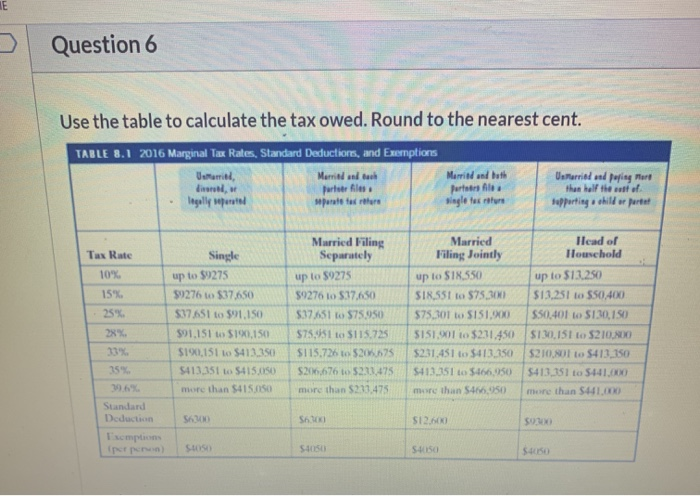

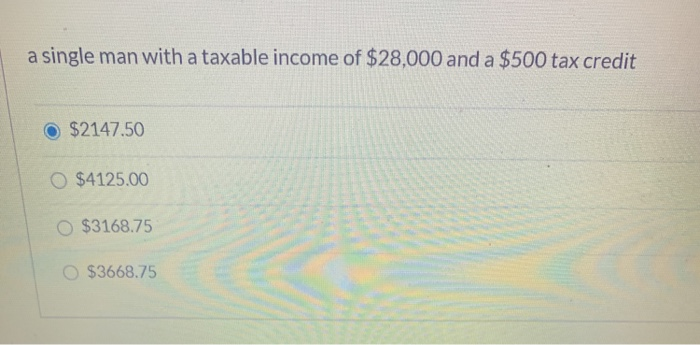

circle answer. Dont show work IE Question 6 Use the table to calculate the tax owed. Round to the nearest cent. TABLE 8.1 2016 Marginal

circle answer. Dont show work

IE Question 6 Use the table to calculate the tax owed. Round to the nearest cent. TABLE 8.1 2016 Marginal Tax Rates, Standard Deductions, and Exemptions Urtarril Married in Married and both UsMarried and paying art portar les partire legally put pode terre sagle talent supporting child or parte than half felt of Married Filing Separately up to $9275 Tax Rate 10% 15% 25% up to $18.550 Single up to $9275 $9276 to $37.650 $37.651 to $91.150 $91.151 to $100,150 $190.151 to $413.350 5413.351 to $415.20 more than $415.00 59276 to 5:37.650 5:37.651.575.950 $75,551 to $115.725 $115.726 to 5206.575 $206.676 to 523,475 more than $211.475 Married Head of Filing Jointly Household up to 513250 SIR,551 to $75,300 $13.251 to 550,400 $75,301 to 5151,900 $50,401 to $130,150 5151.901 10 $231,450 $130,151 to $210.800 $231451 to $413.350 5210.801 to $413.150 5413,351 to $166,050 $41.3_151 to 5441.000 mure than $41.050 more than $441.00 33% 35% S6200 Sh.100 $12.600 $930 Standard Deduction scmption If pen) SOS 54050 540150 $4050 a single man with a taxable income of $28,000 and a $500 tax credit $2147.50 $4125.00 $3168.75 $3668.75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started